Cryptocurrency Review: Your Guide to Trusted Exchange Insights

When diving into Cryptocurrency Review, a systematic evaluation of crypto platforms that looks at fees, security, liquidity and user experience. Also known as Crypto Review, it helps traders separate solid services from risky offers. Cryptocurrency Review encompasses exchange analysis, demands security assessment, and links tokenomics to overall platform health.

Key Elements Shaping Every Review

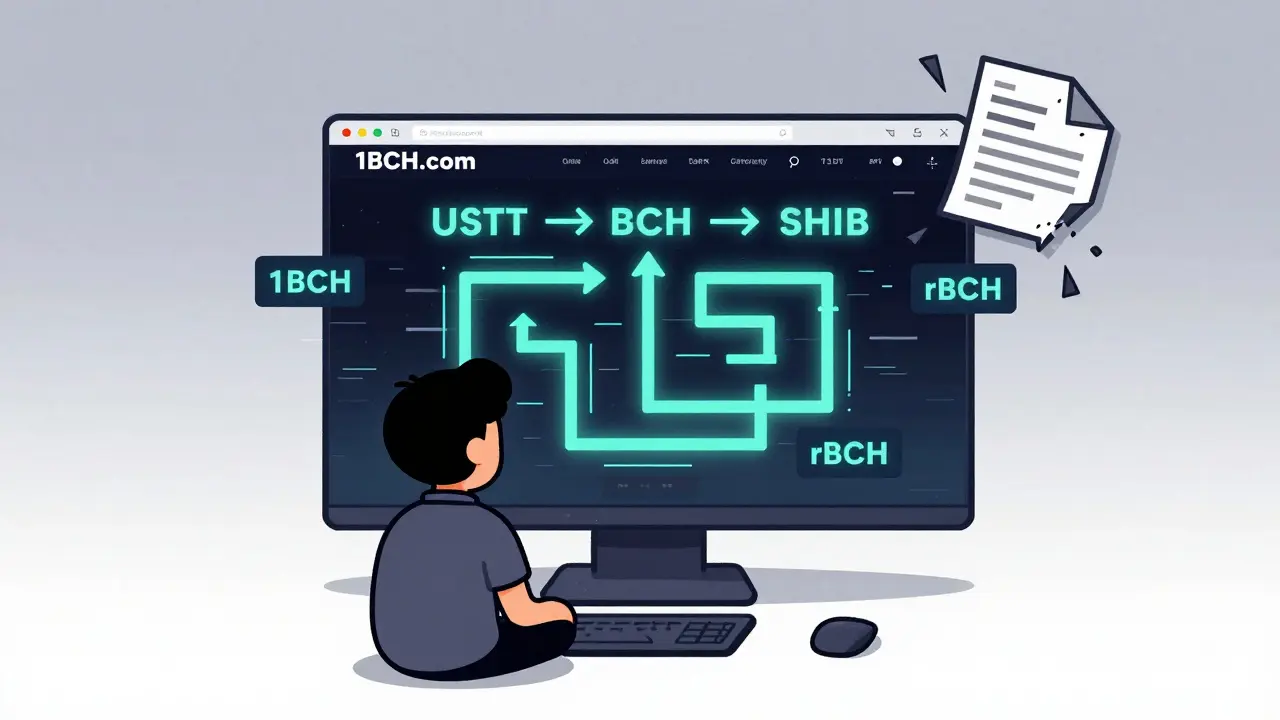

One core entity behind every review is the Decentralized exchange (DEX), a peer‑to‑peer trading venue that runs on blockchain smart contracts. DEXs bring low‑fee swaps and permissionless access, but they also require thorough audit checks. Another crucial piece is Tokenomics, the economic design of a token, including supply schedule, distribution model and utility. Strong tokenomics often boost liquidity and market confidence, directly influencing a platform’s rating. Finally, Security assessment, the process of evaluating encryption, custody methods and compliance measures determines if an exchange can protect user funds against hacks and fraud.

These entities interact in clear ways: a DEX’s smart‑contract security feeds into the security assessment, while tokenomics shapes the liquidity profile examined during exchange analysis. Readers will find that platforms with transparent tokenomics and robust audit trails consistently earn higher scores. The reviews also flag red‑flag signs—like missing compliance data or unusually low fees—that often signal hidden risks.

Below you’ll discover a range of detailed reviews, from EOS‑based DEXs to European spot platforms and niche NFT‑DeFi hybrids. Each article breaks down fees, liquidity, audit status and real‑world usability, giving you a practical checklist before you commit any capital. Dive in to compare, learn, and make smarter trading choices.