Cryptocurrency Hub – Your Guide to Markets, Tokens, and Regulation

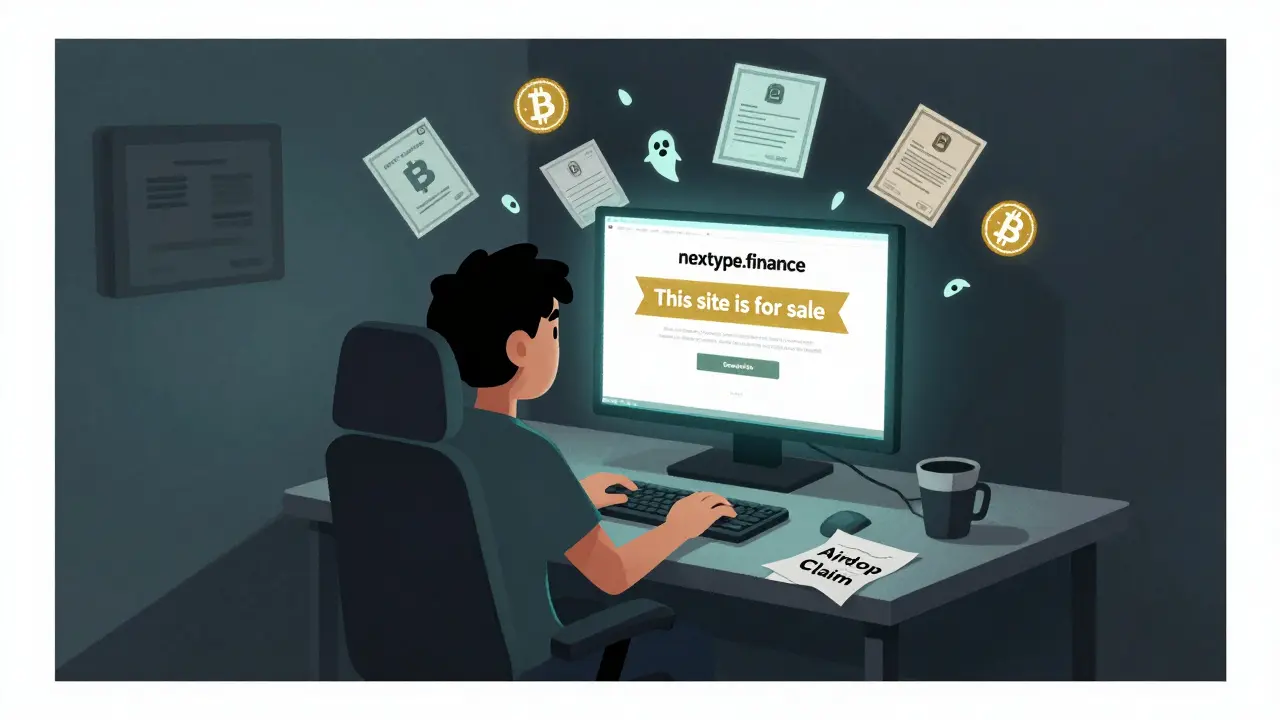

When working with cryptocurrency, digital assets that use cryptography to secure transactions and control new unit creation. Also known as crypto, it has reshaped finance, created new investment classes, and sparked global regulatory debates. In this space we also dive into blockchain, the decentralized ledger that powers every crypto transaction, enabling transparency and trust without a central authority. Another key focus is crypto airdrop, a distribution method that rewards holders or community members with free tokens, often tied to project launches or governance incentives. Finally, we cover crypto exchange, platforms where users trade digital assets, which must navigate regulatory compliance, geofencing, and VPN detection.

What You’ll Find Below

Our curated collection links the technical side of cryptocurrency with real‑world use cases. You’ll see how geofencing impacts traders on Bybit, why Iran turns cheap electricity into Bitcoin mining, and how to claim the latest airdrops from Bit2Me, Cannumo, or Legion SuperApp. There are deep dives into token economics of Terra, Litentry, and SUNCAT, plus practical guides on 2FA recovery and decentralized identity. Regulation topics range from Vietnam’s new laws to the OECD’s automatic tax reporting framework. Whether you’re chasing an airdrop, comparing exchanges, or trying to understand market cycles, these articles give you actionable insight.

Ready to explore? Scroll down to dive into the full range of guides, reviews, and analysis that keep you ahead in the fast‑moving crypto world.