Layer 2 Network Comparison Tool

Compare Autobahn Network (TXL) with Other Layer 2 Solutions

This tool compares TXL against major Layer 2 solutions using real data from the article. See how TXL stacks up against established projects like Polygon zkEVM and Arbitrum One.

Autobahn Network (TXL) isn’t a household name in crypto. You won’t find it on Coinbase or Kraken. It doesn’t power popular DeFi apps. And if you’re looking for real-world use cases, you won’t find any. But if you’re digging into obscure Layer 2 tokens built for BNB Smart Chain, TXL is one of the strangest ones out there right now.

What Exactly Is Autobahn Network (TXL)?

Autobahn Network is a Layer 2 scaling solution built specifically for the BNB Smart Chain (BSC). It uses Optimistic Rollup technology to bundle hundreds of transactions into one single batch, sending them back to BSC to cut down on gas fees and speed things up. Think of it like a highway ramp that lets cars merge into a fast lane - except instead of cars, it’s moving crypto transactions.

Unlike Ethereum-focused Layer 2s like Arbitrum or Optimism, Autobahn only talks to BSC. That’s its whole pitch: faster, cheaper transactions within the Binance ecosystem. The team behind it is anonymous, with no public founders listed. Their only public footprint is a GitHub repo (github.com/tixl) and a basic website (autobahn.network). No whitepaper. No roadmap with dates. No technical deep dives.

How Does TXL Work?

TXL is the native token of Autobahn Network. It’s not meant to be a currency. It’s meant to pay for gas on the Layer 2 network. When you send a transaction on Autobahn, you pay a tiny fee in TXL. The network’s nodes - currently 21 of them - verify those transactions using Proof of Authority (PoA). That means a small group of trusted operators validate blocks, not miners or stakers. It’s fast, but it’s also centralized.

The plan? Eventually switch to zero-knowledge proofs (ZK), likely based on ZkBNB. That would make it more secure and trustless. But there’s no timeline. No code. No testnet. Just a line on their website saying they’re "working on it."

Right now, the network’s performance claims are vague. They say "lightning speed" and "extremely fast." But no benchmarks. No real user data. No comparison to Polygon zkEVM or BSC’s own native scaling tools. If you’re trying to pick a Layer 2 for BSC, you’ve got better options with real traction.

TXL Price and Market Data - The Hard Numbers

As of October 29, 2025, TXL is trading at around $0.000671. That sounds cheap - until you look at the context.

- Market cap: $45,060 (CoinMarketCap) to $83,400 (Holder.io). That’s less than the cost of a decent used laptop.

- Circulating supply: Disputed. CoinMarketCap says 67 million TXL. Holder.io says 127 million. Which one’s right? No one knows.

- Total supply: 600 million TXL. That’s a lot of tokens floating around, but almost none are actively traded.

- 24-hour trading volume: $0 on CoinMarketCap and Bybit. $4.30 on Holder.io. That’s not trading. That’s a glitch.

- Trading pairs: Mostly on PancakeSwap V3 (TXL/WBNB), with $24 in volume in a week. The biggest pair, TXL/WETH, only hit $315 in volume - and that’s over months.

- Number of holders: Around 10,750. For comparison, even a small DeFi token like Shiba Inu has over 1.2 million holders.

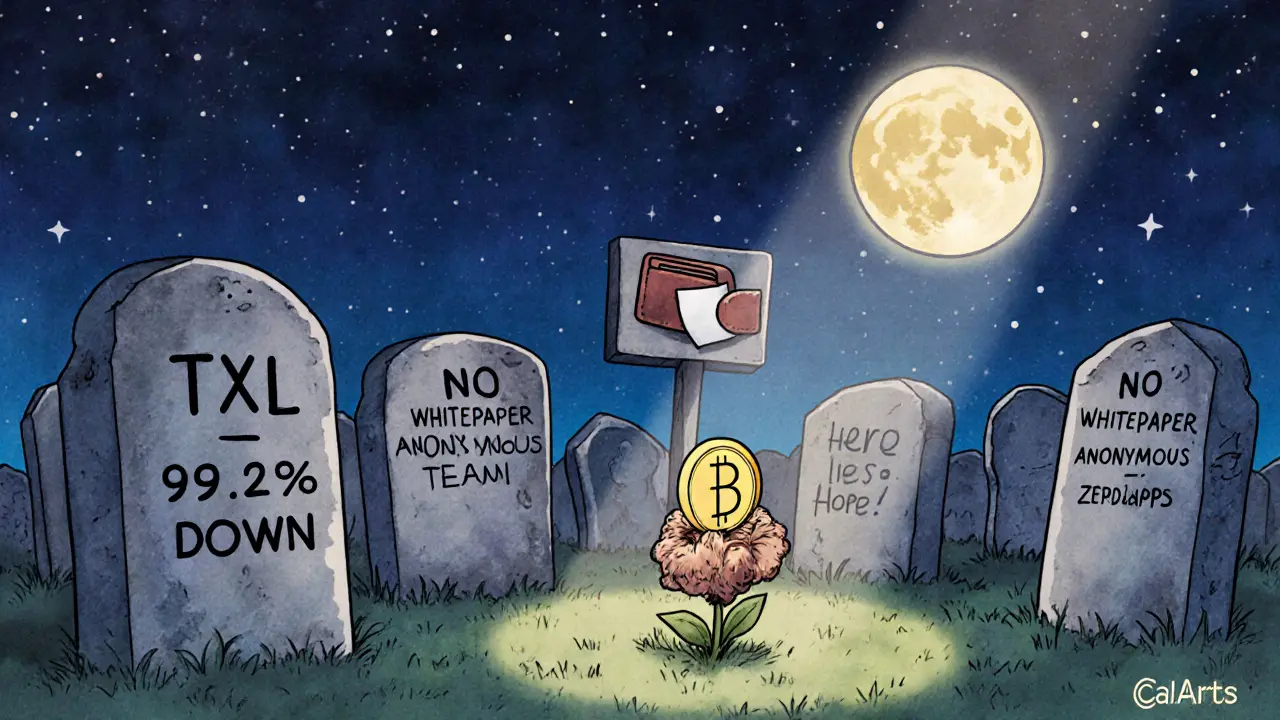

Here’s the kicker: Autobahn Network’s all-time high was $0.842986. That was back in 2023. Today? It’s down 99.92%. That’s not a correction. That’s a collapse.

Why Is TXL So Low? The Real Problems

There’s no mystery here. TXL is dying because nobody uses it.

First - no dApps. No DeFi protocols. No NFT marketplaces. No wallets built on top of it. If a Layer 2 doesn’t have apps using it, it’s just a fancy ledger with no traffic.

Second - liquidity is nonexistent. If you try to buy $100 worth of TXL, you’ll likely end up paying 20-30% more because of slippage. Exchanges don’t have enough buyers or sellers to make trades clean.

Third - the price is manipulated. CoinMarketCap shows a 1.28% market cap increase with $0 volume. That’s mathematically impossible unless someone is dumping small amounts into a shallow pool to inflate the price. That’s not innovation. That’s pump-and-dump behavior.

Fourth - no expert coverage. No The Block. No Messari. No CoinDesk. Just exchange listings and a handful of obscure crypto blogs. If a project can’t get attention from serious analysts, it’s not a serious project.

How Is It Different From Other Layer 2s?

Autobahn claims to be the "first Layer 2 Optimistic Rollup for BSC." That’s technically true - but so what? Polygon zkEVM, zkSync, and Arbitrum One have been scaling Ethereum for years. Even BSC’s own native solutions (like BNB Chain’s upgraded consensus) are more reliable.

Here’s how TXL stacks up against real players:

| Feature | Autobahn Network (TXL) | Polygon zkEVM | Arbitrum One |

|---|---|---|---|

| Blockchain | BNB Smart Chain | Ethereum | Ethereum |

| Technology | Optimistic Rollup (planning ZK) | ZK Rollup | Optimistic Rollup |

| Market Cap | $45K-$83K | $6.2B | $2.8B |

| 24H Volume | $0-$4.30 | $120M+ | $80M+ |

| Active dApps | 0 | 150+ | 200+ |

| Holders | ~10,750 | 1.2M+ | 950K+ |

| Expert Coverage | None | Extensive | Extensive |

TXL doesn’t compete. It’s in a different universe.

Can You Buy TXL? Should You?

You can buy TXL on PancakeSwap, Uniswap, and Sushiswap. Some platforms like Kriptomat let you buy it with Visa, Mastercard, or bank transfer - but that’s like buying a lottery ticket at a gas station.

Here’s the reality: If you’re buying TXL hoping it’ll go up, you’re gambling. There’s no fundamental reason for it to rise. No team. No product. No users. No utility. Just a token with a weird name and a price chart that looks like a heart attack.

Even if you believe in BSC scaling - which has real potential - Autobahn Network isn’t the way to bet on it. There are dozens of BSC-based projects with actual traction. Why risk your money on one that’s barely alive?

What’s the Future for TXL?

The only hope for Autobahn Network is its planned move to zero-knowledge proofs. If they actually ship it - and if they get even one major dApp to build on it - then maybe, just maybe, it could wake up.

But right now? There’s no evidence they can do it. No code releases. No testnet. No announcements. Just a dream on a website.

For now, TXL is a ghost token. It exists on paper. It shows up on price trackers. But it doesn’t move markets. It doesn’t power apps. It doesn’t serve users.

If you’re curious, you can buy a few dollars of it. But treat it like a science experiment - not an investment.

Is Autobahn Network (TXL) a good investment?

No. TXL has a market cap under $100K, near-zero trading volume, no real users, and no dApps built on it. Its price has dropped over 99% from its all-time high. There’s no fundamental reason to believe it will recover. Buying TXL is speculation, not investing.

Where can I buy TXL?

You can buy TXL on decentralized exchanges like PancakeSwap (BSC), Uniswap V2/V3, and Sushiswap. Some centralized platforms like Kriptomat allow you to buy it with credit cards or bank transfers. But due to extremely low liquidity, even small trades can cause huge price swings.

Is TXL built on Ethereum or BSC?

TXL is built as a Layer 2 solution specifically for the BNB Smart Chain (BSC). It does not run on Ethereum. Its entire purpose is to reduce fees and increase speed for transactions happening on BSC.

Why is the trading volume so low?

There’s almost no demand for TXL. No one is using it for payments, staking, or DeFi. Most of the few buyers are speculators trying to catch a pump. With only $4-$24 traded per day across all exchanges, liquidity is virtually nonexistent. That’s why prices jump wildly on tiny trades.

Does Autobahn Network have a team or public leadership?

No. The team behind Autobahn Network is anonymous. There are no known founders, no LinkedIn profiles, no interviews, and no public statements. The only traceable link is a GitHub repository (github.com/tixl), which has minimal activity and no documentation.

Is TXL a scam?

It’s not officially labeled a scam, but it has all the red flags: anonymous team, zero utility, collapsing price, no adoption, and no expert attention. Many crypto analysts would classify it as a "dead project" or a "zombie token." If you’re holding TXL, you’re holding a digital asset with no real value or future.

Final Thoughts

Autobahn Network (TXL) isn’t a crypto coin you should own. It’s a case study in how not to build a blockchain project. It’s got the buzzwords - Layer 2, Optimistic Rollup, BSC - but none of the substance. No users. No apps. No future.

If you’re interested in BSC scaling, look at what’s actually working: PancakeSwap, Venus, or even BSC’s own upgrades. Don’t waste your time on a ghost.

TXL is a dead end. And the only thing it’s scaling is the number of people who’ve lost money on it.