Proof of Work Blockchain: How It Powers Bitcoin and Why It Still Matters

When you think of Proof of Work blockchain, a consensus mechanism that secures decentralized networks by requiring computational effort to validate transactions. Also known as PoW, it's the reason Bitcoin has never been hacked—not because it’s perfect, but because breaking it would cost more than the value it protects. This system isn’t just a technical detail; it’s the backbone of the most valuable crypto network in the world.

Proof of Work blockchain works by turning electricity into trust. Miners compete to solve complex math puzzles using powerful hardware. The first to solve it gets to add the next block of transactions and earns new Bitcoin as a reward. This process, called Bitcoin mining, the act of validating transactions and securing the network through computational power, ensures no single entity can control the ledger. It’s not magic—it’s economics. The cost of hardware, power, and time makes attacks too expensive to be worth it. That’s why, even after 15 years, PoW remains the most battle-tested way to secure a decentralized network.

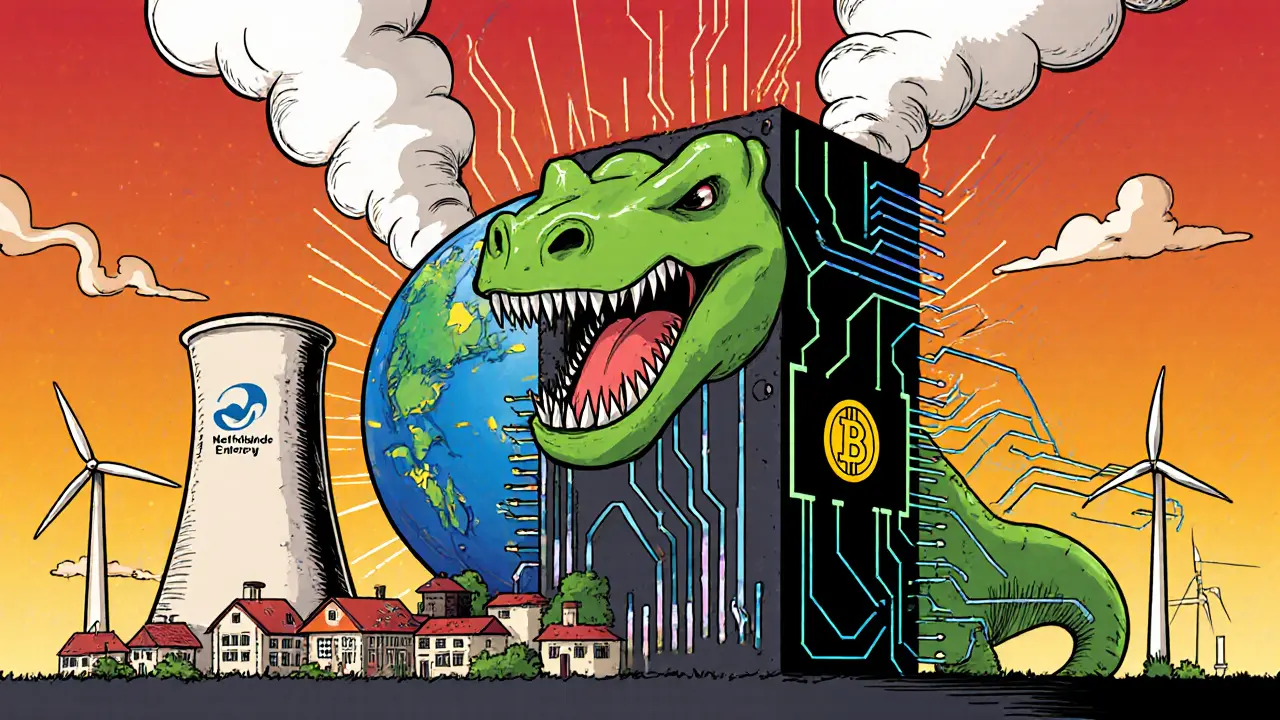

But it’s not without flaws. Critics point to energy use—Bitcoin mining consumes more electricity than some countries. Yet, much of that power comes from stranded or otherwise wasted energy, like flare gas in oil fields or excess hydro power in winter. And while newer blockchains use less energy with Proof of Stake, none have matched PoW’s track record of uptime, resistance to censorship, and simplicity. Crypto consensus, the method by which distributed networks agree on the state of the ledger isn’t just about efficiency—it’s about reliability under pressure. When governments try to shut down mining, when hackers target exchanges, when markets crash—PoW keeps going.

What you’ll find in these articles isn’t theory. It’s real-world evidence. You’ll read about how Iran’s broken power grid fuels Bitcoin mining, how El Salvador’s Bitcoin law failed despite government backing, and how regulators in Singapore and the U.S. are trying to control what they can’t fully stop. You’ll see how mining rewards shape market cycles, how energy subsidies distort global competition, and why even scam tokens still rely on the same PoW infrastructure to exist. This isn’t just about Bitcoin. It’s about the rules that make decentralized value possible—and why, for now, Proof of Work blockchain still holds the line.