Proof of Work vs. Proof of Stake Energy Calculator

Calculate Energy Impact

Compare the environmental cost of Bitcoin transactions versus sustainable alternatives

Energy Comparison

0 kg CO2 = 0 homes powered for a month

Why This Matters

Bitcoin uses 707 kWh per transaction – enough to power a U.S. home for over 3 weeks. Ethereum's switch to Proof of Stake reduced energy use by 99.95%. Most new blockchains like Solana and Cardano use less than 0.001% of Bitcoin's energy.

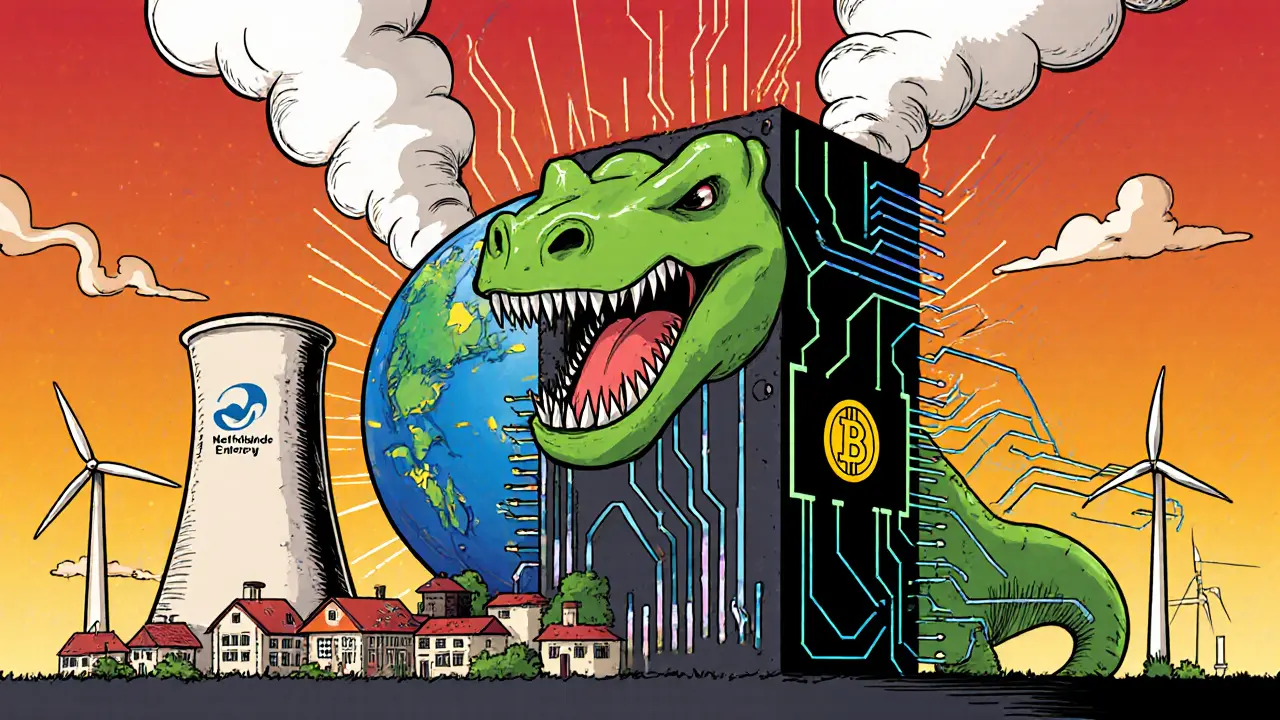

When you send Bitcoin or mine Ethereum before 2022, you’re not just transferring digital money-you’re using as much electricity as a small country. The environmental cost of Proof of Work blockchains isn’t a side effect. It’s built into the system. And it’s massive.

How Proof of Work Uses More Power Than Most Countries

Proof of Work (PoW) works by forcing miners to solve insanely hard math problems using powerful computers. The first one to solve it gets rewarded with new coins. This competition keeps the network secure-but it also guzzles electricity. Bitcoin, the biggest PoW blockchain, uses about 112 terawatt-hours (TWh) of electricity every year. That’s more than the entire nation of the Netherlands. Or Argentina. Or 90% of all African countries.

One Bitcoin transaction alone uses 707 kilowatt-hours (kWh). To put that in perspective: that’s enough to power an average U.S. home for over three weeks. Meanwhile, a single Ethereum transaction after its switch to Proof of Stake uses less than 0.001% of that. The difference isn’t small. It’s planetary.

Why Renewable Energy Doesn’t Fix the Problem

You’ve probably heard: “Miners use solar and wind, so it’s green.” That sounds reasonable-until you look closer. Renewable energy isn’t infinite. When a mining farm in Texas runs on solar power, that’s solar energy that isn’t going to homes, schools, or hospitals. The grid doesn’t magically make more electricity when miners show up.

And here’s the real issue: PoW needs power 24/7. Solar doesn’t work at night. Wind doesn’t blow constantly. So even if miners claim to use renewables, they still need backup from fossil fuels or grid power during lulls. That means they’re not replacing dirty energy-they’re adding to the total demand. And that demand pushes utilities to build more power plants, often gas-fired ones, just to keep up.

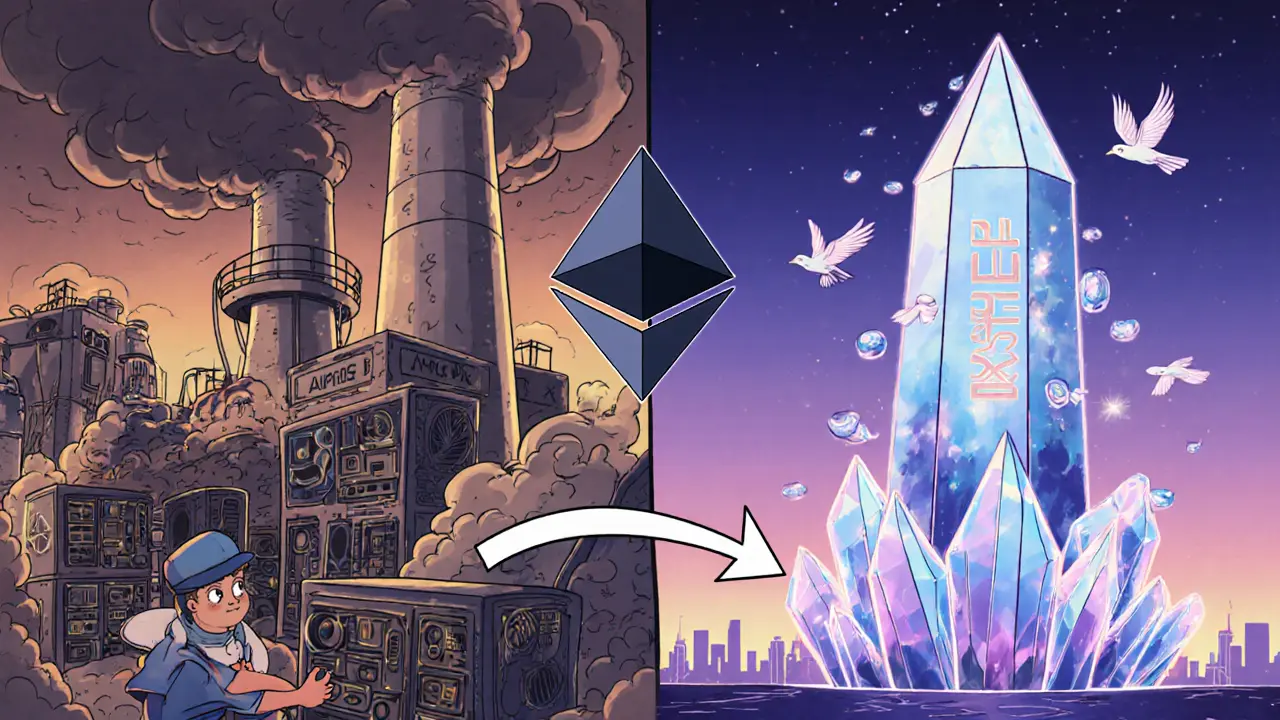

Ethereum’s Switch Proved It Doesn’t Have to Be This Way

In September 2022, Ethereum pulled the plug on Proof of Work. It didn’t shut down. It didn’t break. It just switched to Proof of Stake (PoS)-a system where validators are chosen based on how much crypto they lock up, not how much electricity they burn. The result? A 99.95% drop in energy use.

Before the switch, Ethereum used about 8.5 gigawatts of power. After? Less than 85 megawatts. That’s like turning off 99 out of every 100 power plants running for the network. The carbon footprint collapsed from 13 million tons of CO2 per year to just 0.01 million. That’s not progress. That’s a revolution.

And it wasn’t theoretical. It happened. Real people, real code, real results. If Ethereum could do it, why can’t Bitcoin?

Bitcoin’s Resistance Isn’t Technical-It’s Cultural

Technically, Bitcoin could switch to Proof of Stake. The code exists. The models have been tested. But the community doesn’t want to. Many Bitcoin believers think PoW’s energy use is a feature, not a bug. They argue that the high cost of mining makes the network more secure. That’s true-but it’s also a dangerous trade-off. Security shouldn’t mean burning the planet.

Unlike Ethereum, which had a centralized team pushing for change, Bitcoin’s decentralized structure means no one can force a upgrade. That sounds democratic-but in practice, it means the network is stuck. Even as global regulators step in, as investors pull out, and as younger users reject crypto for its environmental toll, Bitcoin’s core group holds firm. The result? Bitcoin’s emissions are still climbing, while most new blockchains avoid PoW entirely.

Regulators Are Starting to Act

Governments aren’t waiting. The U.S. has introduced bills to cap crypto mining emissions. The European Union has included crypto in its carbon reporting rules. Countries like Iceland and Kazakhstan have banned new mining operations over grid overload fears. China shut down nearly all mining in 2021-not because it hated crypto, but because it couldn’t afford the power drain.

The OECD says every crypto project should now be required to publish its environmental impact. That’s a big deal. It means companies can’t hide behind vague claims like “we use clean energy.” They’ll have to prove it. And when they do, most PoW miners will look bad.

Investors Are Walking Away

Big companies are ditching Bitcoin-not because it’s insecure, but because it’s unsustainable. Tesla stopped accepting Bitcoin payments in 2021, citing environmental concerns. BlackRock and other major asset managers now exclude PoW cryptocurrencies from their ESG (Environmental, Social, Governance) funds. Why? Because their clients don’t want to invest in something that wastes more energy than entire nations.

Meanwhile, funds focused on “green crypto” are growing fast. They’re backing PoS networks like Solana, Cardano, and even Ethereum. These networks use less than 0.001% of Bitcoin’s energy. They’re not perfect-but they’re not destroying the planet to function.

What’s Next for Proof of Work?

Proof of Work isn’t going away overnight. Bitcoin will keep running. Dogecoin, Litecoin, and a few others will stick with it too. But they’re becoming the fossil fuel cars of blockchain-relics of an older era. New projects? Almost none use PoW anymore. Why? Because it’s expensive, inefficient, and increasingly unpopular.

The future belongs to networks that prove they can be secure without being destructive. Proof of Stake isn’t just better for the environment. It’s faster, cheaper, and more scalable. And as more users demand it, the pressure on PoW will only grow.

What You Can Do

If you’re using crypto, ask: Which consensus mechanism does this use? If it’s Proof of Work, you’re contributing to a system that burns more electricity than 90% of the world’s countries. If it’s Proof of Stake, you’re helping build something cleaner.

Don’t just pick crypto because it’s popular. Pick it because it’s responsible. Support projects that measure and reduce their footprint. Move your holdings to PoS chains. Talk to friends about why energy use matters. The technology isn’t the problem. The choice is.

How much electricity does Bitcoin use compared to other cryptocurrencies?

Bitcoin uses about 112 terawatt-hours (TWh) per year-more than the entire Netherlands or Argentina. Ethereum, after switching to Proof of Stake, uses less than 0.01 TWh annually. That’s over 99.9% less. Most new blockchains like Solana, Cardano, and Polygon use even less-often less than 1 TWh per year. Bitcoin’s energy use is an outlier, not the norm.

Is Proof of Work more secure than Proof of Stake?

Proof of Work is secure because it’s expensive to attack-you’d need to control over 50% of the world’s mining power. But Proof of Stake is secure too: attacking it means buying and locking up over half the total supply of the coin, which would be astronomically expensive and would destroy the value of your own holdings. Ethereum has operated securely on PoS since 2022, handling billions in transactions without a single major breach. Security doesn’t require massive energy waste.

Can Bitcoin ever switch to Proof of Stake?

Technically, yes. The code could be written. But politically? Almost certainly not. Bitcoin’s community strongly values decentralization and the energy cost of mining as a form of security. Most core developers and holders believe changing the consensus mechanism would break Bitcoin’s identity. That’s why Bitcoin remains the last major PoW blockchain-and why it’s increasingly isolated from the rest of the industry.

Do crypto mining companies really use renewable energy?

Some do-but not as cleanly as they claim. Many miners buy renewable energy credits or locate near hydroelectric dams, but they still rely on fossil fuels when renewables aren’t available. Because PoW demands constant power, they can’t wait for sun or wind. They need grid backup. That means even “green” miners often contribute to net increases in fossil fuel use. True sustainability means reducing demand-not just offsetting it.

Why do people still mine Bitcoin if it’s so bad for the environment?

Because mining still pays. The block reward and transaction fees are worth more than the electricity cost-for now. Miners are businesses. They follow profit, not principles. But as regulations tighten, electricity prices rise, and public pressure grows, that equation is changing. Many mining operations are already shutting down or moving to cheaper regions. The era of profitable, high-emission mining is ending.

Are there any environmentally friendly blockchains I can use instead?

Yes. Ethereum (after its 2022 Merge), Solana, Cardano, Polygon, and Algorand all use Proof of Stake or similar low-energy consensus. They’re faster, cheaper, and use less than 0.01% of Bitcoin’s energy. You can send payments, stake tokens, or use DeFi apps on these networks without contributing to massive carbon emissions. Switching doesn’t mean giving up crypto-it means choosing a better version of it.