Proof of Stake vs Proof of Work: How Blockchain Consensus Really Works

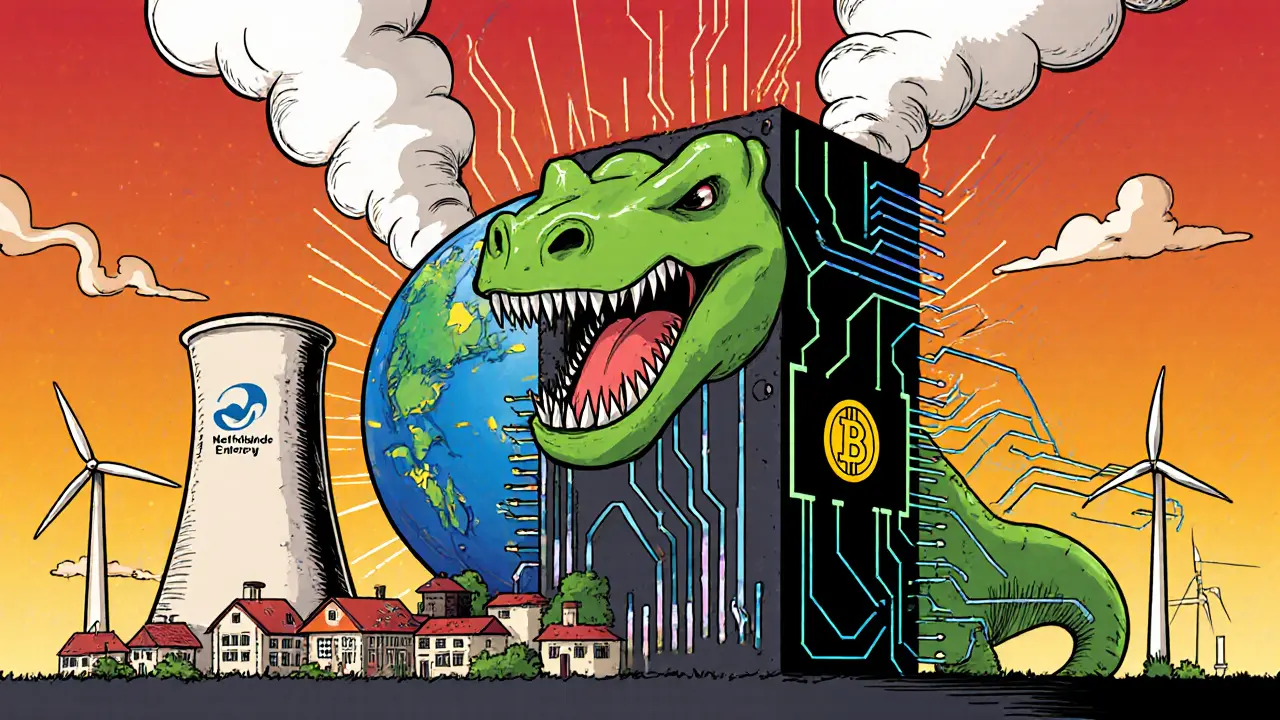

At the heart of every blockchain is a Proof of Work, a consensus mechanism where miners compete to solve complex math puzzles to validate transactions and earn rewards. Also known as mining-based validation, it’s the original method that made Bitcoin secure—but it’s also incredibly energy-heavy. Then came Proof of Stake, a system where validators are chosen based on how much crypto they lock up, not how much electricity they burn. Also known as staking-based validation, it’s what Ethereum switched to in 2022 to cut its energy use by over 99%. These aren’t just technical details—they change who can participate, how much it costs to run a network, and even how secure your coins are.

Proof of Work needs powerful computers, expensive electricity, and specialized hardware. That’s why mining got dominated by big farms in places like Kazakhstan and Texas. Proof of Stake? You just need to hold coins and leave them locked in a wallet. No machines, no noise, no massive power bills. That’s why smaller players can now be part of the network. But it’s not perfect—some worry that Proof of Stake gives too much power to the rich, since the more coins you hold, the more likely you are to be chosen to validate blocks. Still, most experts agree it’s a smarter path forward, especially as climate concerns grow and governments start regulating energy use in crypto.

When Ethereum moved from Proof of Work to Proof of Stake, it didn’t just save energy—it changed the whole economics of the network. Miners lost their jobs. Stakers gained new income. Transaction fees dropped. And suddenly, everyday users could help secure the blockchain without buying a rig. That shift opened the door for more projects to follow, like Solana, Cardano, and Polkadot—all built on Proof of Stake from day one. Meanwhile, Bitcoin still clings to Proof of Work, not because it’s better, but because changing it would risk everything. That tension defines today’s crypto landscape: one side pushing for efficiency and sustainability, the other holding on to the original vision.

What you’ll find below aren’t just articles about consensus. They’re real stories about how these systems shape who wins, who loses, and how governments react. From energy subsidies in Iran fueling Bitcoin mining to Singapore cracking down on crypto compliance, the choices behind Proof of Work and Proof of Stake ripple through laws, markets, and wallets. You’ll see how scams exploit confusion around staking, how exchanges handle the transition, and why some tokens vanish when the underlying tech isn’t trusted. This isn’t theory—it’s what’s happening right now, in real time, with real money at stake.