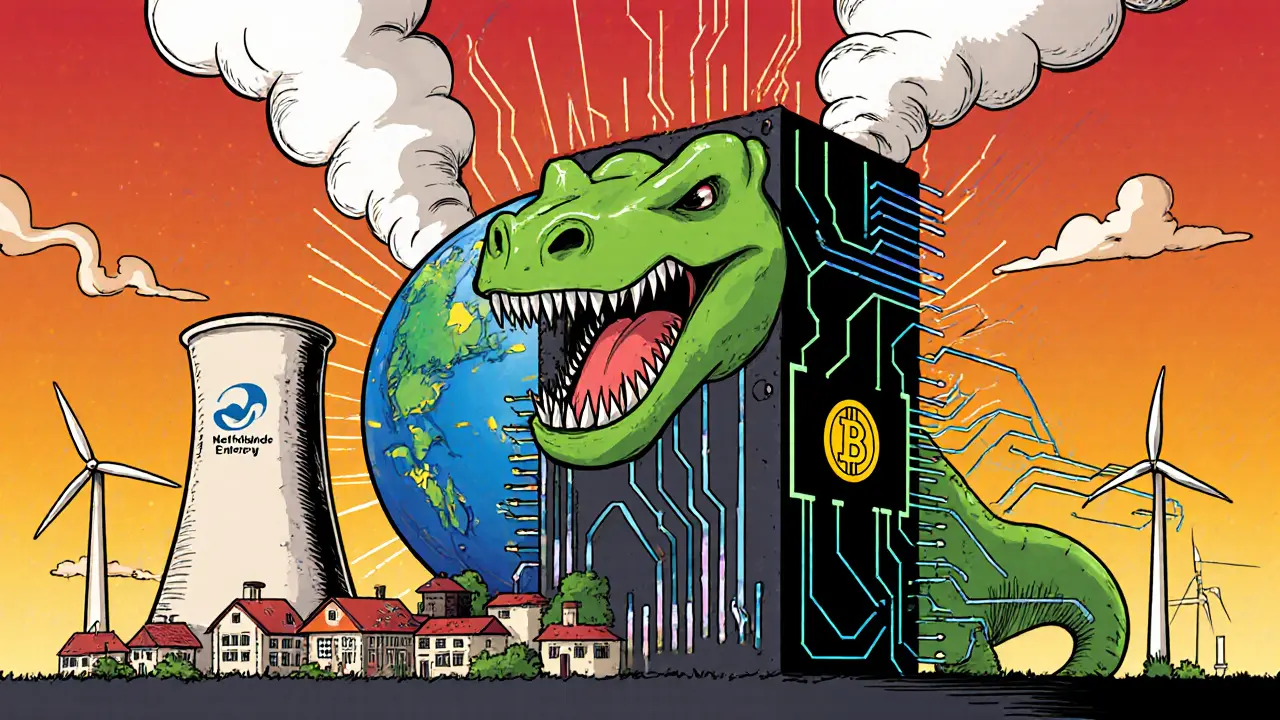

Crypto Carbon Footprint: How Blockchain Mining Impacts the Environment

When you hear crypto carbon footprint, the total greenhouse gas emissions caused by cryptocurrency mining and network operations. Also known as blockchain energy use, it's the hidden cost behind every Bitcoin transaction. It’s not just about how much electricity a mining rig uses—it’s about where that power comes from, who pays for it, and what it means for the planet.

The biggest contributor to this footprint is proof of work, the consensus mechanism used by Bitcoin and other early blockchains that requires massive computational power. Miners race to solve complex math problems, using GPUs and ASICs that can draw as much power as a small town. In 2023, Bitcoin’s annual energy use was estimated at over 120 terawatt-hours—more than entire countries like Argentina or the Netherlands. That’s not theoretical. It’s real electricity pulled from coal plants in Kazakhstan, hydro dams in China, and subsidized grids in Iran, where miners run 24/7 while citizens face blackouts.

But not all blockchains are the same. proof of stake, a newer consensus model that replaces mining with staking, slashing energy use by over 99%. Ethereum switched to this in 2022 and cut its carbon footprint overnight. Other chains like Solana and Cardano were built this way from day one. The difference? One uses the energy of a city. The other uses the energy of a single home. And yet, most people still think all crypto is the same.

Regulators are starting to take notice. The EU’s MiCA rules now require crypto projects to disclose their environmental impact. The U.S. is looking at similar moves. Some countries, like Iceland and Canada, are encouraging miners to use renewable energy. Others, like China, just banned it outright. Meanwhile, crypto projects are quietly shifting—because investors care, customers care, and the planet is running out of time.

What you’ll find below isn’t just a list of articles. It’s a collection of real stories: how Iran’s broken power grid fuels Bitcoin mining, why El Salvador’s Bitcoin experiment failed partly due to energy costs, and how exchanges like THORChain and ShadowSwap operate with little oversight. You’ll see scams tied to fake tokens, regulatory crackdowns, and the quiet rise of low-energy alternatives. This isn’t about fear. It’s about awareness. And if you’re holding crypto, using it, or just curious—you need to know what’s really happening behind the screen.