Crypto Sanctions Evasion Calculator

See how volatile Bitcoin prices affect international trade compared to stablecoins like A7A5 for sanctions evasion. Russia's $400B annual exports need stable value - Bitcoin's 20% weekly swings make it unreliable for large-scale commerce.

Results

Bitcoin Value After Volatility

$0

(20% fluctuation risk)

A7A5 Stablecoin Value

$0

(1:1 ruble peg)

For Russia's $400B annual exports, a 20% Bitcoin price swing means $80B in potential value loss between trade agreements. Stablecoins like A7A5 provide the consistent value needed for international commerce.

When Russia legalized cryptocurrency mining in early 2025, it wasn’t about embracing digital currency for its citizens. It was about survival. After Western sanctions froze billions in central bank reserves and cut off access to SWIFT, Russia needed a way to move money, buy weapons, and pay for oil and grain without using dollars or euros. Crypto mining became the backbone of that plan.

How Crypto Mining Became a Sanctions Tool

Russia didn’t suddenly turn into a crypto paradise. For years, the government viewed Bitcoin and other digital assets with suspicion. But after 2022, when sanctions hit hard, the calculus changed. Mining requires electricity, not banks. And Russia has plenty of both-cheap power from Siberia, excess capacity from state-owned energy firms, and a network of hidden data centers. By legalizing mining, Russia created a legal shield for what was already happening underground. Miners could now operate openly, using state-backed power grids to generate Bitcoin, Ethereum, and other coins. But the real target wasn’t Bitcoin. It was stablecoins-digital tokens pegged to real money-that could move across borders without triggering financial alarms. Enter A7A5. Launched in February 2025 by a Moldovan oligarch linked to Russia’s Promsvyazbank, A7A5 is a ruble-backed stablecoin. Unlike Bitcoin, which swings wildly in price, A7A5 holds steady at 1:1 with the ruble. That makes it perfect for trade. By July 2025, it had processed over $51 billion in transactions. That’s not retail users buying coffee. That’s factories paying for machinery, arms dealers buying parts, and exporters swapping oil for food-all outside the reach of U.S. or EU banks.The Shadow Network Behind the Coins

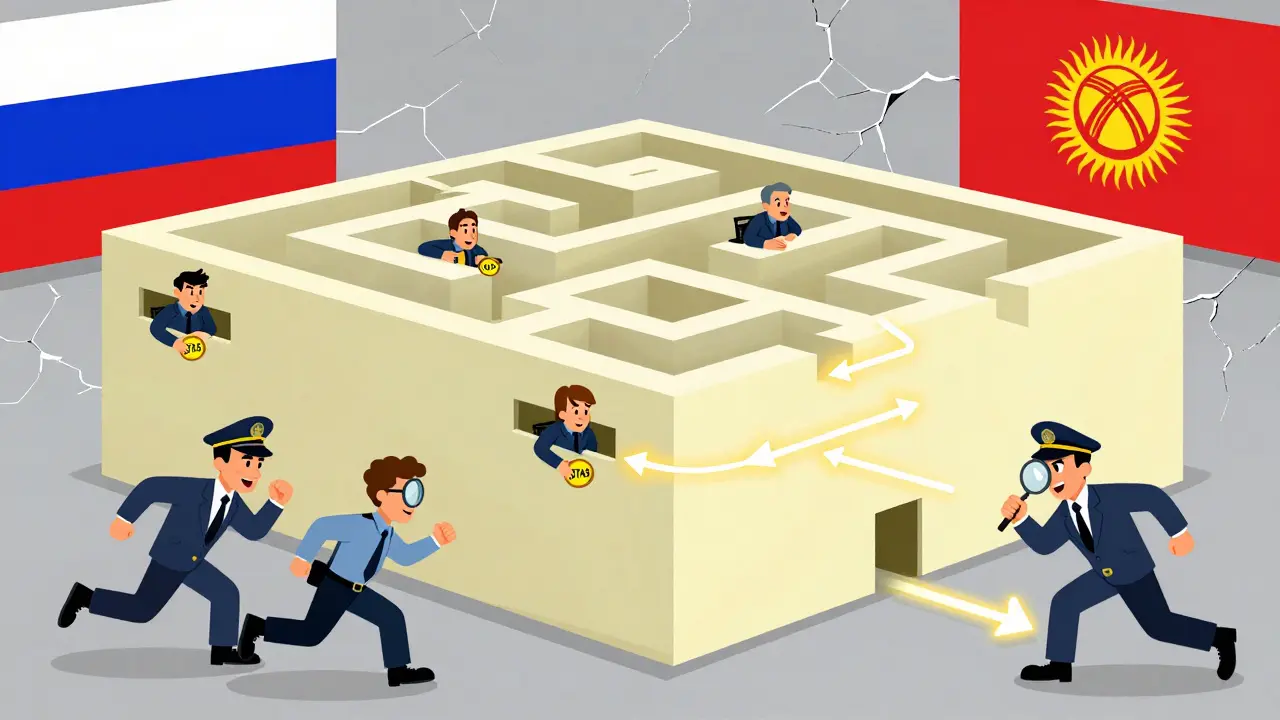

A7A5 doesn’t run on public exchanges like Coinbase or Binance. It flows through a closed loop of sanctioned platforms. Garantex, a Russian-linked exchange banned by the U.S. in 2022, was the first hub. When it got shut down, its former employees launched Grinex in 2024-specifically to dodge sanctions. The U.S. sanctioned Grinex in August 2025, calling it a “sanctions evasion tool.” The infrastructure goes deeper. Kyrgyzstan-based firms, Luxembourg shell companies, and even Kyrgyz banks are now on international sanctions lists. These aren’t random actors. They’re nodes in a system built to avoid detection. Chainalysis, a blockchain analytics firm, found that A7A5 transactions follow business-day patterns-Monday through Friday, with spikes around paydays in Russian industrial zones. That’s not gambling. That’s commerce. Even more telling: you can now buy A7A5 directly with PSB bank cards on its website. That’s Promsvyazbank, a state-owned Russian bank under U.S. sanctions. The message is clear: this isn’t just for miners. It’s for the entire economy.

Why the West Is Fighting Back

The U.S. Treasury didn’t just slap sanctions on exchanges. On August 20, 2025, it made history by designating a crypto mining company for the first time ever. That’s how serious this is. The Treasury didn’t just target the coins-they went after the machines, the power suppliers, and the people managing the rigs. The UK followed suit, sanctioning Old Vector (A7A5’s issuer), Grinex, and four Kyrgyz entities. The goal? Cut off the supply chain. If you can’t power the miners, you can’t make the coins. If you can’t move the coins through sanctioned exchanges, they’re useless. But here’s the twist: blockchain is transparent. Every A7A5 transaction is recorded on a public ledger. That means every dollar moved leaves a trail. The U.S. and UK aren’t trying to shut down crypto-they’re using the blockchain itself to track who’s using it, where the money flows, and who’s helping. The miners might be legal in Russia, but the people they’re trading with? They’re on watchlists.Can Crypto Really Replace the Dollar?

Here’s the reality check: crypto isn’t replacing the dollar. It’s a workaround-not a replacement. Russia’s annual exports before the war were worth about $400 billion. Bitcoin’s entire market cap? Around $800 billion. That sounds like enough-until you realize Bitcoin’s price swings 20% in a week. No one wants to sell oil for Bitcoin if it could drop 30% before they get paid. A7A5 solves that by pegging to the ruble. But rubles aren’t accepted globally. So now Russia has to trade A7A5 for other stablecoins, then convert those into commodities. It’s a chain of middlemen, each step adding risk. The Bitcoin Policy Institute put it bluntly: Bitcoin is too small and too volatile to be a global trade currency. Russia isn’t building a new financial system. It’s patching holes in the old one. Other countries like North Korea and Venezuela have tried similar moves. But none have come close to Russia’s scale. That’s because Russia has state power behind it-power to control energy, banks, and even the legal system. No rogue group or startup could pull this off alone.

The Real Cost of Crypto Sanctions Evasion

The price of this strategy isn’t just in sanctions. It’s in isolation. By relying on crypto, Russia has cut itself off from the global financial system. Western banks won’t touch it. Western tech won’t support it. Even crypto projects that want to work with Russia now risk being blacklisted. That’s why Grinex had to be built from scratch by former Garantex employees. No established platform would touch it. And then there’s the human cost. The U.S. and UK have sanctioned over 40 individuals linked to this network-including oligarchs, bank managers, and engineers running mining farms. These aren’t just businessmen. They’re people whose assets are frozen, whose travel is banned, whose families are affected. Russia’s crypto experiment isn’t a victory. It’s a sign of weakness. A nation forced to build its own financial system because the world turned its back.What This Means for the Future

Russia’s legalization of crypto mining isn’t the endgame. It’s a stopgap. The West is adapting fast. New tools are being built to trace crypto flows across borders. Exchanges are being forced to comply with global rules-or vanish. Meanwhile, Russia keeps mining. It keeps issuing A7A5. It keeps finding new ways to move money. But each step makes it more visible-not less. The lesson? Cryptocurrency doesn’t make you invisible. It just changes the way you’re tracked. If you’re a business trying to trade with Russia, you’re now walking into a minefield. Even if you don’t use crypto, your suppliers might. And if they do, you could be pulled into a sanctions investigation. The age of anonymous financial flows is over. Blockchain doesn’t hide-it records. And right now, the world is watching every transaction Russia makes.Is crypto mining legal in Russia?

Yes, since early 2025, Russia has officially legalized cryptocurrency mining. The government now allows mining operations to use state-owned power grids and even permits certain crypto payments for trade. This shift was made to help bypass Western sanctions, not to promote digital currency for consumers.

What is the A7A5 stablecoin?

A7A5 is a ruble-backed stablecoin launched in February 2025 by Old Vector, a company linked to Russia’s state-owned Promsvyazbank. It’s designed to hold a 1:1 value with the Russian ruble and has processed over $51 billion in transactions by July 2025. It’s primarily used for cross-border trade and sanctions evasion, not personal spending.

Can Russia use Bitcoin to evade sanctions?

Not effectively. Bitcoin’s price is too volatile for large-scale trade. Russia’s annual exports are worth $400 billion-roughly half of Bitcoin’s total market cap. No exporter wants to risk losing 30% of their payment overnight. That’s why Russia uses stablecoins like A7A5 instead.

Why did the U.S. sanction a crypto mining company?

For the first time ever, the U.S. Treasury sanctioned a crypto mining firm in August 2025 because it was directly supporting Russia’s sanctions evasion. The move signaled that even infrastructure like mining rigs and power supplies are now targets if they help fund war efforts or bypass financial restrictions.

Is crypto truly anonymous and untraceable?

No. Every crypto transaction is recorded on a public blockchain. While identities aren’t always visible, experts can trace patterns, link wallets to exchanges, and identify funding flows. Western agencies use this transparency to track Russian evasion networks-not hide them.

What happens if I do business with a Russian company using crypto?

You risk being caught in a sanctions investigation. Even if you don’t use crypto yourself, if your supplier or partner uses A7A5 or other sanctioned platforms, your transactions could be flagged. Banks and regulators now monitor crypto flows closely. Ignorance isn’t a defense.

Is Russia the only country using crypto to evade sanctions?

No. North Korea and Venezuela have also used cryptocurrency to bypass sanctions. But Russia is the only country with the scale, state control, and infrastructure to make it a national strategy. Others use crypto for small-scale evasion. Russia built a system around it.