Whale Transaction Value Calculator

Estimated Value:

When a single wallet moves 10,000 ETH-worth over $30 million-it doesn’t just disappear into the blockchain. It sends ripples through the entire market. Crypto whales aren’t just big holders; they’re market movers. And if you know how to watch them, you can see price shifts before they happen. This isn’t guesswork. It’s data-driven insight, pulled straight from the public ledger.

What Exactly Is a Crypto Whale?

A crypto whale is anyone holding enough cryptocurrency to move markets. There’s no official number, but the industry uses rough thresholds: 1,000+ BTC, 10,000+ ETH, or 5,000+ BNB. These aren’t random people. Many are hedge funds, exchanges, early adopters, or institutions. Their trades are big enough to trigger liquidity changes, stop-loss cascades, or FOMO buying. The key? Blockchain transparency. Every transaction is public. You can see exactly when a whale sends 2,000 BTC from one wallet to another. The trick is knowing what that move means.Where to Watch Whale Activity

You don’t need to run a node or decode raw blockchain data. Tools do the heavy lifting. Here are the top platforms used by traders today:- Whale Alert - The OG. It tweets every transaction over 100 BTC or 1,000 ETH. Free, fast, and simple. Over 1.2 million followers. Great for spotting sudden moves.

- Nansen.ai - The pro tool. It labels wallets: "Coinbase," "Binance Hot Wallet," "Unknown Whale Cluster." It shows whether a whale is depositing to an exchange (likely selling) or withdrawing to a cold wallet (likely holding). Starts at $99/month.

- Arkham Intelligence - Tracks wallet clusters across 15 blockchains. Shows profit/loss history and links transactions to real-world entities like exchanges or DeFi protocols. Pricing starts at $149/month.

- Debank - Free portfolio tracker that shows whale-like movements in real time. Good for beginners. Pro version is $19.99/month.

- CryptocurrencyAlerting.com - Lets you set custom thresholds. Want alerts only for movements over 500 ETH? You can do that. $29/month.

Whale Alert is your free starting point. Nansen and Arkham are where serious traders go. You don’t need both-but if you’re serious, one premium tool is worth it.

How to Interpret Whale Moves

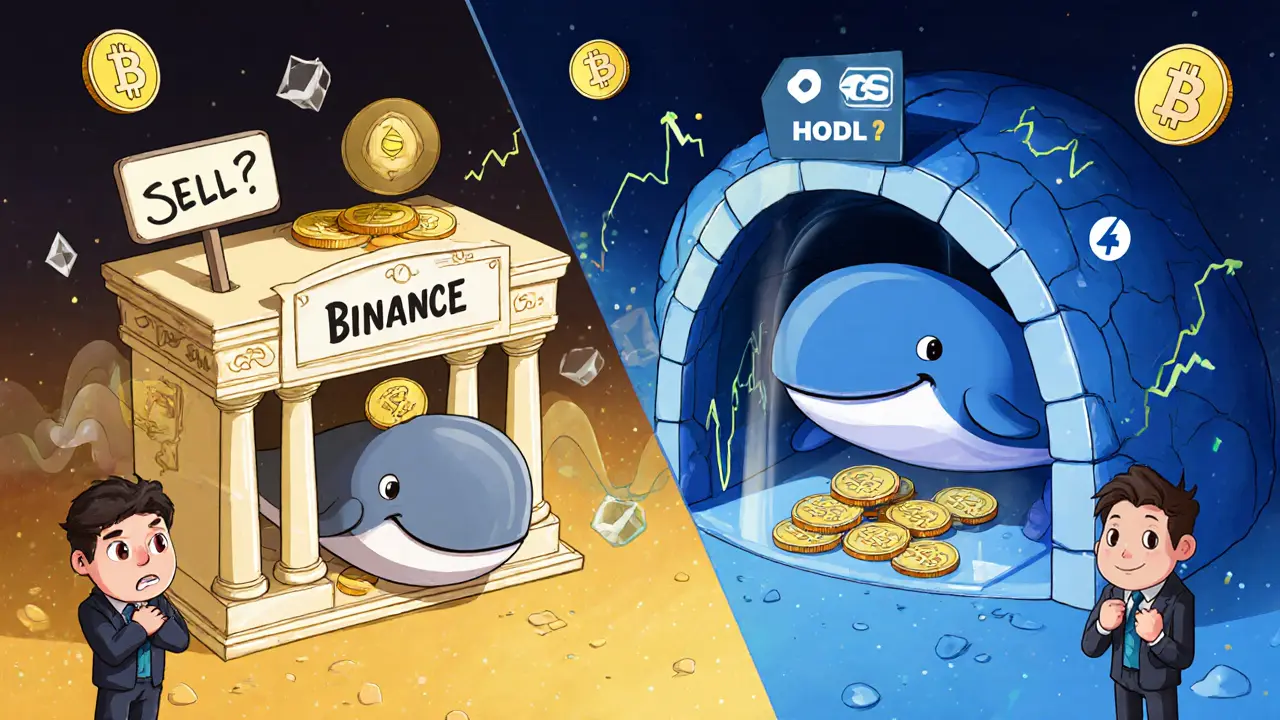

Seeing a big transaction isn’t enough. You need context. Here are five proven strategies:- Exchange Deposits vs. Withdrawals - When whales move crypto to an exchange, they’re likely preparing to sell. When they move it away from exchanges into personal wallets, they’re accumulating. Nansen.ai found that ETH outflows from exchanges preceded 73% of 5%+ price rallies in 2025.

- Stablecoin Flow - Watch USDT and USDC. If whales start moving large amounts of stablecoins onto exchanges, they’re getting ready to buy. A 2025 Nansen study showed that 80% of major BTC pumps followed a spike in stablecoin inflows to Binance and Coinbase within 12-24 hours.

- Wallet Clustering - One whale might use 20 different addresses. Tools like Arkham group these together. If 15 wallets linked to one entity suddenly buy 5,000 ETH in a week, that’s a coordinated accumulation-not random noise.

- Timing with Market Sentiment - A whale buys 3,000 BTC during a market panic? That’s a strong signal. Same move during a hype peak? Could be a trap. Always cross-check with social sentiment and RSI levels.

- Watch for Spoofing - Some whales place fake large orders to scare others. These are called "whale walls." They appear on order books but vanish before execution. If a transaction shows up on Whale Alert but doesn’t show up on the order book, it’s likely a real move-not a manipulation.

One trader on Reddit, u/CryptoWhaleWatcher, caught a 37% ETH pump in July 2025 by spotting a 12,000 ETH withdrawal from Binance-then watching stablecoin inflows rise 4 hours later. He didn’t just follow the whale. He followed the pattern.

What Whale Tracking Can’t Tell You

It’s not magic. There are blind spots.- Privacy Coins - Monero, Zcash, and others hide transaction details. About 8-12% of total crypto value is untrackable.

- Hidden Wallets - Some whales use mixers or multi-sig setups to obscure origins. Tornado Cash’s 2025 update made 15-20% of ETH transfers harder to trace.

- Exchange Moves Aren’t Always Whales - 30-40% of "large" transactions are just internal exchange transfers. A wallet labeled "Binance" might just be moving funds between their own hot and cold wallets. Nansen helps here by labeling known exchange wallets.

- False Signals - Whale Alert has a 2.1/5 accuracy rating on Trustpilot. Many alerts are noise. One user lost 15% following a whale deposit to Binance-only to find out it was a wallet cleanup, not a sell-off.

Whale tracking gives you an edge-not a crystal ball. The best traders combine it with technical analysis. One TradingView contributor, CryptoAnalystPro, backtested 2024-2025 data and found that combining Whale Alert signals with RSI divergence improved prediction accuracy from 52% to 68%.

How to Set It Up (Step by Step)

You don’t need to be a coder. Here’s how to start today:- Choose your tool - Start with Whale Alert on Twitter or Telegram. Free. Instant.

- Set alerts - If you upgrade to Nansen or Arkham, set minimum thresholds. Don’t get spammed by 50 ETH moves. Set it to 1,000 ETH or higher.

- Track specific coins - Focus on ETH and BTC first. They’re the most liquid and have the clearest whale patterns.

- Connect to your wallet - Use Debank or Nansen to see how your holdings compare to whale movements. Are you buying when they’re selling? That’s a red flag.

- Wait for patterns - Don’t trade on one alert. Look for clusters: whale withdrawal + stablecoin inflow + low RSI. That’s the signal.

Beginners often make one mistake: reacting to every big transaction. Don’t. Wait for confirmation. One move is a whisper. Three moves in 24 hours? That’s a shout.

Who’s Using This-and Why It’s Growing

In 2025, 78% of crypto hedge funds use advanced whale tracking tools. Fidelity Digital Assets reported that in Q2 2025. Retail traders? 68% use it, according to Reddit polls. The market for these tools hit $127 million in 2024 and is projected to hit $342 million by 2026. Why? Because whales are getting smarter. And so are the tools. Nansen launched "Whale Pulse" in August 2025-a feature that scans 50+ social platforms to see if hype matches whale activity. Arkham just integrated with Coinbase Prime, giving institutional clients exclusive data. Chainalysis bought Skynet in July 2025 to build AI-powered whale prediction models for 2026. The game is changing. What was once a niche trick is now essential infrastructure.Common Mistakes to Avoid

- Trading on a single alert - One big transfer doesn’t mean the market is turning. Look for patterns.

- Ignoring the time gap - Most free tools have 3-5 minute delays. If you’re day trading, that’s too slow. Use premium tools with real-time alerts.

- Chasing every whale - Not all whales are smart. Some are just dumping. Use wallet labels to tell the difference.

- Forgetting the bigger picture - Whale activity explains 18.7% of Bitcoin’s short-term volatility, according to UC Berkeley’s 2025 study. That’s significant-but not everything. Combine it with volume, news, and macro trends.

The most successful traders don’t follow whales. They follow the story behind the move.

Can I track crypto whales for free?

Yes. Whale Alert offers free real-time Twitter and Telegram alerts for transactions over 100 BTC or 1,000 ETH. Debank also offers free multi-chain tracking. These tools give you the basics: when big moves happen. But they don’t tell you why-for that, you need labeled wallet data from Nansen or Arkham, which require paid plans.

Are whale movements always accurate predictors?

No. Whale moves are signals, not guarantees. A large deposit to an exchange might mean a sell-off-but it could also be a wallet upgrade or tax payment. Nansen’s research shows that only 60-70% of whale movements directly correlate with price moves within 24 hours. Always confirm with other indicators like RSI, volume spikes, or stablecoin flow.

Which blockchain should I focus on for whale tracking?

Start with Ethereum and Bitcoin. They have the most liquidity, the clearest whale patterns, and the best tracking tools. Binance Smart Chain is also popular due to high DeFi activity, but it’s more volatile and has more noise. Avoid privacy chains like Monero-those transactions are intentionally hidden.

How do I know if a whale is buying or selling?

Look at where the coins are going. If a whale moves ETH from a cold wallet to Binance, they’re likely selling. If they move ETH from Binance to a personal wallet, they’re likely accumulating. Stablecoin inflows to exchanges after a whale withdrawal often mean they’re preparing to buy. Nansen.ai labels wallets as "Exchange," "Hodler," or "DeFi," making this much easier.

Is whale tracking legal?

Yes. All blockchain transactions are public. Tracking them is legal in most jurisdictions. However, the SEC warned in May 2025 that tools linking wallet addresses to real identities must comply with data privacy laws. As long as you’re not hacking or de-anonymizing users, you’re fine. Tools like Nansen and Arkham use public on-chain data-they don’t break any rules.

What’s the best way to learn whale tracking?

Start with Whale Alert’s Twitter feed for a week. Note the timing of moves and how prices reacted. Then, sign up for a free Debank account and link a wallet to see how your activity compares. After that, explore Nansen’s free demo (no credit card needed). Join their Discord-there are daily analysis sessions. Practice for 2-3 weeks before trading. Most beginners improve dramatically after just 10-15 monitored moves.

Final Thoughts: Use It Wisely

Crypto whale tracking isn’t about getting rich overnight. It’s about reducing uncertainty. You’re not predicting the future-you’re spotting where the smart money is moving right now. The best traders don’t follow whales blindly. They use whale data as one piece of a larger puzzle: volume, sentiment, technicals, and macro trends.The tools are better than ever. The data is clearer. But the market still rewards patience, not speed. Watch. Wait. Confirm. Then act.