Coinbase Country Access Checker

Enter your country and click "Check Access" to see your service eligibility.

Key Takeaways

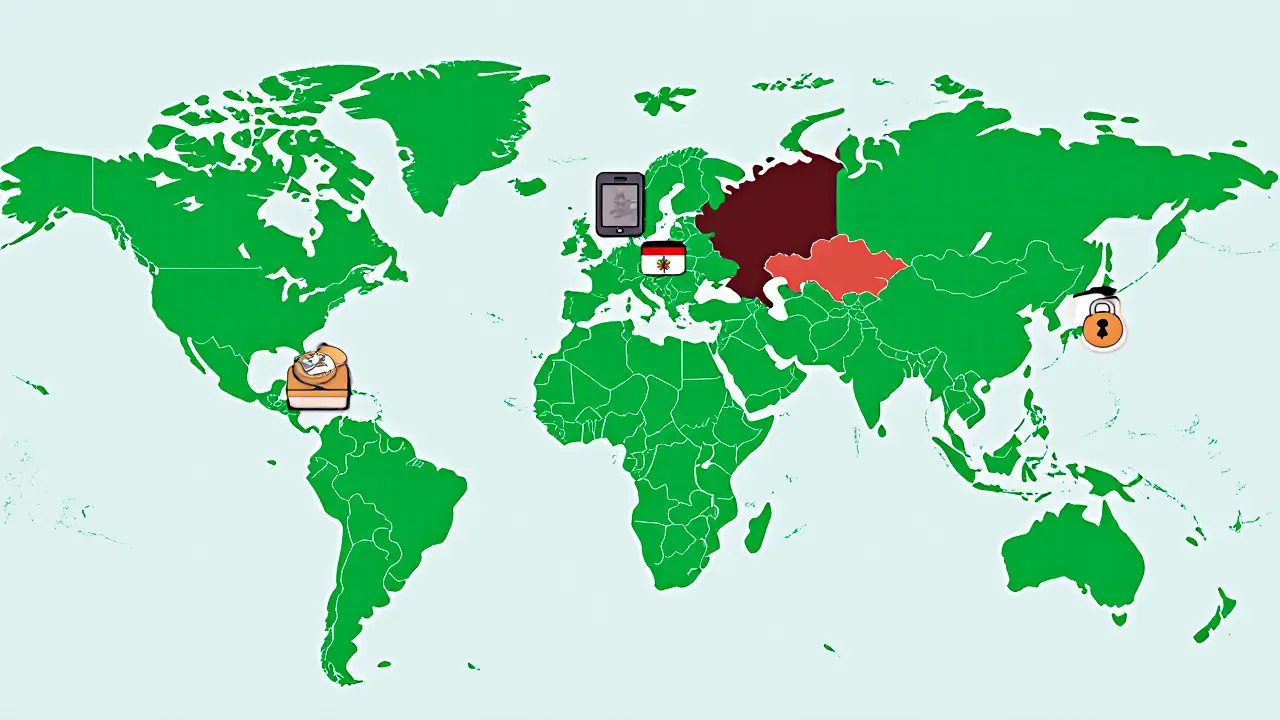

- Coinbase offers full fiat on‑ramps in 48 countries, but the Coinbase Wallet works in most others.

- U.S. Treasury OFAC sanctions drive blocks in Russia, Iran, Crimea, North Korea and related territories.

- European MiCA rules restrict staking of certain tokens, e.g., Cardano in 12 EU states.

- Emerging markets like Pakistan, Philippines and Nigeria see Wallet‑only access, forcing users to alternative exchanges.

- Compliance layers (IP check, KYC, regulatory sandboxes) cause delays of 24‑72 hours for new accounts in high‑risk jurisdictions.

Coinbase is a publicly traded cryptocurrency exchange (NASDAQ: COIN) that provides fiat‑on‑ramp services, crypto trading, and a non‑custodial wallet. It operates in over 100 countries but must obey U.S. Treasury OFAC sanctions, regional regulators like the EU’s MiCA, and local licensing bodies.

Why Geographic Restrictions Exist

Every country has its own set of rules for digital assets. Coinbase can’t ignore them because doing so would risk fines, loss of banking relationships, or even a forced shutdown of services in that jurisdiction. The three main legal forces shaping its map are:

- OFAC (Office of Foreign Assets Control) - blocks any U.S.‑linked company from serving persons in sanctioned regions.

- SEC (Securities and Exchange Commission) - pressures the platform to treat certain crypto tokens as securities, affecting where they can be offered.

- MiCA (Markets in Crypto‑Assets Regulation) - sets EU‑wide licensing and staking limits that vary by member state.

When any of these bodies signals a restriction, Coinbase updates its user agreement (last revised September 26 2025) and instantly blocks the affected services.

Coinbase Product Layers and Their Reach

The platform splits into two main products, each with its own geographic footprint.

- Coinbase App - a custodial app that lets users buy, sell, and withdraw fiat. Available in 48 countries (U.S., U.K., Germany, France, Singapore, etc.). Supports ACH, SEPA, debit/credit cards, Apple Pay, Google Pay, and PayPal. Transaction limits range from $500 daily for unverified users to $50 000 daily for fully verified accounts.

- Coinbase Wallet - a self‑custody Ethereum‑based wallet (5 500 + tokens). Works globally except in OFAC‑sanctioned zones. It does **not** allow fiat on‑ramps, but you can connect to dApps, stake supported tokens (subject to MiCA), and move assets freely.

Both products share the same KYC flow: government‑issued ID, proof of address, and IP geolocation. For high‑risk countries (e.g., Colombia, Pakistan) the system adds a 24‑72 hour hold on the first few transactions.

Country‑by‑Country Access Snapshot

| Country | App (Fiat) Access | Wallet Access | Key Restriction |

|---|---|---|---|

| United States | Yes | Yes | None |

| United Kingdom | Yes | Yes | None |

| Germany | Yes (SEPA) | Yes | MiCA staking limits on ADA |

| France | Yes | Yes | None |

| Singapore | Yes | Yes | None |

| India | Blocked (pending RBI approval) | Yes | Regulatory uncertainty |

| Pakistan | Blocked | Yes | OFAC‑related precaution |

| Philippines | Blocked | Yes | Local fiat on‑ramp shortage |

| Russia | Blocked | Yes (wallet only) | OFAC sanctions since 2022 |

| Nigeria | Blocked | Yes | Local licensing gap |

| Bangladesh | Blocked | Yes | Over‑broad OFAC interpretation |

| UAE | Limited (Apple Pay only) | Yes | Bank‑transfer block |

| Colombia | Blocked | Yes | 24‑72 hr hold on first deposits |

| Brazil | Yes | Yes | Higher AML scrutiny |

| Canada | Yes | Yes | None |

| Japan | Yes | Yes | Additional licensing required for certain tokens |

The table reflects the status as of October 2025. Coinbase updates it in real time via the “Country Restrictions” page in the Help Center, so users should always check their account dashboard for the latest info.

How to Verify Your Eligibility

- Start the sign‑up flow in the Coinbase App or Wallet.

- Enter your legal name, date of birth, and a government‑issued ID (passport, driver’s licence, or national ID).

- Upload a utility bill or bank statement as proof of address.

- The system runs an IP geolocation check. If the IP is flagged, you’ll be asked to verify via a video selfie.

- Once approved, the dashboard displays a green badge with your country code. If the badge reads “Wallet‑Only,” you can still use the non‑custodial features but fiat deposits will stay disabled.

If you’re in a partially restricted region (e.g., UAE), you may see a note saying “Apple Pay deposits supported; bank transfers unavailable.” That’s the final word until Coinbase renegotiates with local banks.

Common Pitfalls and How to Avoid Them

- Using a VPN. Coinbase’s KYC ties your identity to your IP. Switching countries mid‑session can trigger an account freeze or even a $2,300 loss, as seen in a March 2025 Reddit post.

- Skipping address verification. Without a matching proof‑of‑address document, the system defaults to “Wallet‑Only” even if your country is otherwise supported.

- Ignoring hold periods. In high‑risk jurisdictions, the first deposit may sit for up to three days. Plan transactions accordingly.

- Assuming “App‑blocked” means you can’t trade at all. The Wallet still lets you swap tokens on decentralized exchanges (Uniswap, 1inch) without a fiat bridge.

Comparison with Other Major Exchanges

Understanding Coinbase’s reach makes more sense when you line it up against rivals.

| Exchange | Countries with Full Fiat Access | Wallet‑Only Regions | Notable Restrictions |

|---|---|---|---|

| Coinbase | 48 | ~70 (mostly OFAC‑blocked) | MiCA staking limits, OFAC sanctions |

| Binance | ~64 | ~20 (mostly regional licensing) | Regulatory bans in Canada, Netherlands |

| Kraken | 55 | ~10 | Pending US‑SEC ruling on certain tokens |

The numbers highlight why many users in emerging markets turn to Binance or decentralized wallets when Coinbase’s fiat doors stay shut.

Future Outlook: What Might Change in 2026?

Two big forces could reshape the map:

- SEC litigation outcome - a win for regulators could force Coinbase to classify more tokens as securities, tightening EU and US restrictions.

- Global adoption of the EU’s MiCA framework - once fully implemented, staking of assets like Cardano could become limited to a handful of licensed providers, shrinking the list of usable tokens in many EU states.

Conversely, positive developments such as India’s potential deregistration or new banking partnerships in Africa could add dozens of new fiat‑on‑ramp locations.

Quick Checklist for Travelers and Expats

- Check the “Country Restrictions” page before moving abroad.

- Carry a backup hardware wallet (Ledger, Trezor) for Wallet‑Only countries.

- Set up two‑factor authentication while you’re still in a supported region.

- Plan any large fiat withdrawal at least a week in advance to avoid hold delays.

- Keep a photo of your ID and proof‑of‑address handy for rapid re‑verification.

Which countries can I use the Coinbase App for buying crypto with fiat?

As of October 2025 the App supports full fiat deposits in 48 countries, including the U.S., U.K., Germany, France, Singapore, Canada, Brazil, Japan, and most EU members. See the detailed table above for the full list.

Can I use Coinbase Wallet in a country where the App is blocked?

Yes. The non‑custodial Wallet works in almost every country except those on the OFAC sanctions list (e.g., Iran, North Korea, Crimea). You’ll just miss out on fiat on‑ramps.

Why does Coinbase block fiat services in Pakistan but allow the Wallet?

Pakistan isn’t on the OFAC list, but Coinbase classifies it as a high‑risk jurisdiction due to AML concerns and local regulatory uncertainty. The Wallet sidesteps those issues because it never holds fiat.

What happens if I use a VPN to access the Coinbase App from a restricted country?

Coinbase’s KYC system will detect the IP mismatch and may freeze or permanently close your account. Users have reported losing thousands of dollars after trying to bypass the geo‑block.

How often does Coinbase update its country list?

The list is refreshed in real time on the Help Center page. Major changes usually accompany regulatory announcements - for example, the addition of Ukraine in early 2025 after the EU passed a crypto‑friendly directive.

12 Comments

jummy santh

As a Nigerian user, I can confirm Coinbase Wallet is my lifeline. No fiat access, yes-but I use it to receive remittances from diaspora and swap via PancakeSwap. The 24-hour hold on first transfers? Real. But it’s safer than local exchanges that vanish overnight. 🇳🇬

Pranav Shimpi

India is blocked for fiat but wallet works? Bro, that’s a trap. You think you’re safe using wallet but if you ever try to link a local bank, Coinbase will freeze your account for ‘suspicious activity’. RBI doesn’t play. Stay off it. Use WazirX or CoinDCX.

Herbert Ruiz

OFAC sanctions are the real bottleneck. Not regulatory complexity. Coinbase could serve 80+ countries if they ignored U.S. law. They don’t because they’re a publicly traded company, not a crypto-native one. Their compliance team has more lawyers than engineers.

Kirsten McCallum

Using a VPN? That’s not a workaround. It’s a suicide note. I’ve seen accounts wiped. Coinbase doesn’t just freeze-you lose everything. And no appeal. They don’t care if you’re a student in Lagos or a freelancer in Manila. You’re a risk.

Lawrence rajini

Wallet-only doesn’t mean powerless! 🚀 I use my Coinbase Wallet to stake ETH on Lido, trade on Uniswap, and even pay for crypto services via Bitrefill. No bank? No problem. Web3 is about sovereignty, not fiat bridges. 💪

Paul Lyman

Yo, if you’re in a country where Coinbase blocks fiat, you’re not being punished-you’re being protected. Those ‘high-risk’ labels? They’re there because scammers use these places to launder cash. I’ve seen people lose $20K to fake Coinbase support. Better safe than sorry. Stay patient, stay verified.

Will Barnwell

Let’s be real: MiCA is just Europe’s way of controlling crypto without banning it. Cardano staking blocked in 12 EU countries? That’s not regulation-that’s favoritism. They’re protecting institutional staking providers like Coinbase and Kraken from decentralized competition. Wake up.

Henry Gómez Lascarro

People act like Coinbase is some kind of benevolent giant, but let’s cut through the PR. They only operate in 48 countries because it’s profitable. In Nigeria? They don’t want the compliance burden. In Pakistan? Too many money mules. In India? Too many people trying to dodge taxes. They don’t care about access-they care about liability. And if you think they’ll ever expand to Africa or Southeast Asia without a fat regulatory payoff, you’re dreaming. They’re a Wall Street firm with a crypto skin. That’s it.

Meanwhile, Binance runs on offshore shells and serves 64 countries. Guess who’s actually serving users? Not Coinbase. Not even close.

Anna Mitchell

Just signed up from Colombia-wallet works, app blocked. First deposit took 48 hours, but it cleared. I’m so glad I didn’t use a VPN. The verification video was awkward but worth it. Thanks for the heads-up on the hold periods!

Jean Manel

Anna Mitchell just said ‘thanks for the heads-up’? Cute. But let’s not romanticize this. You’re not ‘glad’ you didn’t use a VPN-you’re lucky Coinbase didn’t ban you permanently. And now you’re stuck with a wallet that can’t convert to naira or pesos. This isn’t empowerment. It’s digital exclusion disguised as compliance.

Cory Munoz

Hey Jean, I get your point-but Anna’s just sharing her experience. Not everyone’s trying to game the system. For a lot of us in emerging markets, this wallet access is the only way to participate in crypto at all. Maybe we don’t have fiat ramps, but we still have control. That’s something.

Saurav Deshpande

Coinbase is a U.S. intelligence front. OFAC isn’t about sanctions-it’s about tracking crypto flows to identify dissidents. If you’re in Pakistan, Nigeria, or Iran, your wallet activity is being logged. They don’t care if you’re buying ETH or sending money to your family. You’re a data point. Wake up.