BB EXCHANGE Yield Calculator

Calculate Your Net Returns

BB EXCHANGE claims a 6% annual yield. However, without fee transparency, it's difficult to know if this is worthwhile. Compare your potential returns against established exchanges with known fees.

Results

Enter your investment amount to see how BB EXCHANGE compares to established exchanges.

When you type BB EXCHANGE into a search bar, you’ll quickly notice a fog of missing information. Unlike Coinbase, Binance, or Kraken, there’s no clear homepage, no press kit, and no public roadmap. The only concrete clue comes from a Traders Union note that mentions a “BB yield” offering about 6% return, but that reference talks about a browser‑only interface and a missing mobile app, not a fully fledged exchange platform. Below is a straight‑talk look at what we can verify, where the gaps are, and how you can decide if BB EXCHANGE is worth a deeper dive.

What We Actually Know About BB EXCHANGE

Here’s the hard data we could pull from public sources as of October 2025:

- “BB yield” reportedly offers a 6% annual return - typical for crypto staking or lending products.

- The service appears to be accessed solely through a web browser; no dedicated mobile app is mentioned.

- No official documentation on fees, KYC requirements, or security protocols is publicly available.

- The name does not appear in any major exchange rankings, such as Kaiko’s Q3 2025 list.

- There are no known regulatory filings or licensing disclosures for BB EXCHANGE.

Because the information is so sparse, it’s crucial to treat BB EXCHANGE with the same caution you’d apply to any new or unverified crypto service.

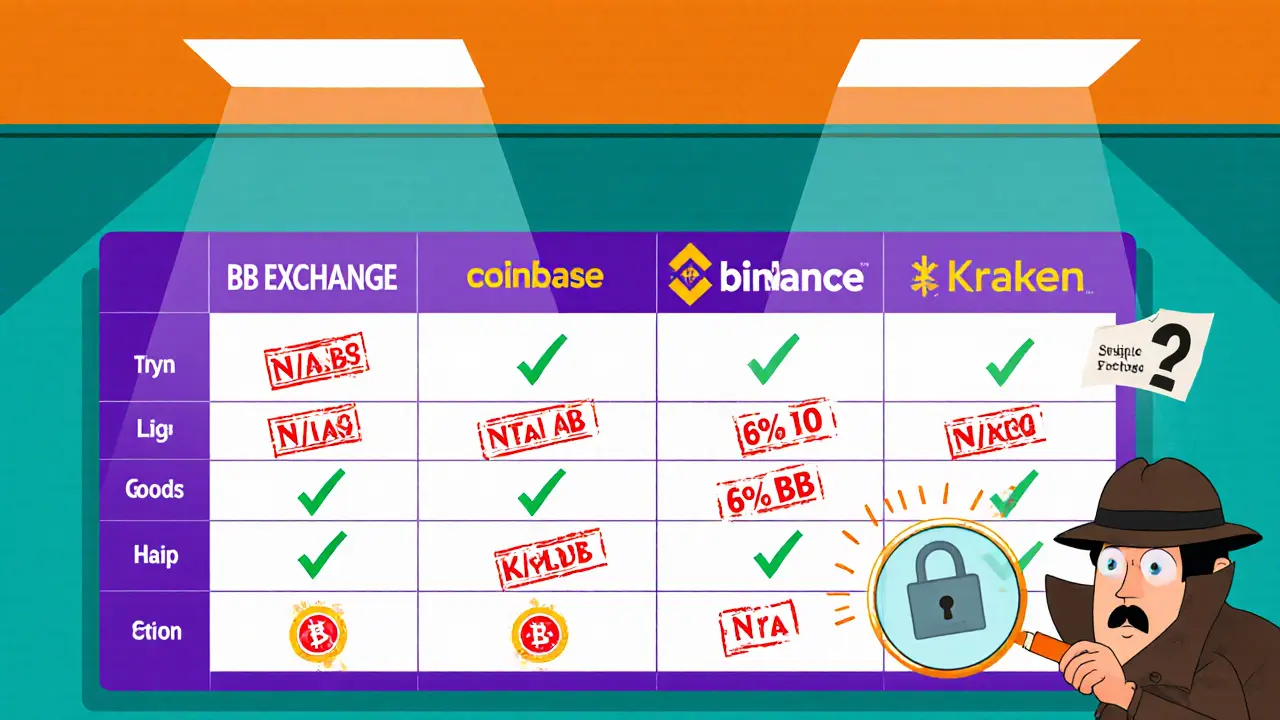

How BB EXCHANGE Stacks Up Against the Big Players

To give you perspective, we’ve lined up the most common criteria used to evaluate crypto exchanges. Where data for BB EXCHANGE is missing, we’ve marked it “N/A” (not available). All other platforms have publicly verified details.

| Feature | BB EXCHANGE | Coinbase | Binance | Kraken |

|---|---|---|---|---|

| Founded | N/A | 2012 | 2017 | 2011 |

| Supported crypto assets | N/A | 235+ | 500+ | 350+ |

| Trading fees (maker/taker) | N/A | 0%‑3.99% | 0%‑0.6% | 0%‑0.4% |

| Yield / staking options | ~6% (BB yield) | Varies by asset | Varies by asset | Varies by asset |

| Mobile app | No dedicated app (browser only) | iOS/Android | iOS/Android | iOS/Android |

| KYC / AML | Unclear | Required | Required | Required |

| Regulatory license | Unclear | US, EU, etc. | Various worldwide | US, EU, etc. |

Notice how the “N/A” cells dominate BB EXCHANGE’s row. That’s a red flag for any investor who expects transparency.

Security & Compliance - What’s Missing?

Security is non‑negotiable in crypto. Established exchanges publish cold‑storage percentages, third‑party audit reports, and bug bounty programs. For example, Coinbase stores 98% of user funds offline and undergoes regular SOC 2 audits.

BB EXCHANGE offers no public security whitepaper, no evidence of insurance coverage, and no disclosed custody solution. The lack of a mobile app also means no biometric lock or push‑notification alerts, which are standard safety features on other platforms.

If you’re serious about protecting your assets, demand answers to these questions before you deposit:

- Where are funds stored (cold vs. hot wallets)?

- Is the platform audited by an independent security firm?

- Does the service have insurance for breaches or hacking?

- What encryption standards protect API keys and user data?

Until BB EXCHANGE publishes this data, the safest move is to keep any holdings small and treat the platform as a high‑risk experiment.

Fees, Yields, and the “BB Yield” Claim

The only concrete number we have is a 6% yield mentioned in the Traders Union piece. That figure aligns with typical staking pools, not a trading fee rebate or exchange discount.

We also have no fee schedule for spot or futures trading. Compare that to Binance, which offers 0‑0.6% maker/taker fees, and Kraken, which caps taker fees at 0.4%.

Without a clear fee table, you can’t calculate true net returns. If the 6% yield is the only benefit, ask yourself: does it outweigh the hidden costs you can’t see?

User Experience - Browser‑Only Access

Most traders expect a native app for on‑the‑go trading, price alerts, and biometric login. BB EXCHANGE’s reliance on a web interface puts you at a disadvantage:

- Slower order execution on mobile browsers compared to native apps.

- No push notifications for price spikes or security events.

- Potentially poorer UI/UX design, since responsive web design often sacrifices features for simplicity.

If you’re a casual investor who only checks balances on a laptop, a browser‑only service might be acceptable. Power traders, however, will likely find the experience limiting.

Red Flags & Due Diligence Checklist

Given the scarcity of data, treat BB EXCHANGE with a healthy dose of skepticism. Use the checklist below before you deposit more than a trial amount:

- Verify the domain’s SSL certificate and WHOIS registration date.

- Search for the company’s legal entity, registration number, and any regulator‑issued licences.

- Check community forums (Reddit, Trustpilot) for independent user reviews.

- Contact support with specific questions about security, fees, and KYC - note response time and detail.

- Start with a small test fund (e.g., $50‑$100) and monitor withdrawal speed and any hidden fees.

If any step raises unanswered questions, consider moving to a more transparent platform.

Bottom Line - Should You Trade on BB EXCHANGE?

In short, the answer is “proceed with caution.” The platform’s main claim - a 6% BB yield - could be legitimate, but without clear fee structures, security disclosures, or a mobile app, the risk outweighs the potential reward for most users. If you love hunting for hidden gems and have a high risk tolerance, a tiny trial can be informative. For anyone else, the market already offers well‑audited, feature‑rich exchanges at competitive fees.

Is BB EXCHANGE a legitimate crypto exchange?

There is no public evidence of licensing, security audits, or a transparent fee schedule for BB EXCHANGE. While the platform may exist, the lack of verifiable information makes it a high‑risk choice.

What is the “BB yield” and how does it compare to staking?

The only data point is a 6% annual return mentioned by Traders Union. This lines up with typical crypto staking yields, but without details on the underlying assets, lock‑up periods, or risk mitigation, it’s hard to evaluate its true value.

Does BB EXCHANGE have a mobile app?

All publicly available sources say the platform is only accessible via a web browser. No iOS or Android app has been announced.

How do fees on BB EXCHANGE compare to major exchanges?

Fee details are not disclosed, so you can’t directly compare. Major exchanges like Binance and Kraken charge between 0%‑0.6% for takers; without BB EXCHANGE’s numbers, any comparison is speculative.

What security measures should I look for before using a new exchange?

Ask for cold‑storage percentages, third‑party audit reports, insurance coverage, two‑factor authentication options, and a clear regulatory license. If the exchange doesn’t publish these, treat it as a red flag.

10 Comments

Derajanique Mckinney

bb exchange?? lol i thought it was a typo for bittrex 😂 i literally typed it in and got nothing but sketchy ads. 6% yield? sure babe. my crypto portfolio has more ghosts than this site has info.

Rosanna Gulisano

No license no app no audits just a number and a dream. If you’re putting money here you’re not investing you’re gambling and you know it.

Sheetal Tolambe

I know it’s scary when you find something new but maybe this is just early? I’ve seen projects start with just a website and grow slowly. Maybe reach out to them and ask questions? Sometimes the quiet ones have the most to offer if you give them a chance 😊

gurmukh bhambra

you think this is just some shady crypto site? nah this is a government op. they’re testing how fast people hand over cash without asking questions. the 6%? it’s bait. the real game is harvesting your seed phrases. i’ve seen this script before in the Philippines. they disappear after 3 months. don’t be the one who gets wiped.

Sunny Kashyap

why even care about this bb thing? india has good exchanges. why waste time on some american ghost site? if you don’t know the basics then stay away. no app no license no future. just trash.

james mason

Oh darling, you’ve stumbled upon the avant-garde of crypto minimalism. No UI? No KYC? It’s like a Duchampian readymade - the absence of everything is the statement. The 6% yield? It’s not a return, it’s an aesthetic. You’re not investing, you’re curating a postmodern risk experiment. How… *daring*.

Anna Mitchell

I get why people are skeptical but I think it’s worth giving small amounts to test. I started with $20 on another unknown platform and now I’m up 3x. Sometimes the quiet ones win. Just go slow and watch your withdrawals.

Pranav Shimpi

look if you really wanna try this thing check the ssl cert first. if it’s from lets encrypt and domain is less than 6 months old? walk away. also try to find the whois info - if it’s private and registered via a offshore company? red flag. i’ve seen this exact pattern before with 3 scam sites in 2024. and yeah the mobile app thing? if they’re not building one they don’t plan to grow. just sayin’.

jummy santh

As a Nigerian who has seen too many 'high-yield' crypto platforms vanish overnight, I must say with all due respect - this reads like a classic Ponzi setup wrapped in minimalist branding. The absence of transparency is not elegance, it is evasion. In our context, we call this 'Naija ghost platform'. Please, for your peace of mind, invest only what you can afford to lose completely - and even then, consider a regulated exchange with a physical office. Your future self will thank you.

Kirsten McCallum

Transparency isn’t optional. It’s the moral baseline of finance. If you can’t prove your integrity, you don’t deserve capital. This isn’t a platform - it’s a void. And voids don’t create wealth. They consume hope.