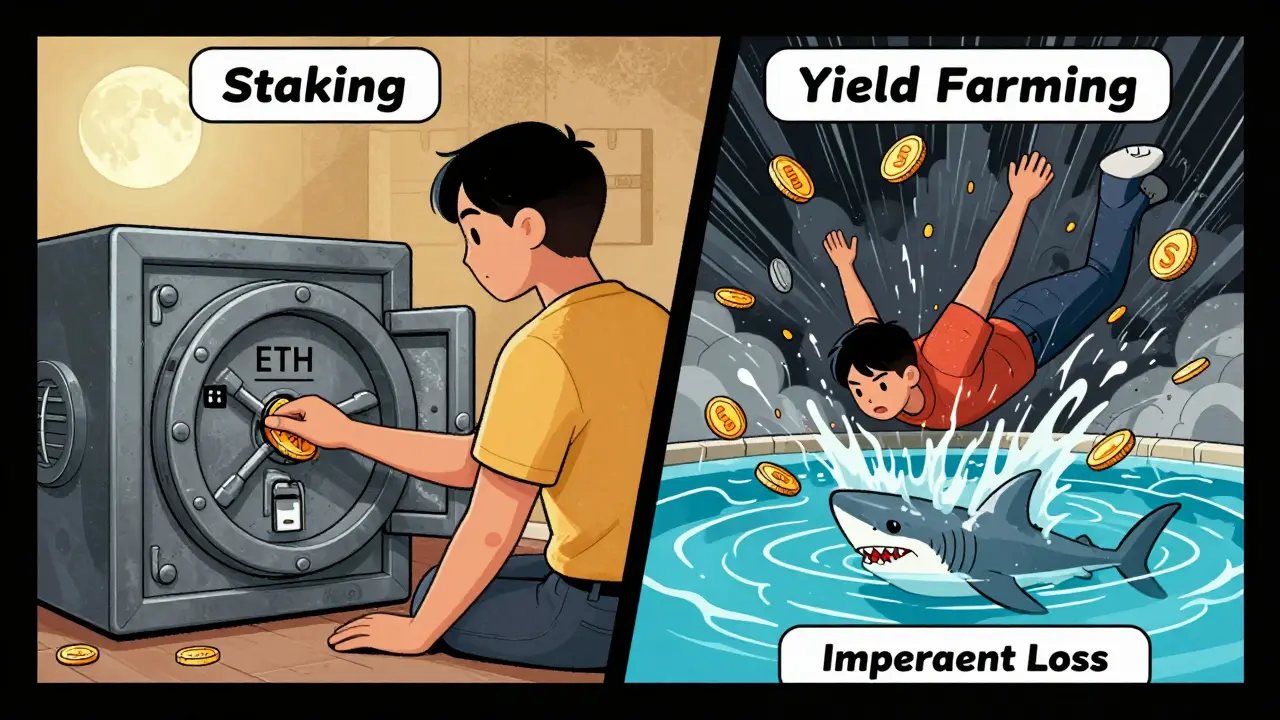

Yield farming and staking both let you earn crypto without selling your assets-but they’re not the same thing.

If you’ve heard people talking about making 50% returns on their crypto and assumed it’s all the same, you’re not alone. But yield farming and staking operate on completely different systems, carry wildly different risks, and suit very different types of investors. One is like renting out your car through a ride-share app. The other is like putting money in a savings account that pays interest. Confusing them can cost you.

How staking works: Locking up crypto to secure a blockchain

Staking is how proof-of-stake (PoS) blockchains like Ethereum, Cardano, and Solana keep themselves running. Instead of using massive amounts of electricity to mine blocks (like Bitcoin), PoS networks pick validators based on how much crypto they’ve locked up-or "staked." The more you stake, the higher your chance of being chosen to verify transactions and earn rewards.

You don’t need to run your own server. Most people stake through exchanges like Coinbase or Binance, where you just click a button and lock your ETH, ADA, or SOL. The minimum? As low as $100 on some platforms. For Ethereum solo staking, you need 32 ETH (around $100,000 as of early 2026), but that’s only for people running their own validator nodes. The average user doesn’t need to go that far.

Staking rewards typically range from 3% to 12% APY, depending on the network. Ethereum’s current rate sits around 4.5%, while newer chains like Polygon or Arbitrum offer closer to 7-9%. These returns are predictable. You know roughly how much you’ll earn each month. No surprises.

But there’s a catch: lock-up periods. Once you stake, your coins are locked for a set time. On Ethereum, it takes 7-28 days to withdraw your staked ETH after you request it. During that time, you can’t sell-even if the price crashes or spikes. That’s the trade-off for simplicity and safety.

How yield farming works: Lending crypto to DeFi pools for higher returns

Yield farming is where things get complicated-and potentially much more profitable. Instead of securing a blockchain, you’re lending your crypto to decentralized finance (DeFi) protocols to create liquidity pools. These pools let traders swap tokens on platforms like Uniswap or Curve. In return, you earn a share of the trading fees plus bonus tokens from the protocol itself.

Here’s how it works: You deposit two tokens in equal value-say, 50% ETH and 50% USDC-into a liquidity pool. The protocol gives you LP (liquidity provider) tokens as proof of your deposit. You then stake those LP tokens in another contract to earn extra rewards, often in the form of the protocol’s native token (like UNI or CRV).

That’s where the big numbers come from. APYs can hit 20%, 50%, even 200% during hype cycles. In 2021, some farms offered over 1,000% APY. Those days are gone, but solid 15-40% returns are still common on well-established pools.

But here’s the problem: you’re exposed to impermanent loss. If the price of ETH rises sharply compared to USDC, the protocol automatically rebalances your pool to maintain equal value. You end up with more USDC and less ETH than you started with. If ETH surges 50%, your portfolio could be down 15-30% even if the overall market is up. That’s not a theoretical risk-it’s happened to thousands.

Staking is passive. Yield farming is a full-time job.

Staking is set-and-forget. Once you click "Stake," you can check your balance once a month. No need to monitor prices, gas fees, or new pools. Your rewards come automatically.

Yield farming? That’s a different story. To make real money, you have to move between farms constantly. One day you’re in the ETH-USDC pool on Uniswap. The next day, a new farm on Arbitrum offers 35% APY with a bonus token that’s trending. You need to withdraw, pay gas fees (sometimes $50-$150 per transaction), swap tokens, deposit into the new pool, and stake your LP tokens. All of that takes time.

Top yield farmers report spending 5-10 hours a week just tracking opportunities, reading contract audits, and checking for rug pulls. One Reddit user in r/DeFi shared that he lost $12,000 in impermanent loss after jumping into a new farming pool that crashed within 48 hours. Another spent $800 in Ethereum gas fees in a single month chasing APYs that ended up being lower than staking.

Yield farming isn’t just about earning more. It’s about managing risk across dozens of smart contracts. One bug, one hacked protocol, one rug pull-and your entire position can vanish. The SQUID token crash in 2021 wasn’t a farming pool, but it’s a warning: when a project’s token is the reward, and no one’s watching the code, things go to zero fast.

Risk comparison: Predictable vs. unpredictable

Here’s a quick breakdown of the biggest risks in each:

- Staking risks: Slashing (rare penalties for validator misbehavior), lock-up periods, and exchange insolvency (if you stake on a centralized platform). But the underlying blockchain is secure. Your coins aren’t being used to trade-they’re just sitting there.

- Yield farming risks: Impermanent loss, smart contract exploits, rug pulls, high gas fees, and token depreciation. The protocol’s bonus token might crash 80% after you stake your funds. Your LP tokens might become worthless if the pool dries up. And you pay fees every single time you move.

Staking is like a bond. Yield farming is like day trading options.

Who should do what?

If you’re new to crypto and want steady, low-effort returns, staking is the clear choice. You don’t need to understand AMMs, liquidity pools, or tokenomics. Just pick a trusted exchange or staking service, lock your coins, and wait. Your returns are predictable. Your stress levels stay low.

If you’ve been in crypto for over a year, understand how wallets and smart contracts work, and enjoy tracking markets like a trader, then yield farming might be worth your time. But only if you treat it like a business. Track every transaction. Never stake more than you can afford to lose. And always, always check the contract audit before depositing.

Most institutional investors stick to staking. Why? Because they need reliability. They can’t afford to lose millions because a DeFi protocol got hacked. Retail investors often chase yield farming because of the hype. But the data shows most end up earning less than they would’ve from staking-after accounting for fees and losses.

What’s changing in 2026?

Both strategies are evolving. Liquid staking derivatives like Lido’s stETH now let you stake ETH and trade your staked position like a regular token. That solves the lock-up problem. You earn staking rewards while still being able to use your ETH in DeFi.

On the yield farming side, new protocols are automating the process. Some platforms now auto-compound your rewards and shift your funds between pools based on real-time APY changes. You still need to monitor them, but you don’t have to manually switch every week.

Regulators are also taking notice. The U.S. IRS and EU authorities are treating staking rewards as taxable income, but they’re still unclear on yield farming. That legal gray area makes yield farming riskier in the long run.

Bottom line: Pick the right tool for your goals

Staking gives you peace of mind. Yield farming gives you excitement-and the chance to get rich. But it also gives you sleepless nights.

There’s no "best" option. Only the right one for you.

If you’re holding ETH, SOL, or ADA and want to earn 5-8% a year with zero effort-stake it.

If you’ve got $10,000+ to play with, understand how DeFi works, and don’t mind spending hours every week managing your portfolio-then try yield farming. But start small. Test one pool. Watch it for a month. See how impermanent loss hits. Then decide if it’s worth it.

Most people who try both end up sticking with staking. Not because they’re scared. But because they realize they were better off not trying to outsmart the system.

Can you do both yield farming and staking at the same time?

Yes, and many experienced users do. For example, you can stake your ETH to earn 4.5% APY, then use a portion of your USDC earnings to farm on Uniswap. But be careful: if you farm with ETH/USDC, you’re still exposed to impermanent loss on your staked ETH. Don’t assume staking is risk-free just because you’re farming on the side. Track your total exposure.

Is staking safer than yield farming?

Yes, significantly. Staking only exposes you to the risk of the blockchain network (which is very low for major chains like Ethereum) or the exchange you use. Yield farming exposes you to smart contract bugs, token crashes, liquidity loss, and gas fee spikes. One study from CertiK in 2024 found that DeFi protocols lost over $1.2 billion to exploits in 2023-almost all from yield farming pools. Staking hacks are rare.

What’s the minimum amount to start yield farming?

You can technically start with $100, but it’s not practical. Gas fees on Ethereum can eat up 20-50% of your returns on small deposits. Most successful farmers start with $5,000-$10,000 to make the math work. On cheaper chains like Polygon or Base, you can start with $1,000 and still break even after fees.

Do you pay taxes on staking and yield farming rewards?

Yes. In the U.S., the IRS treats staking rewards as ordinary income when you receive them. Yield farming rewards are also taxable as income, but the complexity increases if you earn tokens that later drop in value. Many users end up paying taxes on tokens that are now worth 80% less. Keep detailed records.

Which is better for long-term holding?

Staking. If you’re buying crypto to hold for years, staking adds passive income without forcing you to trade or manage positions. Yield farming turns your long-term holdings into active trading assets. That increases risk and taxes. For buy-and-hold investors, staking is the only logical choice.

Can you lose your principal in staking?

Only if the exchange you use goes bankrupt or gets hacked. If you stake on a reputable platform like Coinbase or through a trusted validator like Lido, your principal is safe. The blockchain doesn’t take your coins-you just lock them. The only way you lose is if the platform holding them fails.

What’s the biggest mistake new users make with yield farming?

Chasing the highest APY without checking the protocol’s history, audit reports, or token supply. A farm offering 200% APY might be a scam or a dying project. Always look at the TVL (Total Value Locked). If it’s under $10 million, avoid it. Real, sustainable farms have TVL over $100 million.