THORChain Swap Time Estimator

Estimate how long your cross-chain swap will take on THORChain based on the source and destination chains you select. Note: Actual times may vary based on network congestion.

Estimated swap time:

Most crypto exchanges make you hand over your Bitcoin to trade it for Ethereum. THORChain doesn’t. It lets you swap BTC for ETH, SOL, or any other major chain’s asset - without ever giving up control of your coins. That’s not a feature. It’s a revolution.

By November 2025, THORChain has processed over $1.2 billion in cross-chain swaps. Its TVL sits at $80 million, and it’s the only protocol that handles native Bitcoin swaps without wrapped tokens. No WBTC. No custodians. No middlemen. Just direct, trustless swaps between blockchains that were never meant to talk to each other.

How THORChain Actually Works

THORChain isn’t a traditional exchange. It’s a decentralized liquidity network. Think of it like a global swap shop where every asset has a dedicated locker. When you want to trade BTC for ETH, you don’t send your Bitcoin to a company. You lock it into a THORChain liquidity pool. In return, you get ETH from another user’s locked pool - all coordinated by a network of independent validators.

The secret sauce? RUNE. The protocol’s native token isn’t just a currency. It’s the glue. Every liquidity pool holds a 1:1 ratio of RUNE and the paired asset. So a BTC pool has $500,000 in BTC and $500,000 in RUNE. That balance keeps prices stable and ensures swaps always have liquidity.

When you swap, you pay fees in the asset you’re sending - not RUNE. That’s unusual. Most DEXs force you to buy their token just to pay gas. THORChain lets you pay in BTC, ETH, or DOGE. Your wallet stays in your hands the whole time.

Supported Chains and Real Swap Times

As of November 2025, THORChain supports 12+ blockchains: Bitcoin, Ethereum, Binance Smart Chain, Avalanche, Polygon, Solana, Cosmos, Polkadot, NEAR, Litecoin, Dogecoin, and now TON (just added). The November 2025 NEAR Intents upgrade made cross-chain messaging faster and more reliable.

Swap times vary. Bitcoin confirmations take 10 minutes on average. Ethereum can take 15-45 seconds during low congestion. Most swaps finish in 30 seconds to 2 minutes. But if Ethereum is busy? You might wait 8-10 minutes. That’s the trade-off for decentralization.

Compare that to Binance, which handles 10,000+ transactions per second. THORChain manages 3-5. It’s not built for day traders. It’s built for people moving $5,000, $50,000, or $500,000 who don’t want to trust a company with their life savings.

THORChain vs. the Competition

Other cross-chain tools like Wormhole or Cosmos IBC focus on transferring assets between chains. THORChain focuses on swapping them - and doing it without custody.

| Feature | THORChain | Wormhole | Cosmos IBC | Multichain |

|---|---|---|---|---|

| Native BTC Support | Yes | No (uses WBTC) | No | No (uses WBTC) |

| Custody Model | Non-custodial | Custodial | Non-custodial | Custodial |

| TPS (Avg) | 3-5 | 10-15 | 5-8 | 20-30 |

| Fee Payment | Source asset | Native token | Native token | Native token |

| Market Share (Q3 2025) | 8.2% | 6.1% | 4.9% | 15.7% |

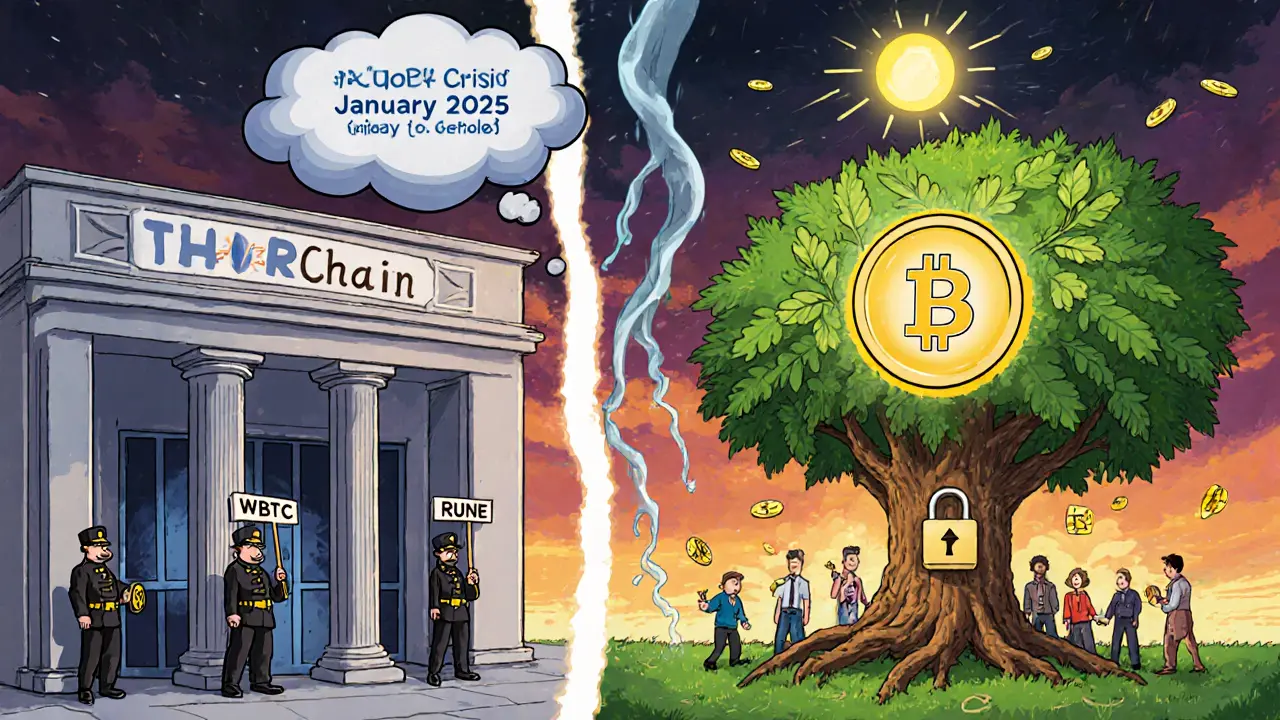

Wormhole and Multichain are faster and support more chains, but they rely on wrapped tokens and centralized bridges. If the bridge gets hacked - your funds vanish. THORChain’s security model is different. Node operators must bond RUNE as collateral. If they act maliciously, they lose it. That’s why the protocol survived the January 2025 crisis, when a flawed debt repayment mechanism briefly flooded the market with new RUNE. The fix? TCY tokens - a new system that settled liabilities without minting more RUNE.

RUNE Token: Value, Supply, and Risks

RUNE is the engine. It’s used for security, governance, and liquidity incentives. As of November 2025, 450 million RUNE are in circulation. The max supply is capped at 500 million. Market cap: $462 million. Price: around $1.03.

But RUNE’s dual role creates tension. It’s both the collateral securing the network and the asset people trade. When the network needs to pay out rewards or settle debt, it mints more RUNE. If too much gets minted, the price drops. That’s what happened in January 2025. The fix? TCY tokens. Now, THORFi (THORChain’s lending protocol) pays back debts using TCY, not RUNE. That’s kept inflation in check.

Analysts at Messari warn this balance is fragile. If RUNE’s price falls too far, node operators may pull their stakes, weakening security. But since the TCY update, RUNE has stabilized. In May 2025, it jumped 60% after the TCY rollout. That’s not speculation - it’s documented on 99Bitcoins and Reddit.

Who Should Use THORChain?

THORChain isn’t for everyone.

- Use it if: You hold Bitcoin and want to swap it to Ethereum without trusting a centralized exchange. You’re moving large sums ($5k+). You value privacy and hate KYC. You understand blockchain basics and don’t mind waiting 2 minutes for a swap.

- Avoid it if: You’re day trading. You need instant trades. You’re new to crypto and don’t know how to manage multiple wallets. You’re swapping small amounts like $50 - the fees aren’t worth it.

Reddit users split. One user, CryptoNewbie2025, said: “It took 45 minutes to swap ETH to BTC. I gave up and used Binance.” Another, CrossChainPro, said: “Worth the wait for $50k swaps. I won’t trust Binance with my life savings.”

Trustpilot gives THORSwap (the most popular THORChain frontend) a 3.7/5. The top complaints? Slow during congestion and confusing UI. The top praise? No KYC and direct BTC swaps.

How to Use THORChain in 2025

You don’t download THORChain. You use a frontend. The most trusted are:

- THORSwap - Official, clean interface, supports 12+ chains.

- AsgardX - More advanced, better for power users.

- ThorWallet - Mobile app with built-in swap function.

Steps to swap BTC to ETH:

- Connect your Bitcoin wallet (like Electrum or Trust Wallet) and Ethereum wallet (MetaMask).

- Go to THORSwap, select BTC → ETH.

- Enter amount. The platform shows estimated fees and time.

- Confirm the swap in your Bitcoin wallet. Wait for 1 confirmation (10-20 mins).

- Wait for ETH to arrive. You’ll get a notification.

Pro tip: Always test with $10 first. If your wallets aren’t set up right, the swap fails - and you’ll lose the gas fee.

Security and Risks

THORChain has been audited by CertiK and PeckShield. The protocol hasn’t been hacked since 2022. But it’s not risk-free.

- External chain risks: If Bitcoin has a 51% attack, THORChain’s BTC pools are vulnerable.

- Slippage: Large swaps on small pools can move prices. Always check the slippage tolerance before confirming.

- Wallet mistakes: Sending to the wrong address = permanent loss. Double-check every address.

- Node failures: If too many nodes go offline, swaps stall. The network has 100+ active nodes as of November 2025 - redundancy is high.

The protocol’s biggest weakness? It depends on Bitcoin’s security. If Bitcoin breaks, THORChain breaks. That’s why it’s not for casual users. It’s for those who believe in decentralization over convenience.

Future Roadmap

THORChain’s 2026-2027 roadmap includes integrations with Tron, XRP Ledger, and TON. Marketing efforts are ramping up. The team is targeting SEO, media coverage, and developer grants to attract more frontends and apps.

They’re also working on a new liquidity incentive program to boost TVL without minting RUNE. If they succeed, the protocol could double its market share by 2027.

But the real test? Adoption by institutions. Only 3 enterprises use THORChain today. If a hedge fund or crypto fund starts using it for cross-chain treasury swaps, that’s when the market will take notice.

Final Verdict

THORChain isn’t perfect. It’s slow. It’s complex. It’s not for beginners. But if you want to swap Bitcoin for Ethereum - without handing your keys to anyone - it’s the only game in town.

It’s the closest thing to a true decentralized exchange that actually works. Not a prototype. Not a beta. A live, battle-tested network handling real money.

For users who value control over convenience, THORChain isn’t just a tool. It’s a statement.

Is THORChain a crypto exchange?

THORChain isn’t a traditional exchange. It doesn’t hold your funds. It’s a decentralized liquidity protocol that enables direct peer-to-peer swaps between blockchains. You keep custody of your assets the whole time.

Can I swap Bitcoin for Ethereum on THORChain?

Yes. THORChain is one of the few protocols that allows direct swaps between native Bitcoin and Ethereum without using wrapped tokens like WBTC. Your BTC stays on the Bitcoin blockchain until the swap completes.

Do I need to do KYC to use THORChain?

No. THORChain is completely non-custodial and requires no identity verification. You only need a compatible wallet like MetaMask, Trust Wallet, or Electrum.

How long does a THORChain swap take?

Swap times depend on the blockchains involved. Bitcoin swaps take 10-20 minutes for 1 confirmation. Ethereum swaps take 15-60 seconds under normal conditions. Most swaps finish in 30 seconds to 2 minutes, but network congestion can extend this.

What’s the difference between THORChain and Uniswap?

Uniswap works only on Ethereum and requires you to trade ETH-based tokens. THORChain connects multiple blockchains - Bitcoin, Solana, BSC, etc. - and lets you swap native assets. THORChain also lets you pay fees in the source asset, not RUNE.

Is THORChain safe for large swaps?

Yes - that’s its main use case. Over $1.2 billion has been swapped on THORChain since 2023. The protocol’s security model - with bonded RUNE collateral and regular audits - has proven resilient. It’s safer than centralized exchanges for large amounts because you never surrender custody.

What happens if RUNE’s price crashes?

If RUNE’s price drops too far, node operators may unstake their collateral, reducing network security. The protocol has safeguards - like TCY tokens - to prevent runaway minting. The January 2025 crisis showed the risks, but the fixes implemented since then have improved stability.

Can I stake RUNE on THORChain?

Yes. You can provide liquidity to THORChain pools by depositing RUNE and another asset (like BTC or ETH). You earn swap fees and inflation rewards. But you’re exposed to impermanent loss if the paired asset’s price swings sharply.