OFAC sanctions and the crypto world

When dealing with OFAC sanctions, restrictions issued by the U.S. Treasury’s Office of Foreign Assets Controls that block transactions with designated individuals, entities, or countries. Also known as Office of Foreign Assets Controls restrictions, they affect every crypto platform that wants to stay legal and keep users’ funds safe.

U.S. Treasury Department, the federal agency that oversees economic sanctions and foreign policy tools uses OFAC sanctions as a primary lever to influence global finance. Crypto compliance, the set of policies and technical measures crypto businesses adopt to meet legal requirements therefore becomes a must‑have capability. In practice, compliance means screening wallet addresses, monitoring transaction flows, and updating blacklists in real time. Without it, a platform risks being cut off from U.S. banking services and facing hefty fines.

How OFAC sanctions impact crypto operations

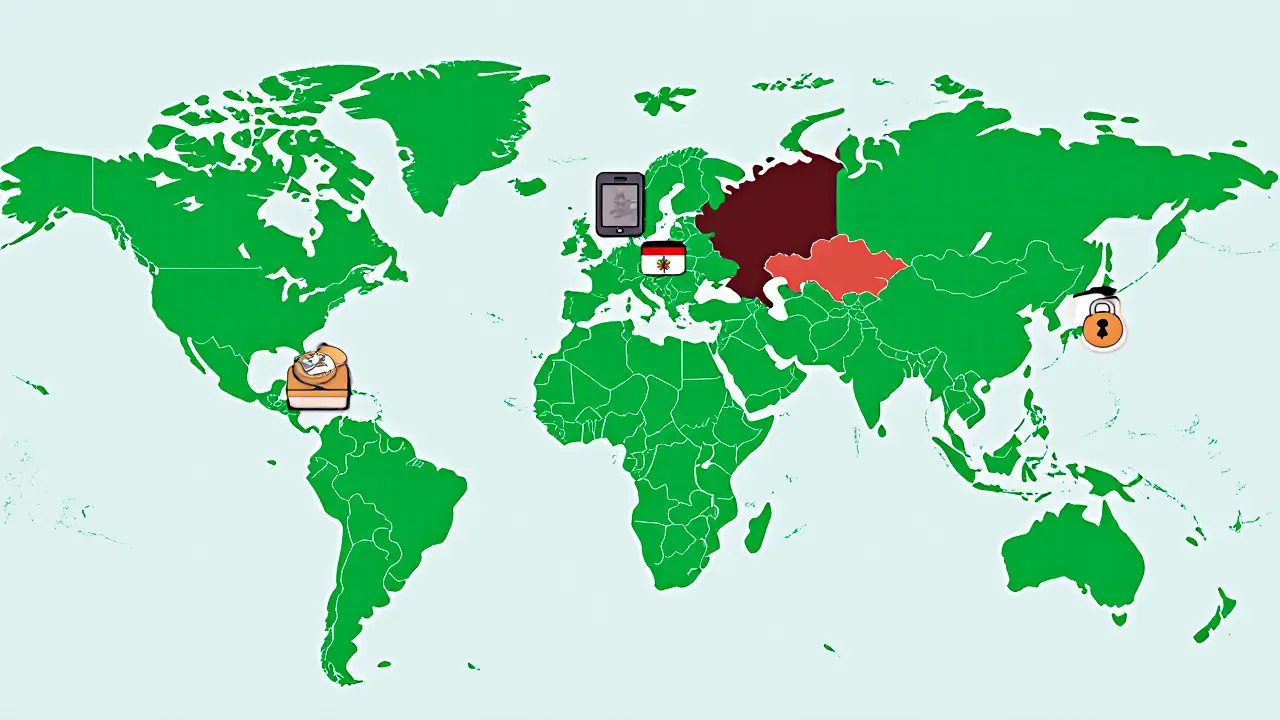

One of the most visible ways platforms enforce these rules is through geofencing, technology that blocks access from IP ranges linked to sanctioned regions. Bybit’s recent geofencing rollout, for example, blocks traders in Iran and North Korea, while VPN detection layers add another hurdle for anyone trying to mask their location. This tech stack directly tackles sanctions evasion techniques such as using cheap electricity for Bitcoin mining in Iran, a practice highlighted in recent analyses of how the country sidesteps U.S. pressure.

The ripple effect reaches other regulatory frameworks too. Europe’s MiCA regulation now requires crypto‑asset service providers to embed sanction‑screening tools before they can passport services across the bloc. Vietnam’s new split between trading and payment rules also forces firms to map OFAC lists onto local licensing. In each case, the core idea stays the same: identify prohibited actors, stop the flow, and report to authorities.

On the tax side, the OECD’s Automatic Exchange of Crypto Tax Information (CARF) mirrors the sanction‑screening mindset. By automatically sharing transaction data across borders, CARF helps tax agencies spot illicit profit‑making that often hides behind the same VPN tricks used to dodge sanctions. The synergy between tax reporting and sanctions enforcement creates a tighter net for bad actors.

Decentralized exchanges add another layer of complexity. While DEXs like those popular in Iran give users a way to trade without a central gatekeeper, they still rely on on‑chain analytics to flag suspicious patterns. Tools that trace token flows across wallets can flag addresses that appear on OFAC lists, prompting DeFi projects to freeze or blacklist them. This blend of on‑chain monitoring and off‑chain legal compliance shows how the sanction landscape has moved beyond traditional banking.

All these pieces—government agencies, compliance programs, geofencing, VPN detection, tax information sharing, and on‑chain analytics—form an interconnected system that keeps the crypto ecosystem aligned with OFAC rules. Understanding how each part works helps traders, developers, and investors stay ahead of potential roadblocks.

Below you’ll find a curated set of articles that break down each of these topics in depth, from practical guides on VPN detection to country‑specific compliance strategies. Dive in to see how the latest developments shape the day‑to‑day reality of crypto under OFAC sanctions.