Crypto Compliance 2025: Rules, Risks, and What You Must Know

When it comes to crypto compliance 2025, the set of legal and operational rules that crypto businesses and users must follow to operate legally under global regulations. Also known as digital asset regulation, it’s no longer about avoiding scrutiny—it’s about navigating it wisely. If you’re trading, airdropping, or using a decentralized exchange, you’re already in the crosshairs of regulators. The days of anonymous, unrestricted crypto activity are fading fast, and 2025 is the year those changes hit hardest.

One of the biggest drivers is MiCA, the European Union’s Markets in Crypto-Assets regulation, which sets the first unified legal framework for crypto across 27 countries. Also known as EU crypto law, it forces exchanges, wallet providers, and token issuers to register, disclose team details, and follow strict anti-fraud rules. If you’re outside the EU but want to serve EU users, you need MiCA compliance—or you’ll be blocked. That’s why platforms like LFJ v0 and Newdex are updating their policies: they can’t afford to lose access to millions of European traders.

Then there’s KYC, the process of verifying a user’s identity before allowing crypto transactions. Also known as know your customer, it’s now standard on nearly every major exchange, even ones that used to pride themselves on being anonymous. Platforms like Bybit use advanced geofencing and VPN detection to stop users from bypassing regional restrictions. If you’re in Iran, the U.S., or any restricted country, you’re not just fighting technical barriers—you’re navigating legal gray zones. That’s why guides on DEX access in Iran and VPN detection are so popular: people need to know what’s safe, not just what’s possible.

And don’t forget airdrops. In 2025, claiming a free token isn’t just about following a tutorial—it’s about staying compliant. Scams like fake BAKECOIN airdrops are everywhere, but even real ones like B2M and CANU now require identity checks, wallet history reviews, and sometimes even geographic verification. What used to be a quick freebie is now a compliance checkpoint.

Regulators aren’t just targeting exchanges—they’re watching every wallet interaction. Verifiable Credentials and Decentralized Identifiers (DID) are emerging as the next layer of compliance: self-sovereign identity systems that let you prove who you are without handing over your data to a central company. It’s privacy with accountability, and it’s already being tested by projects like Litentry and Terra 2.0.

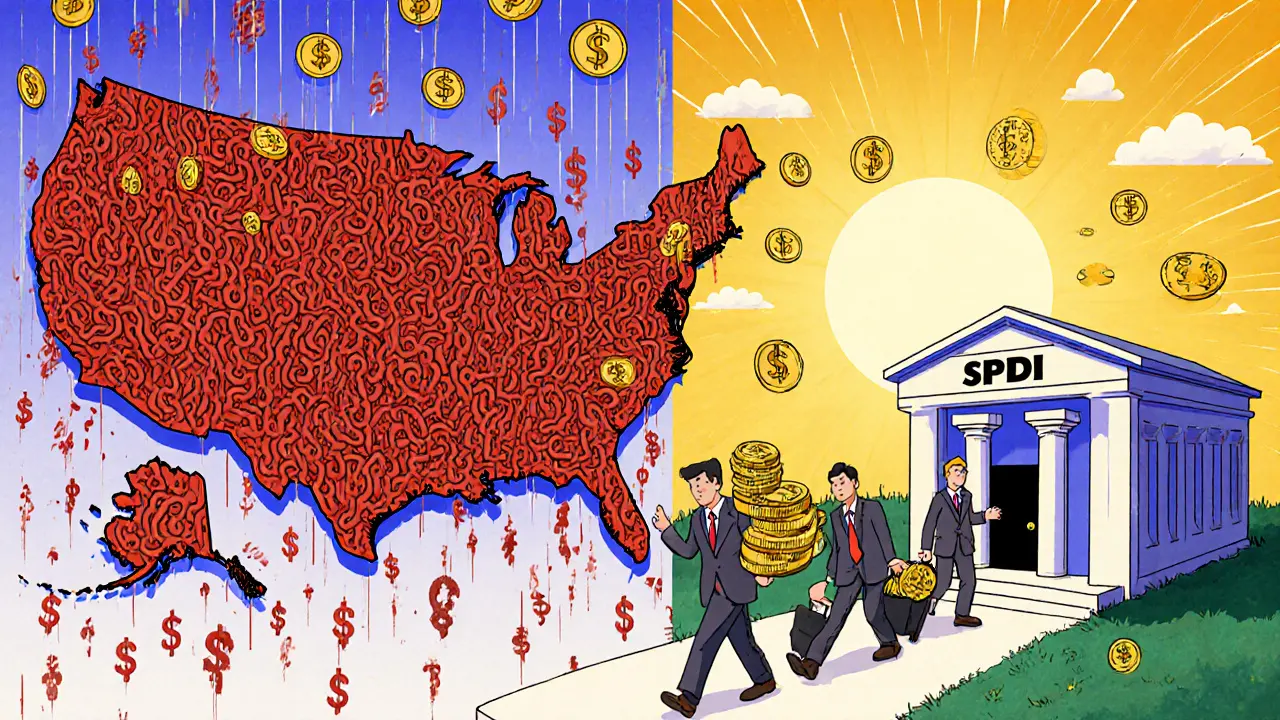

What you’ll find below isn’t just a list of articles. It’s a practical field guide to surviving crypto compliance in 2025. You’ll see real breakdowns of how exchanges enforce rules, how countries like Switzerland and El Salvador are setting different paths, and how scams exploit loopholes in unregulated spaces. Whether you’re trying to claim a token, trade on a DEX, or just avoid getting locked out of your own wallet, the answers are here—no jargon, no fluff, just what you need to know before you click.