Crop Insurance Calculator

Smart Contract Insurance Calculator

Calculate your parametric crop insurance premium and automatic payout based on weather conditions using blockchain technology. This demonstrates how smart contracts replace traditional insurance processes.

Most people think smart contracts are just for buying and selling Bitcoin or Ethereum. But that’s like saying a car is only for driving to the grocery store. Smart contracts are programmable agreements that run on blockchain networks - and they’re already changing how we handle everything from home sales to crop insurance, energy trading, and even voting.

Real Estate Without the Paperwork

Buying a house used to mean stacks of paperwork, weeks of waiting, and multiple middlemen: agents, lawyers, banks, title companies. Smart contracts cut through all of that. When you sign a digital agreement on a blockchain, the contract automatically checks if all conditions are met - inspections passed, funds cleared, deeds verified - and then releases the money and transfers ownership. No delays. No human error. Platforms like Propy and Real have already done this in dozens of countries. A buyer in New Zealand can purchase a property in Canada, and the entire transaction settles in hours, not weeks. Even better, smart contracts let you buy fractions of a property. Instead of needing $500,000 to own a house, you can buy 1% of it for $5,000. This opens up real estate investment to people who never had the capital before.Insurance That Pays Itself

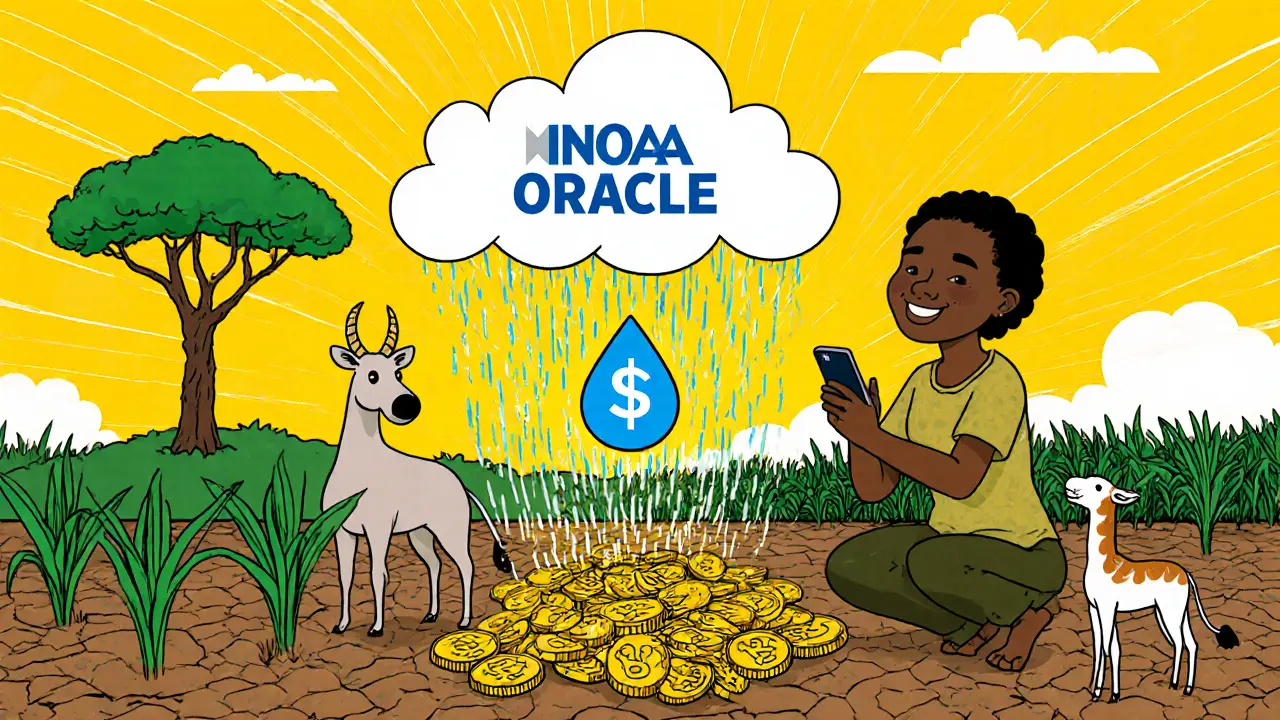

Imagine your crop fails because of a drought. Traditional insurance? You file a claim, wait months, argue with adjusters, and maybe get half what you expected. Parametric insurance using smart contracts changes that. Companies like Arbol use weather data from NOAA (National Oceanic and Atmospheric Administration) delivered through Chainlink oracles. If rainfall in your region drops below a set threshold, the smart contract triggers an automatic payout - no forms, no calls, no delays. Farmers in Kenya, India, or Iowa get paid within minutes. This isn’t theory. It’s live. In 2024, Arbol paid out over $12 million in automated claims to smallholder farmers across 18 countries. The same system works for flight delays. Etherisc lets you buy flight insurance that pays out if your flight is delayed more than 3 hours. The system pulls real-time flight data from airlines, checks the delay, and sends cash to your wallet. No paperwork. No customer service. Just code doing what it was told.Energy You Can Sell to Your Neighbor

If you have solar panels on your roof, you’re probably sending excess power back to the grid - and getting pennies in return. Smart contracts change that. Platforms like Power Ledger and WePower let you sell your extra electricity directly to neighbors. Here’s how it works: Your solar system generates power. A smart meter records how much you produce and how much your neighbor uses. A smart contract matches supply and demand in real time. You get paid in cryptocurrency. Your neighbor gets cheaper power. The grid stays balanced. No utility company takes a cut. In Wellington, pilot projects are already testing this model. Households with solar panels are earning up to $200 a month by selling surplus energy to nearby homes. It’s not just green energy - it’s peer-to-peer economics.Gaming That Actually Pays You

Remember spending hundreds on in-game skins or weapons, only to lose them when the server shut down? That’s the problem with centralized games. Smart contracts fix that by giving you true ownership. In Axie Infinity, every creature, weapon, and piece of land is a non-fungible token (NFT) stored on the blockchain. You don’t just play the game - you own parts of it. You can sell your Axies on open marketplaces. You can rent them to other players. You can even stake them to earn passive income. Illuvium takes it further. Players earn tokens by winning battles, and those tokens can be traded or used to upgrade their creatures. The game’s economy runs entirely on smart contracts. No company can freeze your assets. No developer can delete your inventory. The rules are written in code - and they can’t be changed without community approval. In 2025, the play-to-earn gaming sector generated over $4 billion in economic activity, mostly powered by smart contracts.

Tracking Your Food from Farm to Fork

Ever heard of a food recall? A bag of spinach contaminated with E. coli? A batch of recalled baby formula? It takes weeks to trace the source because supply chains are a black box. Smart contracts change that. Every step - from the farm that grew the lettuce, to the truck that shipped it, to the store that sold it - gets recorded on a blockchain. If contamination is found, the system instantly shows you exactly where it came from and who handled it. Walmart and Nestlé already use this. In 2024, Walmart reduced the time to trace a mango’s origin from 7 days to 2.2 seconds. That’s not just efficiency - it’s safety. Consumers can scan a QR code on their produce and see the entire journey: where it was grown, when it was harvested, how it was stored, and who shipped it. Counterfeit goods? That’s another problem smart contracts solve. Luxury brands like LVMH use blockchain to verify authenticity. You can prove your handbag isn’t fake - because the chain of custody is public and unchangeable.Your Identity, Your Control

Your identity is scattered across banks, hospitals, governments, and social media. Every time you sign up for a service, you hand over your data - and lose control. Decentralized identity systems like MyEarth ID use smart contracts to let you own your digital identity. You store your credentials - driver’s license, passport, credit score - encrypted on your device. When you need to prove who you are, you share only what’s necessary. A lender doesn’t need your full birth certificate - just a verified credit score. A hospital doesn’t need your entire medical history - just your blood type and allergies. Smart contracts verify the data without seeing it. This means less fraud, faster approvals, and real privacy. In Estonia, the government already uses blockchain-based digital IDs for 99% of public services. In New Zealand, pilot programs are testing similar systems for healthcare and voting.Voting That Can’t Be Tampered With

Election fraud isn’t just a conspiracy theory - it’s a real problem. Ballots get lost. Machines get hacked. Votes get miscounted. Smart contracts offer a solution: tamper-proof digital voting. Each vote is encrypted and recorded on a blockchain. Once cast, it can’t be changed. Voters can verify their vote was counted - without revealing who they voted for. No polling stations needed. No long lines. Just a secure app on your phone. Switzerland tested this in 2023 for local elections in Zug. Voter turnout jumped 32%. In the U.S., West Virginia used a blockchain voting system for overseas military personnel in 2024, with zero reported breaches. Yes, there are challenges. Not everyone has a smartphone. Cybersecurity needs to be flawless. But the technology is ready. The question isn’t if - it’s when.

Tokenizing Real-World Assets

Think of a painting worth $10 million. Only billionaires can buy it. But what if you could own 0.1% of it? Smart contracts make this possible. Real estate, fine wine, carbon credits, even gold bars - they’re all being turned into digital tokens. Each token represents a share. You can buy, sell, or trade those shares like stocks. Companies like Securitize and Polymarket are tokenizing commercial buildings, vineyards, and renewable energy projects. A farmer in Australia can sell tokens representing future carbon credits from his land. An investor in Singapore can buy a fraction of a New York office tower. Liquidity that didn’t exist before? Now it’s just a click away.Who’s Using This Right Now?

This isn’t science fiction. Major players are already in:- IBM uses blockchain for supply chain tracking across 100+ countries.

- Mastercard launched a blockchain-based identity verification system for banks.

- Unilever tracks tea and palm oil from farms to shelves using smart contracts.

- Swiss Federal Railways uses smart contracts to automate ticket refunds for delays.

- California Department of Health is piloting blockchain for secure medical record sharing.

Why Isn’t Everyone Using This Yet?

There are hurdles. Smart contracts need good code. A single bug can cost millions - remember the DAO hack in 2016? That’s why audits matter. Scalability is still a challenge - Ethereum handles about 15 transactions per second. Layer-2 solutions like Polygon and Arbitrum are fixing that. Regulation is messy. Some countries welcome blockchain. Others ban it. And most people don’t know how to use it. Wallets, private keys, gas fees - it’s still too complicated. But adoption is growing fast. In 2025, global investment in blockchain infrastructure hit $28 billion. Governments are drafting laws. Banks are building bridges between traditional finance and blockchain. The tools are getting simpler. The use cases are proving themselves.What’s Next?

Smart contracts won’t replace every system. But they’re replacing the slow, broken ones. The future isn’t about replacing banks - it’s about replacing the parts of banking that don’t work. The future isn’t about replacing doctors - it’s about making medical records secure and portable. The future isn’t about replacing farmers - it’s about protecting them from weather they can’t control. This isn’t just about technology. It’s about fairness. Transparency. Trust. And it’s already here.Are smart contracts only used for cryptocurrency transactions?

No. While smart contracts were first popularized in cryptocurrency, they now power real-world systems like property sales, insurance payouts, energy trading, supply chain tracking, digital identity, and voting. Their ability to automate agreements without middlemen makes them valuable in any industry that relies on trust and documentation.

How do smart contracts get real-world data like weather or flight status?

They use oracles - trusted third-party services that connect blockchains to outside data. Chainlink is the most common oracle network. It pulls live data from sources like NOAA (for weather), airline APIs (for flight delays), or stock exchanges (for financial prices). This data is verified and fed into the smart contract to trigger actions - like paying out insurance or releasing funds.

Can smart contracts be changed or hacked after they’re deployed?

Once deployed on a public blockchain, smart contracts are immutable - meaning they can’t be altered. That’s a feature, not a bug. But if there’s a bug in the code before deployment, it can lead to losses. That’s why serious projects get audited by firms like CertiK or OpenZeppelin. Some contracts include upgrade mechanisms, but these require community approval and are rare in high-stakes applications like finance or voting.

Do I need to understand blockchain to use a smart contract application?

No. Most users interact with smart contracts through apps - like a mobile wallet for parametric insurance or a platform for buying property tokens. You don’t need to know how the code works. Just like you don’t need to understand electricity to flip a light switch. The interface hides the complexity. But you do need to understand basic digital security - like protecting your private key.

Are smart contracts legal?

In many countries, yes. The U.S., Switzerland, Singapore, and Estonia recognize smart contracts as legally binding if they meet basic contract requirements: offer, acceptance, consideration, and intent. Some jurisdictions are still catching up, but courts are increasingly treating blockchain records as valid evidence. The key is ensuring the contract’s terms are clear and enforceable under existing law - the code just automates execution.

Can smart contracts replace lawyers or notaries?

They reduce the need for intermediaries in routine tasks - like transferring property titles or releasing escrow funds. But they don’t replace legal advice. You still need a lawyer to draft the terms correctly. A smart contract can’t interpret intent or handle disputes. It just enforces what’s written. Think of it as an automated clerk, not a judge.

What’s the biggest barrier to wider adoption of smart contracts?

User experience. Most people still find wallets, private keys, gas fees, and blockchain browsers confusing. Until these tools become as simple as using a banking app, adoption will be limited to tech-savvy users. The second biggest barrier is regulatory uncertainty - businesses hesitate to build on a platform where laws might change overnight.