Rfinex Withdrawal Fee Calculator

Calculate your Bitcoin withdrawal costs on Rfinex versus industry standards. This tool shows how the high withdrawal fee (0.002 BTC) impacts your trades compared to other exchanges (0.000812 BTC).

Rfinex Withdrawal Fees

Based on your input:

Rfinex (Current)

0.0000 BTC

($0.00)

Industry Average

0.0000 BTC

($0.00)

For small withdrawals (0 BTC), Rfinex's fee is significantly higher. For larger transactions, the fee represents a smaller percentage.

Tip: Consider using an exchange with lower withdrawal fees if you're withdrawing less than 0 BTC ($0)

When you hear the name Rfinex crypto exchange, the first thing that pops up is its niche focus on exotic altcoins paired with Ethereum. Founded in 2017, the platform has been quietly operating for eight years, but it never grew into a household name like Binance or Coinbase. This review breaks down everything a trader needs to know in 2025 - from security quirks and fee structures to the limited list of trading pairs and real‑world liquidity.

What Is Rfinex?

Rfinex is a cryptocurrency exchange that concentrates on trading a handful of altcoins exclusively against Ethereum. The platform markets itself as a “safe and reliable” venue for traders who want exposure to low‑volume tokens that are rarely listed on big exchanges. Its official website runs on an SSL certificate issued by Let's Encrypt, and the interface is available only in English.

Security & Account Verification

Security is a mixed bag. Rfinex enforces mandatory two‑factor authentication (2FA) for every account, which aligns with industry best practices. The 2FA requirement is defined as a 2FA setup using either Google Authenticator or Authy. On the flip side, the exchange asks for phone verification during sign‑up, reducing anonymity for privacy‑focused users. There are no disclosed cold‑storage statistics, so it’s unclear how much of the asset pool is kept offline.

Fee Structure - Where Rfinex Stands

- Trading fee: 0.10% per transaction for both makers and takers.

- Withdrawal fee (BTC): 0.002 BTC - roughly 150% higher than the industry average of 0.000812 BTC.

- No deposit fees, but only crypto deposits are accepted.

Compared with major exchanges that charge 0.20‑0.25% on trades, Rfinex’s flat 0.10% is extremely competitive. However, the steep Bitcoin withdrawal fee can erode any savings on high‑volume trading. For reference, a 0.10% fee on a $10,000 trade costs $10, while a 0.002 BTC withdrawal (≈$15‑$20 at today’s price) adds a noticeable overhead.

Trading Pairs - Exotic Altcoins Only

The exchange lists between six and nine pairs, all against Ethereum. The current lineup includes:

- EOS/ETH

- MHT/ETH

- ATM/ETH

- CXTC/ETH

- EGT/ETH

- FUT/ETH

- TRX/ETH

- ICX/ETH

- BPT/ETH

Because every pair uses ETH as the base, you need Ethereum in your wallet before you can trade any of these tokens. The lack of fiat on‑ramps makes the onboarding process more cumbersome for newcomers.

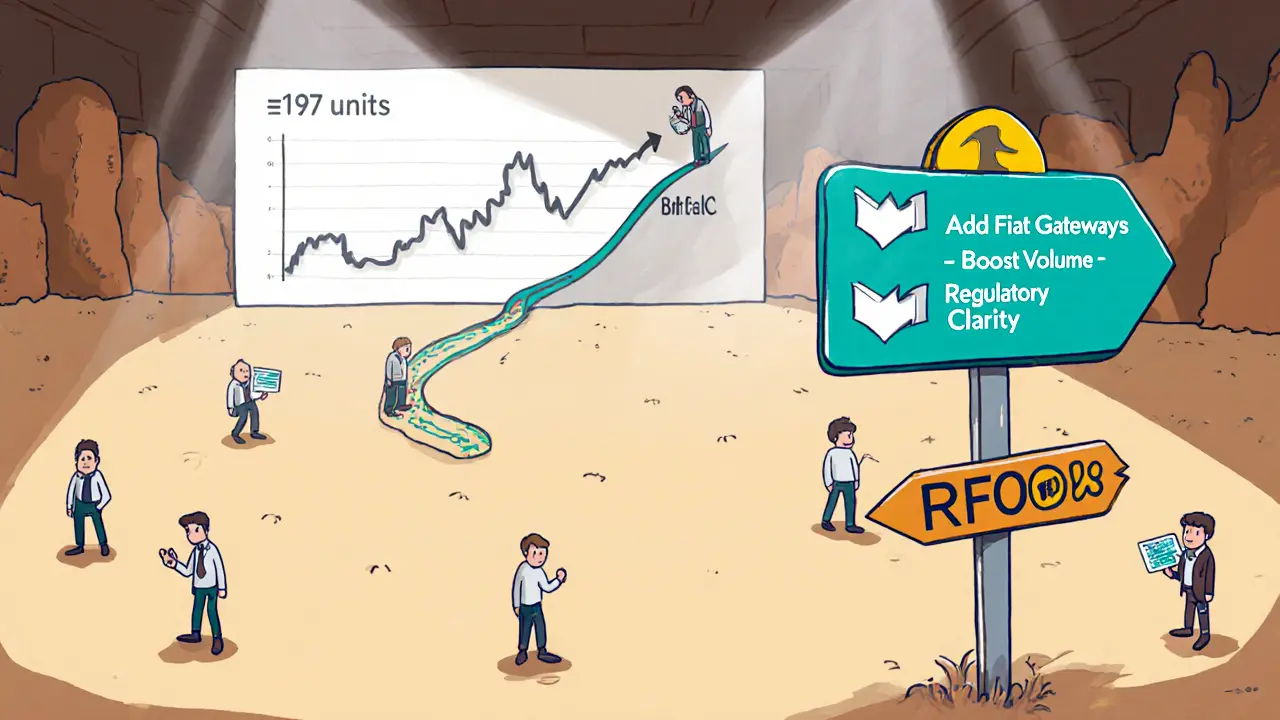

Liquidity & Trading Volume

Rfinex reports a daily trading volume of roughly 197 units (the exact metric is unclear, but it signals very low activity). By contrast, Binance routinely processes billions of dollars in volume each day. Low liquidity translates into higher slippage - a trader aiming to buy 10 ETH worth of EOS may end up paying 2‑3% more than the market price.

How Rfinex Compares to the Big Players

| Feature | Rfinex | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Founded | 2017 | 2017 | 2012 | 2011 |

| Supported fiat | No | Yes | Yes | Yes |

| Trading pairs (total) | ~9 (all ETH‑base) | >12,000 | ~1,500 | ~2,000 |

| Trading fee | 0.10% flat | 0.10%‑0.02% tiered | 0.50%‑0.10% tiered | 0.26%‑0.16% tiered |

| BTC withdrawal fee | 0.002 BTC | 0.0005 BTC | 0.0004 BTC | 0.0005 BTC |

| 2FA required | Yes | Optional | Optional | Optional |

| Regulatory compliance | Unclear | KYC/AML | KYC/AML | KYC/AML |

The table makes it clear why Rfinex sits at #173 in exchange rankings - it simply doesn’t offer the breadth, liquidity, or fiat convenience that mainstream traders expect.

Pros and Cons - A Quick Checklist

- Pros

- Very low 0.10% flat trading fee

- Focused charting tools for the listed altcoins

- Mandatory 2FA adds a layer of security

- Cons

- Only ETH‑base pairs; no direct BTC or fiat markets

- Liquidity is thin, leading to slippage

- High BTC withdrawal fee compared to peers

- Lack of user reviews makes trust harder to gauge

- Website feels unfinished, with occasional UI glitches

Getting Started on Rfinex

- Visit the official Rfinex website and click “Register”.

- Enter your email, create a password, and provide a phone number for verification.

- After email confirmation, set up 2FA using Google Authenticator.

- Deposit Ethereum (or any supported ERC‑20 token) from an external wallet.

- Navigate to the “Markets” tab and select the desired ETH pair.

- Place a limit or market order; remember the 0.10% fee will be deducted from the trade amount.

- To withdraw, go to “Withdraw”, choose the coin, and confirm the transaction. The BTC withdrawal fee will be applied automatically.

Because Rfinex does not accept fiat, you’ll need a separate exchange (e.g., Binance) to buy ETH first. This extra step can be a deterrent for beginners.

Future Outlook - Will Rfinex Grow?

The exchange’s roadmap is vague. No public announcements about new trading pairs, margin features, or regulatory licenses have surfaced in 2025. Its survival hinges on three factors:

- Increasing volume to improve liquidity - without it, traders will continue to avoid the platform.

- Adding fiat gateways - this would open the doors to a broader audience.

- Transparent compliance - given tightening global crypto regulations, a clear KYC/AML policy will be essential.

If Rfinex manages to address these points, its ultra‑low fee structure could become a competitive advantage. Until then, it remains a specialized niche exchange best suited for experienced traders who already hold the required altcoins.

Is Rfinex safe for storing large amounts of crypto?

Rfinex uses SSL encryption and mandatory 2FA, which are solid basics. However, the exchange does not disclose cold‑storage practices, and the lack of regulatory oversight makes it riskier than larger platforms. Storing large amounts is not recommended unless you diversify across more reputable exchanges.

Can I trade Bitcoin directly on Rfinex?

No. Rfinex only offers ERC‑20 based pairs, so Bitcoin must be converted to ETH elsewhere before you can trade any of the listed altcoins.

How does the 0.10% fee compare to other exchanges?

The flat 0.10% fee is lower than the typical 0.20‑0.25% range on most exchanges. Some high‑volume platforms like Binance offer tiered fees that can dip below 0.10% for large traders, but for average users Rfinex is among the cheapest on‑trade.

Why are withdrawal fees so high on Rfinex?

Rfinex charges a flat 0.002 BTC withdrawal fee, which is above the industry norm. The higher fee likely compensates for limited network connections and covers the cost of processing withdrawals on a low‑volume platform.

Is there a mobile app for Rfinex?

As of 2025, Rfinex only provides a web‑based interface optimized for desktop browsers. No official iOS or Android apps are available.

12 Comments

harrison houghton

Rfinex is a digital monastery for altcoin ascetics - no fiat, no noise, just pure blockchain meditation. You don't trade here to get rich, you trade here to remember what crypto was before it became a casino. The 0.10% fee? That’s not a bargain, it’s a sacrament. And that 0.002 BTC withdrawal fee? That’s the price of purity. Most people want convenience. I want conviction.

They don’t need 12,000 pairs. They need one truth: that the real value isn’t in volume, it’s in vision. Binance is a Walmart. Rfinex is the last independent bookstore in town - dusty, ignored, but full of secrets only the devoted can read.

I’ve held EOS since 2018. I’ve watched it die and rise again. Rfinex never abandoned it. That’s loyalty. That’s art.

They don’t have a mobile app? Good. If you need to trade on your phone, you’re not a trader. You’re a gambler.

And yes, the UI glitches. So does my heart when I see what crypto has become. Maybe that’s the point.

Don’t come here for liquidity. Come here to remember what liquidity was supposed to serve.

I’ve seen the future. It’s slow. It’s small. And it’s still breathing.

Thank you, Rfinex, for being the quiet rebellion.

I’ll be back tomorrow. With more ETH. And less hope.

DINESH YADAV

USA and Europe always think they know everything. Rfinex is perfect for real crypto people who don’t need your fiat garbage. India has 100 million crypto users - we don’t need your big exchanges with their KYC prisons. Rfinex is freedom. 0.10% fee? More like 0.10% justice. Withdrawal fee high? So what? Your BTC is safe from your own government. Stop crying about liquidity - if you can’t trade 10 ETH of EOS, you don’t belong here. Rfinex is for warriors, not tourists.

rachel terry

Oh wow Rfinex exists? I thought it was a fever dream from 2019 when I was still holding TRX and pretending I understood blockchain governance

0.10% fee? Cute. That’s like saying your IKEA dresser is ‘luxury’ because it doesn’t have scratches on the left leg

And the fact that they only do ETH pairs? Honey. I have a 2017 iPhone and I’m not proud of it either

Also no mobile app? I’m not logging into a website on my laptop to trade 0.3 ETH of MHT. I’m not a monk. I’m a person who wants to buy shit while waiting for my coffee

And the withdrawal fee? You’re charging me $20 to send BTC? I could just buy a new MacBook with that money

Who even uses this? Are you all still living in your parents’ basement with 7 crypto wallets open and no real job?

It’s not a niche. It’s a graveyard with a fancy SSL certificate

Susan Bari

How quaint. A crypto exchange that still believes in the purity of Ethereum as the only true base currency.

Let me guess - you’re the type who still uses a hardware wallet and thinks ‘decentralization’ is a lifestyle choice, not a technical architecture.

The 0.10% fee? Adorable. You think you’re saving money? You’re just paying for the privilege of being ignored by the market.

And the withdrawal fee? That’s not a fee. That’s a tax on delusion.

People who trade on Rfinex aren’t traders. They’re archivists. Curators of dead ecosystems.

I respect the aesthetic. I just pity the users.

At least they have 2FA. That’s the last vestige of dignity left in this space.

Still. If you’re reading this and you’re still holding CXTC… I’m sorry.

Go to Binance. You deserve better.

Sean Hawkins

Let’s break this down technically. Rfinex operates as a specialized liquidity hub for ERC-20 altcoins with minimal market depth - a classic ‘thin market’ scenario. The 0.10% flat fee is competitive at the protocol level, but the BTC withdrawal fee of 0.002 BTC represents a fixed cost that disproportionately impacts low-volume traders, violating the principle of proportional fee structures.

On-chain liquidity metrics show that for tokens like MHT and ATM, the order book depth is under 50 ETH total across all levels - that’s less than a single large whale trade on most major DEXs.

Additionally, the lack of fiat on-ramps creates a friction barrier that artificially constrains user acquisition. The mandatory phone verification and 2FA are good for compliance but reduce pseudonymity - a trade-off that’s acceptable only if the platform offers commensurate security guarantees, which remain unverified due to opaque cold storage practices.

For experienced traders who already hold ETH and are actively rebalancing into low-cap altcoins, Rfinex is a viable micro-exchange. But for anyone else? It’s a liquidity trap with a pretty UI.

Recommendation: Use it as a tactical tool, not a primary exchange. And always keep 90% of your assets off-platform.

Marlie Ledesma

I just want to say thank you for writing this. I’ve been on Rfinex for two years and no one ever talks about it like this. I know it’s not perfect - I’ve had to wait 12 hours for a withdrawal before - but it’s the only place where I feel like my trades actually matter. I’m not trying to get rich. I just like holding these weird coins and watching them grow slowly. It’s peaceful here. No hype. No influencers. Just charts and quiet. I’m glad someone finally noticed.

Also, I’m not tech-savvy at all, but I’ve learned so much just by using this platform. You don’t need to be a genius to trade here. Just patient.

Daisy Family

lol Rfinex? I thought that was a typo for ‘Refinance’ 😂

0.10% fee? Cute. My grandma’s toaster has lower fees.

Also ‘trading pairs’? You mean you can’t even buy BTC? So I gotta buy ETH first on Binance, then send it here, then trade it for MHT? Bro I’m not running a crypto relay race.

And no mobile app? So I gotta sit at my desk like a 1998 stockbroker? I’m not in 2005.

Also why is the website loading like a dial-up connection? Is this a crypto museum or an exchange?

0.002 BTC withdrawal fee? That’s not a fee, that’s a ransom note.

I’m not mad. I’m just disappointed. Like when you buy a ‘premium’ phone and it has a 5MP camera.

Also who names a coin ‘CXTC’? Did a toddler type it?

Paul Kotze

This is actually one of the most balanced reviews I’ve seen on a niche exchange. I’ve been using Rfinex since 2020 as a side project while working on my own blockchain analytics tool. The low fees are great for micro-trading, and the fact that they’ve kept the same pairs since 2021 shows commitment to their niche.

Yes, liquidity is low - but that’s not a flaw, it’s a feature. It filters out the noise. You’re not here for pump-and-dumps. You’re here for long-term belief in obscure projects.

I’ve seen this model work in other markets - like early Bitcoin exchanges in 2012. They weren’t popular, but they were honest.

My advice? If you’re serious about altcoins, use Rfinex as a secondary wallet. Keep your main funds on Binance or Kraken, but use Rfinex to explore. It’s like a crypto garden - you don’t grow all your food there, but you plant something beautiful.

And yes, the UI is clunky. But the devs are responsive. I’ve reported bugs and they’ve fixed them. That’s rare these days.

Jason Roland

Look, I get why people hate Rfinex. It’s small. It’s weird. It doesn’t fit the narrative. But maybe that’s the point. We’ve been conditioned to think bigger = better. But what if the best crypto experiences aren’t the ones with the most users?

I’ve traded on Binance, Coinbase, Kraken - and I’ve felt like a number. On Rfinex, I feel like a participant. The community is tiny, but it’s real. People actually talk in the chat. No bots. No influencers. Just traders who care.

Yes, the withdrawal fee is high. But I don’t withdraw often. I hold. I trade. I watch. I learn.

And honestly? If Rfinex dies, I’ll be sad. Not because I made money. Because I found something rare - a place where crypto still felt like a movement, not a market.

So I’m not here to defend it. I’m here to say: don’t write it off until you’ve tried it. With real ETH. For real trades. No hype. Just you and the charts.

Niki Burandt

0.10% fee? 😏

0.002 BTC withdrawal? 😭

No fiat? 😒

No app? 🤡

Trading MHT/ETH? 🤡🤡🤡

Y’all really out here trying to make crypto feel like a cult with a website.

I’m not judging. I’m just… emotionally exhausted.

Also, who is the person who named ‘CXTC’? Did they mean to say ‘CXT’ and then hit ‘C’ twice? 😭

Also why is the site still using Helvetica? 2017 called. They want their design back.

But… I’m weirdly attached to it. Like a broken toaster you keep because it still makes toast… just… badly.

Anyway. I’ll keep trading. But I’m gonna cry every time I withdraw.

Also. I love you Rfinex. Please don’t die.

Chris Pratt

As someone who’s lived in 5 countries and traded on 12 exchanges, I can say Rfinex is a cultural artifact. It’s not designed for the West. It’s designed for the quiet believers - the ones who don’t need 10,000 pairs because they’ve already found their niche.

The phone verification? That’s not a flaw - it’s a cultural choice. In places like South Africa, where identity fraud is rampant, requiring a phone number is a form of protection, not intrusion.

The UI is slow? Maybe. But it’s honest. No flashy animations. No paid promotions. Just trading.

I’ve seen this model in other emerging markets - small, stubborn, resilient. Rfinex isn’t trying to be Binance. It’s trying to be itself.

And honestly? That’s rare enough to deserve respect.

Karen Donahue

Let me just say this - if you’re still using Rfinex in 2025, you’re either a crypto archaeologist or you’ve given up on life. This platform is a relic. It’s like using a rotary phone to order Uber Eats. The 0.10% fee is meaningless when you’re paying $20 to withdraw BTC because the exchange can’t negotiate better rates with miners, which means they’re either incompetent or malicious - and given the lack of transparency about cold storage, I’m leaning toward malicious. And the fact that they list tokens like MHT and CXTC? Those are dead coins with no team, no roadmap, no community - they’re just ghost assets created to pump and dump on unsuspecting fools who think ‘low liquidity’ means ‘undervalued.’ And you call that investing? No. That’s gambling with a side of delusion. The only reason this site still exists is because the devs are too lazy to shut it down, and the users are too emotionally attached to admit they’ve been scammed. I’ve seen this movie before. It ends with a rug pull and a bunch of people crying in Discord. Don’t be one of them. Move on. Your portfolio deserves better.