Exchange Token Fee Savings Calculator

Calculate Your Savings

Estimate how much you save annually by using exchange tokens for trading fees.

Estimated Annual Savings

If you’ve ever wondered why traders keep a stash of exchange tokens in their wallets, you’re not alone. These native assets have turned from a quirky add‑on into a core part of many crypto strategies. Below we break down the real advantages-fee cuts, staking yields, voting power, and more-so you can decide whether adding them to your portfolio makes sense.

What Exactly Is an Exchange Token?

Exchange Token is a utility token issued by a cryptocurrency exchange that functions as the platform’s internal currency. The concept started in 2017 when Binance launched BNB through an ICO. Since then, over 40 exchanges have introduced their own tokens, each promising a mix of fee discounts, staking opportunities, and governance rights.

Why Hold Them? The Core Value Props

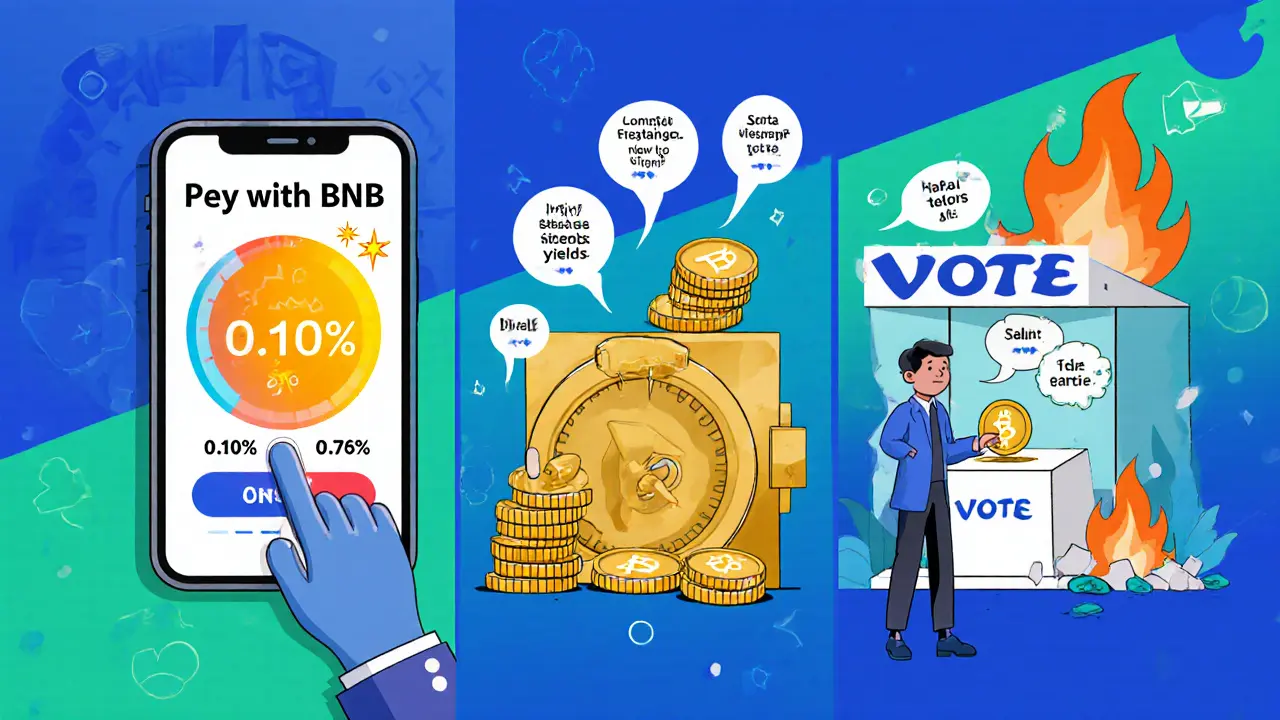

Exchange tokens create a closed‑loop economy: the more you own, the more you save or earn on the same platform. The four biggest benefits are:

- Fee discounts: Paying trading fees with the native token usually trims 10‑25% off the headline rate.

- Staking yields: Locking tokens can generate 3‑15% APY, depending on lock‑up periods and platform demand.

- Governance participation: Holders vote on new listings, fee structures, and protocol upgrades.

- Deflationary mechanics: Quarterly token burns shrink supply, often boosting price as demand stays steady.

Fee Discount Mechanics - How Much Can You Save?

Imagine you trade $50,000 worth of crypto per month on Binance. The standard taker fee sits at 0.10%. Paying with BNB at the typical 25% discount drops the fee to 0.075%, saving you $37.5 each month. Over a year that’s $450-enough to cover a modest hardware wallet.

Other exchanges follow similar models but differ in tiering. OKB on OKX offers a 5‑20% discount based on how many tokens you hold, while KCS on KuCoin gives a flat 20% reduction once you meet a 100‑token threshold.

Staking and Yield Generation

Staking isn’t just a buzzword; it’s a practical way to turn idle tokens into income. Most platforms lock the token for 30‑180 days and return a percentage of the exchange’s fee revenue.

Typical APY ranges:

- BNB - 5‑12% depending on lock‑up length.

- OKB - 3‑9% with a higher rate for longer commitments.

- KCS - 8‑15% for users who stake at least 500 KCS.

Because the rewards come from the exchange’s own fee pool, they tend to scale with the platform’s trading volume, creating a virtuous cycle for early adopters.

Governance Rights - Your Voice Matters

Holding exchange tokens can grant you voting power on key decisions. For example, Binance requires 1,000 BNB (about $2,300 at current prices) to propose a change, while OKX only needs 100 OKB (roughly $1,150). Votes usually cover:

- New token listings.

- Changes to fee structures.

- Allocation of burn proceeds.

- Community fund grants.

These votes can directly affect market dynamics, so savvy holders keep an eye on upcoming proposals.

Token Burns - Built‑In Deflation

Most exchange tokens employ scheduled burns to curb supply. Binance’s quarterly BNB burn has removed roughly 19.2% of the token’s maximum supply since 2017, translating to over $12 billion worth of tokens destroyed at today’s price. KuCoin’s “Supercharger” program burns 80% of fees collected in KCS, trimming supply by 14.7% since 2019.

Deflation helps maintain price support, especially when trading volume spikes. However, the impact depends on the burn schedule and overall demand for the token’s utility.

Market Performance - Do the Numbers Back the Benefits?

Historical data shows that leading exchange tokens have outperformed the broader crypto market. BNB posted a 3‑year CAGR of 42.7%, OKB 38.2%, and KCS 29.5% through Q3 2023, versus the market’s 18.3% average. This premium largely stems from the fee‑discount and staking revenue streams that keep demand steady even in bearish cycles.

That said, volatility remains. Newer tokens like AZA Power, which focuses on Nigerian fiat conversions, display standard deviations above 80%-far higher than BNB’s 62.1%.

Risks You Can’t Ignore

Every upside has a flip side. The biggest risk is counter‑party exposure: if the issuing exchange falters, the token can plummet. The FTX collapse in 2022 wiped out over $2.5 billion of FTT value in under three days, a stark reminder that exchange tokens behave like equity in a private company.

Regulatory uncertainty adds another layer. The SEC’s 2023 enforcement actions suggest some tokens might be classified as unregistered securities, while Europe’s MiCA framework treats them as utility tokens. Depending on jurisdiction, token discounts could be taxed as ordinary income.

Practical Tips for Holding Exchange Tokens

- Start with the exchange you trade most on. If you’re a high‑frequency Binance user, allocate enough BNB to hit the 25% discount tier.

- Keep an eye on minimum balance requirements-most platforms need 50‑500 tokens for full utility.

- Consider staking only the portion you’re comfortable locking. Split between a liquid cache (for fee discounts) and a staked pool (for yield).

- Monitor upcoming governance proposals. A single vote can shift listing policies that affect token price.

- Stay updated on burn schedules. Quarterly announcements give clues about future supply constraints.

Comparison of Major Exchange Tokens (2025 Snapshot)

| Token | Fee Discount | Staking APY | Governance Threshold | Burn Cadence |

|---|---|---|---|---|

| BNB | 25% flat | 5‑12% (30‑180 days) | 1,000 BNB | Quarterly |

| OKB | 5‑20% tiered | 3‑9% (45‑180 days) | 100 OKB | Quarterly |

| KCS | 20% flat | 8‑15% (30‑120 days) | 500 KCS | Monthly |

| AZA Power | 15‑20% on NGN conversions | 6‑10% (30‑90 days) | 250 AZA | Bi‑annual |

Bottom Line - Should You Hold Exchange Tokens?

For active traders, the fee savings alone often outweigh the opportunity cost of capital. Add staking yields, and you’re turning a cost‑center into a modest income stream. Governance rights give a voice in platform direction-useful if you’re heavily invested in one ecosystem.

However, if you’re a casual holder or heavily risk‑averse, the counter‑party exposure and regulatory gray area may outweigh the perks. The smart approach is to allocate only the amount you’d already spend on fees, then let the token work for you through staking and voting.

Frequently Asked Questions

Do exchange tokens count as taxable income?

In most jurisdictions, the discount you receive when paying fees with the native token is treated as a reduction in trading costs, not ordinary income. However, staking rewards are generally taxed as ordinary income at the time they’re received. Always check local tax guidance.

Can I use exchange tokens on other blockchains?

Most tokens are ERC‑20 or BEP‑20 assets, so they can be moved to any compatible wallet. Their utility-fee discounts, staking, governance-only works inside the issuing exchange’s ecosystem.

What’s the difference between a token burn and a buy‑back?

A burn permanently removes tokens from circulation, usually by sending them to an irretrievable address. A buy‑back repurchases tokens and may hold them for later use or re‑burn them. Both aim to reduce supply but have different accounting treatments.

How often do exchanges update their token burn schedule?

Most major exchanges announce burns quarterly. Some, like KuCoin, burn a portion of every fee transaction, resulting in continuous supply reduction.

Is staking safe if the exchange gets hacked?

Staked tokens are typically held in a smart‑contract controlled by the exchange. If the exchange suffers a security breach, staked assets could be at risk. Using hardware wallets for unstaked holdings mitigates exposure.

8 Comments

Sean Hawkins

Exchange tokens are essentially loyalty programs with leverage. The fee discounts alone make them worth holding if you're even moderately active. BNB’s 25% cut is the gold standard-when you’re trading $100K/month, that’s $250/month in free savings. Add staking yields on top and you’re effectively getting paid to trade. The burn mechanics are the silent MVP-supply pressure without any marketing. It’s not magic, it’s economics.

Marlie Ledesma

I just started holding BNB last year and honestly didn’t expect to like it. But the staking rewards just kind of… appear. Like free money you didn’t have to do anything for. I didn’t even realize how much I was saving on fees until I checked my statements. Now I keep a little stash just for that.

Daisy Family

Oh wow, another ‘exchange tokens are the future’ blogpost. Let me guess-you also think NFTs are ‘digital art’ and DeFi is ‘financial freedom’? 😏 BNB’s just a corporate token with a burn gimmick. And don’t get me started on ‘governance’-you think your 50 BNB actually matters? Nah. It’s a placebo for retail who think they’re part of the ‘club’.

Paul Kotze

Interesting breakdown. I’m from South Africa and we’re seeing more local traders here pick up KCS because KuCoin supports ZAR deposits. The 20% fee discount is huge when you’re dealing with small trades. The monthly burn is a nice touch too-feels more transparent than quarterly. Still, the volatility scares off a lot of new users. Maybe a stablecoin-backed fee option would help adoption?

Jason Roland

People are underestimating how much this model is shifting the power dynamic. Exchanges used to be gatekeepers. Now they’re giving users a stake in the business-literally. Governance votes on listings? That’s revolutionary. I voted last quarter to block a scammy memecoin and it passed. It’s not perfect, but it’s a step toward decentralization. If you’re not holding at least one exchange token, you’re leaving money and influence on the table.

Niki Burandt

LOL at the ‘deflationary mechanics’ hype. 😅 BNB’s price is up because people are FOMOing, not because burns matter. And staking APY? That’s just the exchange giving back a fraction of the fees they collect from YOU. It’s a circular economy designed to lock you in. And don’t even get me started on the tax nightmare-every staking reward is taxable income. 🤑💸

Chris Pratt

As someone who’s traded on Binance for 7 years, I can say this: holding BNB changed my whole approach. I used to cash out after every trade. Now I keep a buffer of BNB just to cut fees. It’s like having a loyalty card that pays you back in crypto. And the burn announcements? I check them like clockwork. It’s not just about price-it’s about being part of the ecosystem. 🙌

Karen Donahue

Look, I get that people love these tokens, but let’s be real-this whole thing is just a way for exchanges to extract more value from retail traders while pretending to be ‘community-driven.’ You think you’re saving money on fees? You’re just paying more upfront to buy the token so you can get a discount on the fees you were already going to pay. And the governance? A joke. The top 1% of holders control everything. And don’t even get me started on the regulatory risk-this is exactly the kind of thing the SEC is going to come after next year. It’s not a ‘smart allocation,’ it’s a trap wrapped in a whitepaper.