Creator Earnings Calculator

Earnings Comparison Calculator

Your Potential Earnings

Traditional Platforms

YouTube/Spotify/Patreon

$0.00

After platform fees (30-50%)

Social Tokens

Direct fan economy

$0.00

From token sales & revenue sharing

Key Insights

Your token earnings are 0% higher than traditional platforms

Based on article data: 5,000+ engaged fans required

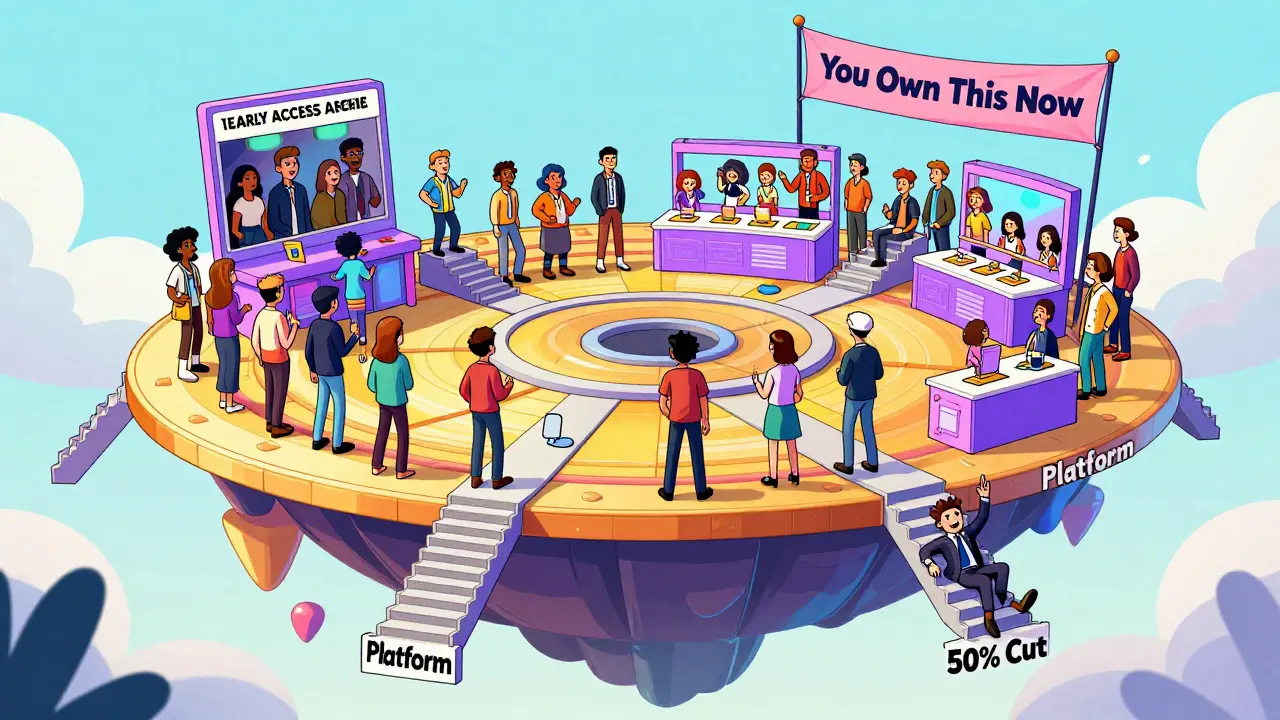

When a musician releases a new song, most platforms take half the money. YouTube, Spotify, Instagram - they all slice off big chunks just for hosting. But what if fans could buy into the success directly? That’s where social tokens come in.

These aren’t just crypto coins. They’re digital keys that unlock access, influence, and a real stake in a creator’s work. Artists, podcasters, and visual creators are using them to cut out the middlemen and build communities where fans aren’t just viewers - they’re co-owners.

What Exactly Are Social Tokens?

Social tokens are fungible digital assets built on blockchains like Ethereum, Solana, or Polygon. Unlike NFTs - which are one-of-a-kind digital collectibles - social tokens are interchangeable, like cash within a closed economy. You can hold 100 of them, trade them, or spend them for exclusive perks.

They’re issued by creators using tools like Roll, Coinvise, or Mintgate. Once launched, fans can buy them with credit cards or crypto. The creator sets rules: what the tokens do, how they’re earned, and how much they’re worth. The value isn’t set by a stock exchange. It’s set by the community.

Think of it like buying a membership card to a private club - except the club is run by your favorite artist, and every time someone joins, they’re betting on that artist’s future.

How Creators Actually Use Them

Creators aren’t just selling tokens. They’re selling access, influence, and belonging.

- Exclusive content: Holders get early access to music, unreleased art, or private livestreams. RAC, a musician and producer, gave $RAC token holders early listens to new tracks - and later, invite-only Zoom calls. The token wasn’t just a payment; it was a backstage pass.

- Community voting: Some tokens let holders vote on creative decisions. Should the next album be electronic or acoustic? Should a mural go in Tokyo or Berlin? Fans don’t just consume - they help shape the work.

- Revenue sharing: Creators can program their tokens to give back a percentage of every resale. If a fan buys a token for $10 and later sells it for $50, the creator gets 5% - $2.50 - automatically. No platform takes a cut.

- Membership tiers: Tokens can unlock different levels. 50 tokens = access to a Discord channel. 200 tokens = a personalized shoutout. 500 tokens = a custom digital artwork. It turns loyalty into a ladder, not a flat fee.

One creator on Reddit, who goes by u/MusicCreator89, launched a token called $SONG. Within six months, they were earning $8,200 a month - not from streams or ads, but from fans buying in. The upfront cost? $1,200 for smart contract development. The return? Over 600% in under a year.

Why This Beats Traditional Models

On YouTube, creators get about 55% of ad revenue. On Spotify, it’s often less than $0.003 per stream. Patreon takes 5-12% on top of payment processing fees. That’s 30-50% gone before the creator sees a dime.

Social tokens remove that. Everything stays in the creator’s hands. And because tokens can rise in value as the creator grows, early supporters can profit too. One artist’s token jumped from $2 to $12 in eight months as their following grew. Fans who bought in early didn’t just get content - they got a financial upside.

Compare that to a $10/month Patreon subscription. It’s predictable, sure - but it doesn’t reward loyalty with growth. A token does.

The Real Challenges

This isn’t magic. It’s hard work - and it doesn’t work for everyone.

First, there’s the tech barrier. Setting up a wallet, buying crypto, paying gas fees - it’s confusing for non-crypto users. One creator told Trustpilot that only 12% of their fans completed the wallet setup. That’s not a failure of interest - it’s a failure of onboarding.

Platforms are fixing this. Twitter now lets users connect wallets directly to profiles. Moonpay and Stripe let fans buy tokens with credit cards. But the learning curve is still real.

Second, volatility. If a creator goes quiet for a month, token prices can drop. Fans who bought in expecting steady value get nervous. Some creators now tie tokens to fixed-value stablecoins or bundle them with NFTs to add stability.

Third, regulation. The SEC has taken action against social tokens that act like unregistered securities - especially if they promise profit without clear utility. The fix? Separate ownership from financial rights. ECOS.am’s "Constitutional Token Model" does this: tokens grant access and voting, but not分红 (dividends). That’s legal, and it’s becoming the new standard.

Who’s Winning - And Who’s Not

Social tokens aren’t for every creator. Harvard Business Review found you need at least 5,000 highly engaged followers to make it work. Not just followers - people who comment, share, and show up.

Top users? Musicians (32%), visual artists (28%), and podcasters (19%). Why? Their audiences are passionate, loyal, and used to supporting them directly. A painter with 10,000 dedicated collectors? Perfect fit. A fitness influencer with 50,000 followers who rarely comment? Probably not.

Some creators tried and quit. One artist on Reddit spent $3,000 on a token launch and only 87 people bought in. "It felt like shouting into a void," they wrote. The lesson? Don’t launch a token because it’s trendy. Launch it because your fans are already asking for more.

What’s Next

The next wave is hybrid models. Creators are combining tokens with subscriptions, NFTs, and even real-world perks. A token might get you a digital poster - and also a limited-edition vinyl. Patreon is testing token integration, and Nike’s .SWOOSH platform is letting designers launch their own creator tokens.

By 2025, social tokens could make up 8.3% of the $104 billion creator economy. That’s billions in direct fan funding - bypassing platforms entirely.

But the real win isn’t the money. It’s the relationship. When fans hold a token, they’re not just watching your content. They’re invested in your next move. They’re your collaborators. And that’s something no algorithm can replicate.

Getting Started - The Real Steps

If you’re a creator thinking about this, here’s how to begin - no blockchain degree needed.

- Start small: Launch a token with just 3 perks - early access, a private Discord, and a monthly Q&A. Keep it simple.

- Use a platform: Roll, Coinvise, or Mintgate handle the tech. Costs range from $500 to $5,000. You don’t need to code.

- Offer fiat on-ramps: Let fans buy with credit cards. Don’t make them buy crypto first.

- Be transparent: Tell your audience exactly what the token does - and doesn’t do. No promises of "getting rich." Just access and inclusion.

- Launch to your core fans: Don’t broadcast to everyone. Invite your most active 100 followers first. Get feedback. Refine. Then scale.

It’s not about becoming a crypto expert. It’s about building a community that believes in you - and giving them a way to prove it.

Are social tokens the same as NFTs?

No. NFTs are unique digital items - like a one-of-a-kind painting. Social tokens are like cash - they’re interchangeable. You can own 100 of them. They’re used for access, voting, or tipping, not collecting. Many creators use both: NFTs for art, tokens for community.

Can I make money just by holding a social token?

Not unless the token’s value goes up. Some creators design tokens to appreciate as their audience grows, so early buyers can sell later for a profit. But that’s not guaranteed. The main benefit isn’t speculation - it’s access to exclusive content, events, and influence. Don’t buy a token hoping to get rich. Buy it because you love the creator’s work.

Do I need a crypto wallet to use social tokens?

Yes - but not necessarily. Platforms like Roll and Coinvise now let fans buy tokens with credit cards and store them in a simple, hosted wallet. You don’t need to manage private keys or understand gas fees. The wallet is built into the platform. You just log in and use it.

Is this legal?

It depends. If a token is sold as an investment with promises of profit, it may be classified as a security - and that’s regulated. The safest approach is to make the token’s value tied to access and utility, not financial return. Many creators now use models like ECOS.am’s "Constitutional Token," which separates ownership rights from financial claims. Always consult a legal expert familiar with Web3.

What if my token’s value drops?

Token prices can fluctuate based on activity, engagement, and market sentiment. If your content slows down, so might the price. The best way to prevent this is to keep the community active - drop new perks regularly, host events, and communicate openly. A token isn’t a stock. It’s a living part of a relationship. Keep nurturing it.

How much does it cost to launch a social token?

Basic launches cost between $500 and $5,000, depending on complexity. Platforms like Roll offer templates for under $1,000. That includes smart contract setup, a simple website, and integration with payment systems. Legal advice (recommended) adds $2,500-$7,500. Most creators spend $2,000-$3,000 total to get started.

Do I need thousands of followers to make this work?

Yes - but not thousands of casual followers. You need at least 5,000 highly engaged fans who comment, share, and show up. A creator with 10,000 followers who rarely interact won’t succeed. But one with 3,000 superfans who buy merch, attend livestreams, and DM you daily? That’s the sweet spot. Engagement matters more than numbers.

Can I use social tokens on Instagram or TikTok?

Not directly. You can’t issue tokens inside those apps. But you can link to your token page from your bio. Many creators use Twitter or dedicated websites to manage tokens, then drive traffic from Instagram or TikTok. Twitter now supports wallet integration in profiles, making it easier. The key is to use social media to drive people to your token ecosystem - not host it there.

What happens if I stop creating?

If you stop posting or engaging, token value will likely drop. But the tokens don’t disappear. They’re on the blockchain forever. Your community might keep them as memorabilia, or sell them to collectors. Some creators plan for this by handing over governance to a DAO or community council. Others use tokens as a legacy project - a digital archive of their work, owned by fans.

Is this just a bubble?

Some projects will fail. Many will. But the core idea - direct creator-fan ownership - isn’t going away. The platforms that survive will be the ones focused on utility, not speculation. Think of it like the early days of YouTube: a lot of noise, but the ones who built real communities thrived. Social tokens are the same. They’re not for everyone. But for the right creators with the right fans? They’re a revolution.