Every time you trade tokens on a decentralized exchange, someone else might be making money off your move-even before you know it happened. This isn’t a glitch. It’s called MEV, or Maximal Extractable Value, and it’s quietly reshaping how blockchain networks work. You don’t need to be a hacker to be affected by it. You just need to use DeFi.

What Is MEV, Really?

MEV stands for Maximal Extractable Value. It’s the total profit a validator (or miner) can make by reordering, inserting, or blocking transactions in a block they’re building. Before Ethereum switched to Proof-of-Stake, this was called Miner Extractable Value. Now, it’s called Maximal because anyone who validates blocks-whether they run a node, use a staking pool, or even rent computing power-can do it.

The concept exploded into the spotlight after the 2019 paper "Flash Boys 2.0" showed that bots were already making millions by watching the mempool-the public queue of unconfirmed transactions. By 2021, over $554 million had been pulled from Ethereum just through MEV. Today, it’s over $686 million. That’s not a typo. That’s real money taken from everyday users.

How Front-Running Works

Imagine you want to buy 500 DAI worth of UNI on Uniswap. You send your transaction. But before it gets confirmed, a bot sees it in the mempool. The bot notices your trade will push the price of UNI up. So it quickly sends its own buy order-right before yours-with a higher gas fee. The validator includes the bot’s transaction first. Now the bot buys UNI at the lower price. When your transaction goes through, the price rises. The bot immediately sells, pocketing the difference.

This is front-running. It’s legal on-chain because the blockchain doesn’t care who submitted first-it cares who pays more. The system rewards speed and gas, not fairness. You end up paying more for your tokens than you planned. The bot? They made a clean profit with zero risk.

Backrunning and Sandwich Attacks

Front-running isn’t the only trick. Backrunning is its shadow twin. Instead of moving before your trade, the bot waits until after. When your big buy pushes the price up, the bot sells its existing tokens at the new, inflated price. It’s like riding the wave you created.

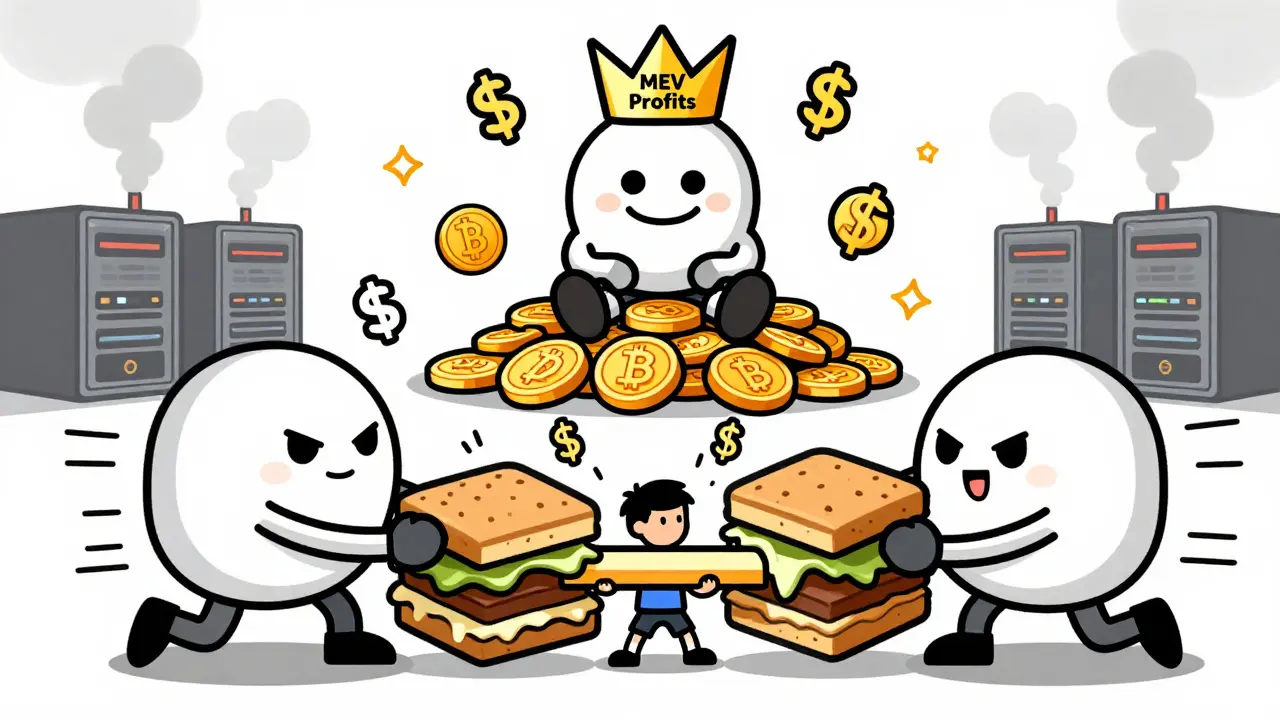

Combine both? That’s a sandwich attack. The bot buys before your trade, then sells right after. Your transaction is squeezed between two hostile moves. You pay higher prices, get fewer tokens, and the bot walks away with profit from both sides. These attacks are common on AMMs like Uniswap, SushiSwap, and Curve. A single large swap can trigger multiple sandwich bots at once.

Other MEV Tactics You Should Know

There’s more than just front- and back-running. Liquidation MEV targets undercollateralized loans in DeFi protocols like Aave or Compound. Bots watch for positions that are about to be liquidated, then race to trigger the liquidation themselves-often before the protocol’s own system can act. They pocket the liquidation reward and the collateral.

Time-bandit attacks are sneakier. They manipulate the timestamp of blocks to exploit smart contracts that rely on time locks or block numbers. For example, a lottery contract that pays out after 24 hours might be manipulated if a validator reorders blocks to make it expire early. These attacks are rare but terrifying when they happen.

Even something as simple as reordering transactions to maximize gas fees can be MEV. Validators can group high-fee transactions together to reduce block overhead. It’s not always malicious-but it’s still extraction.

Why Ethereum Is the Main Target

Bitcoin barely has MEV. No smart contracts. No complex DeFi. No automated market makers. Just simple transfers. That’s why MEV is almost entirely an Ethereum problem.

Ethereum’s smart contracts let you do things like swap tokens, lend, borrow, and stake-all in one chain. That creates endless opportunities for bots to find price gaps, arbitrage opportunities, and timing flaws. Other chains like Solana or Polygon have MEV too, but they’re not as deep or as crowded. Ethereum has the most users, the most liquidity, and the most complex contracts. That’s why it’s the goldmine.

Who’s Really Doing This?

It’s not random people. It’s well-funded teams with servers in data centers near Ethereum nodes. They run custom software that monitors the mempool in real time, simulates thousands of trades, and executes with sub-millisecond precision. Some are hedge funds. Some are crypto-native firms. A few are even run by validators themselves.

The average user? No chance. You can’t compete with a bot that sees your transaction before your wallet confirms it. Even if you raise your gas fee, they’ll outbid you. The system is designed to favor speed, not fairness.

The Hidden Tax on Everyday Users

Every time a sandwich attack happens, you pay more. Your trade executes at a worse price. Your gas fee doesn’t help-you still lose value. Over time, this adds up. Researchers estimate that MEV acts like a 1% to 5% hidden tax on every DeFi trade. For large traders, it’s hundreds of dollars. For small ones, it’s the difference between profit and loss.

And it’s getting worse. As more bots enter the game, competition increases. To win, they need faster hardware, better algorithms, and more capital. That means the gap between professional extractors and regular users keeps growing. What started as a clever hack is now an industry.

Are There Any Fixes?

Yes-but they’re imperfect.

Flashbots created MEV-Boost, a system that lets validators outsource MEV extraction to specialized searchers. Instead of letting bots fight in the open mempool, MEV-Boost creates a private auction. Validators get paid fairly. Users get their transactions processed without being sandwiched. It’s a step forward, but adoption is still patchy. Many validators still run their own bots.

Another idea: fair sequencing. Some Layer-2 chains like Optimism and Arbitrum are testing systems that order transactions by time instead of gas fee. That would stop front-running dead. But it’s not easy to implement on Ethereum Mainnet without breaking compatibility.

Commit-reveal schemes are another approach. You send an encrypted version of your trade first. Only after the block is built do you reveal the details. That way, bots can’t see your move ahead of time. But it adds complexity-and users hate extra steps.

What’s Next?

MEV isn’t going away. It’s evolving.

Next up: cross-chain MEV. Bots are already watching for price differences between Ethereum, Solana, and Polygon. Imagine a bot buying ETH on one chain, selling it on another, and pocketing the spread-all in a single block. That’s the next frontier.

Regulators are watching too. The SEC and other agencies have started asking if MEV counts as market manipulation. If so, it could be treated like insider trading. But with no central authority on blockchain, enforcement is nearly impossible.

For now, the best defense is awareness. If you trade on DeFi, assume someone is trying to profit from your move. Use tools like Flashbots Protect or BloxRoute’s MaxProfit to shield your transactions. Avoid large swaps on public DEXs. Use limit orders. Use aggregators that route trades through MEV-resistant paths.

And remember: blockchain isn’t just code. It’s economics. And in this economy, the fastest players always win.

Is MEV the same as front-running?

Front-running is one type of MEV. MEV is the broader category that includes front-running, backrunning, sandwich attacks, liquidation manipulation, and even simple gas optimization. All front-running is MEV, but not all MEV is front-running.

Can I protect myself from MEV?

Yes, but not perfectly. Use MEV protection services like Flashbots Protect or BloxRoute. Avoid large trades on public DEXs. Use aggregators like 1inch or Matcha that route trades through private mempools. Set slippage tolerance low to limit losses. And never assume your transaction is private-on-chain, everything is public until confirmed.

Does MEV only happen on Ethereum?

No, but Ethereum has the most MEV because of its heavy DeFi usage. Other chains like Polygon, Arbitrum, and Solana also experience MEV, but at lower levels. Bitcoin has almost none because it lacks smart contracts. Newer chains are designing around MEV from the start, but Ethereum’s legacy infrastructure makes it the main battleground.

Why do validators allow MEV?

Because it’s profitable. Validators earn block rewards and transaction fees. MEV adds hundreds or thousands of dollars per block on top of that. In a competitive market, refusing MEV means leaving money on the table. Most validators use MEV-Boost or similar tools to automate extraction without having to build their own bots.

Is MEV illegal?

Legally, it’s a gray area. On-chain, it’s allowed because the protocol doesn’t forbid it. Off-chain, regulators are debating whether it counts as market manipulation. Some argue it’s legitimate arbitrage. Others say it’s unfair to retail users. No major jurisdiction has ruled on it yet, but pressure is building.