Back in June 2021, a wave of crypto hype swept through online communities. Dogecoin was on fire. Meme coins were everywhere. And then came the ElonDoge x CoinMarketCap Mission airdrop - a flashy, space-themed campaign promising free EDOGE tokens to anyone who jumped through a few hoops. Five days. $20,000 in value. A partnership with one of the biggest crypto data sites in the world. It felt like a golden ticket.

But here’s the thing: that ticket didn’t lead to a spaceship. It led to a parking lot.

What Was the ElonDoge Airdrop?

The ElonDoge (EDOGE) airdrop wasn’t just another random giveaway. It was a coordinated push between two entities: the fledgling ElonDoge project and CoinMarketCap. CoinMarketCap, known for tracking prices and market data across hundreds of coins, used its massive user base to spread the word. The goal? Get people to learn about EDOGE - and maybe stick around.

The campaign lasted five days. Users had to complete simple tasks - like reading short explainers about the token, signing up for CoinMarketCap’s newsletter, or sharing posts on social media. In return, they got a small slice of EDOGE. Nothing huge. Maybe 500,000 tokens. But back then, with the meme coin frenzy at its peak, that felt like a windfall.

It wasn’t just about giving away tokens. It was about branding. ElonDoge leaned hard into the Elon Musk x Dogecoin mythos. Space themes. Moon missions. A DAO called EDAO. It was all designed to feel like the next big thing. And for a few days, it did.

How Did EDOGE Tokens Perform After the Airdrop?

Fast forward to today - February 2026 - and EDOGE trades at $0.000000004163. That’s not a typo. Fourteen zeros after the decimal. The 24-hour trading volume? Barely noticeable. You’d need to hold over 2 billion EDOGE to make a single dollar.

Compare that to its peak. At launch, EDOGE briefly hit $0.00000005. That’s over 10 times higher than today. Even during the height of the 2021 bull market, when Dogecoin surged to $0.70, EDOGE never broke into the top 500 coins. It stayed stuck in the shadows of bigger names like Dogecoin, Shiba Inu, and even lesser-known rivals like MOONDOGE.

Why? Because airdrops don’t create value - they create awareness. And awareness fades fast if there’s no real utility behind it.

The EDAO Governance Token: Did It Save the Ecosystem?

ElonDoge didn’t just drop EDOGE. They also launched EDAO - a governance token meant to give holders voting rights over the project’s future. Think: NFT auctions, funding new partnerships, deciding how to spend the project’s reserve funds. Sounds smart, right?

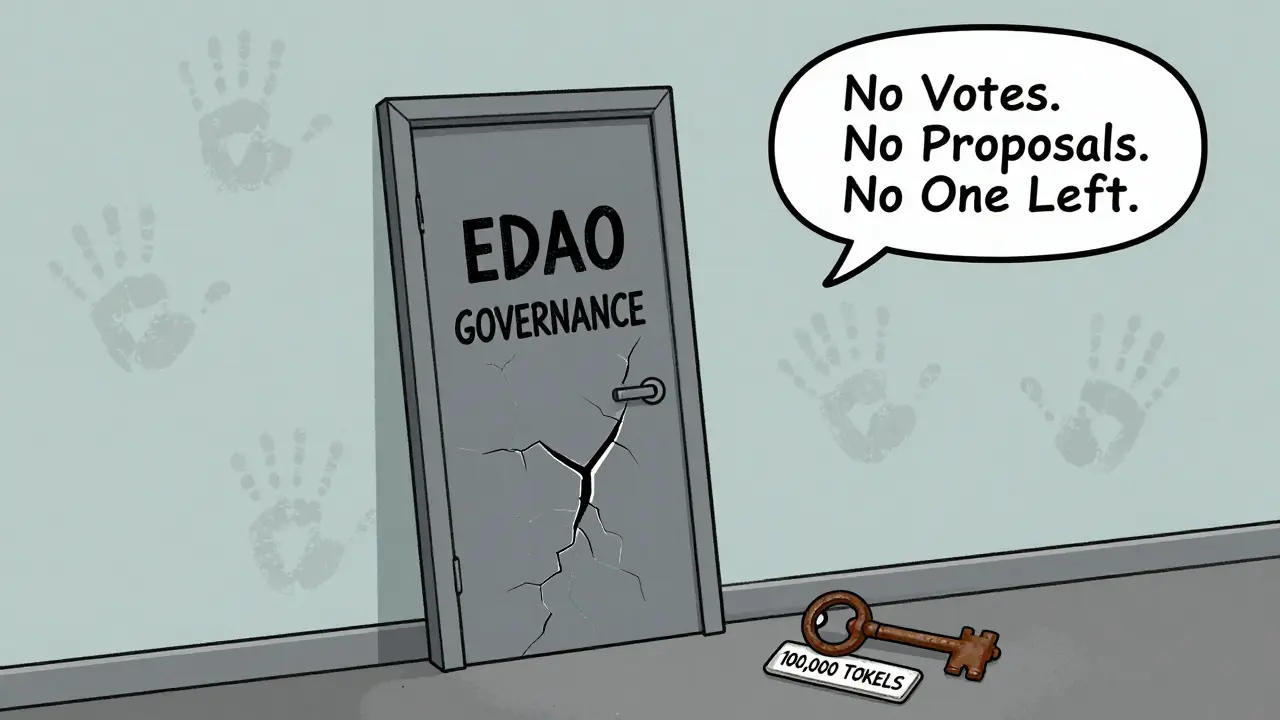

Here’s the catch: EDAO was launched with only 100,000 tokens. Two percent went to liquidity. The rest? Distributed to early supporters, team members, and airdrop participants. But with no active development, no real roadmap, and zero updates in over two years, EDAO became a ghost token. No votes. No proposals. No meetings. Just a static balance on a blockchain.

It’s not that the idea was bad. Many successful projects use governance tokens. But ElonDoge never built the community or infrastructure to make it work. Without active users pushing for change, EDAO became a digital relic - like a key to a door that was never installed.

Why CoinMarketCap Got Involved

CoinMarketCap isn’t in the business of promoting random meme coins. So why partner with ElonDoge?

Simple: in 2021, they were running a wave of "learn and earn" campaigns. Users who completed educational quizzes about new tokens got rewarded with crypto. It was a win-win. CoinMarketCap got more traffic. Projects got exposure. And users got free tokens.

The ElonDoge campaign was one of many. Others included tokens like NEAR, Acala, and even Polygon. But unlike those, ElonDoge had no real tech, no team transparency, and no long-term plan. It was pure marketing.

CoinMarketCap has since stopped running most of these campaigns. Their current homepage shows zero active airdrops. The platform is quieter. More focused on data accuracy than hype.

What Happened to Other Meme Coins From That Era?

ElonDoge isn’t alone. The 2021 meme coin boom left a graveyard of tokens behind.

- MOONDOGE trades at $0.0000828 - still active, but with just $2,400 in daily volume.

- MOON DOGE? Worth $0.00000000000007076. That’s less than a trillionth of a cent. Nobody trades it.

- Doge-1 Mission to the Moon? Still hanging on with a $124K market cap and 2,240 holders. It has a website. A roadmap. A Discord. And still, it’s barely alive.

These aren’t failures because they were scams. They’re failures because they were built on hype, not utility. No one needed another Doge clone. No one wanted to hold a token with no use case beyond speculation.

What Can You Learn From the ElonDoge Airdrop?

If you got EDOGE in 2021, you probably didn’t cash out. You held. You hoped. You watched the price drop. And now? It’s just a footnote in your wallet.

Here’s what actually matters:

- Airdrops aren’t free money. They’re marketing tools. The value is in the education, not the token.

- Don’t chase hype. If a project has no whitepaper, no team, no roadmap - walk away.

- Check the trading volume. If a token trades less than $100 a day, it’s not a currency. It’s a placeholder.

- Governance tokens mean nothing without participation. If no one’s voting, no one’s in charge.

The real win from the ElonDoge airdrop wasn’t the tokens. It was the lesson: crypto projects that rely on memes die when the meme dies.

Is EDOGE Still Active?

Technically, yes. EDOGE still shows up on CoinMarketCap. It still trades on PancakeSwap. But there’s no active development. No new features. No team updates. No community events. The last social post was over 18 months ago.

It’s not dead. But it’s not alive either. It’s in crypto limbo - a ghost token, haunting wallets of those who took the airdrop and never sold.

If you still hold EDOGE? You’re not alone. But you’re also not winning.

Was the ElonDoge airdrop a scam?

No, it wasn’t a scam. CoinMarketCap partnered with the project, and tokens were distributed as promised. But the project itself had no real utility, no team transparency, and no long-term plan. That’s not fraud - it’s poor execution. Many airdropped tokens from 2021 followed the same pattern: hype first, substance never.

Can I still claim EDOGE tokens from the 2021 airdrop?

No. The 5-day campaign ended in June 2021. There’s no active claim portal, no wallet recovery option, and no official channel to receive more tokens. Any website claiming to offer EDOGE claims today is either outdated or a phishing attempt.

Is EDAO still used for voting or governance?

No. The EDAO token exists on-chain, but there have been no proposals, no votes, and no community meetings since late 2021. The governance system was never activated. It’s a digital placeholder with no function.

Why did CoinMarketCap stop running airdrops?

CoinMarketCap shifted focus after 2021. The market became saturated with low-quality projects using airdrops as a marketing band-aid. The platform now prioritizes accurate data, educational content, and user trust over promotional campaigns. They still list tokens, but they don’t push them.

Should I still hold EDOGE tokens today?

If you’re holding EDOGE hoping for a rebound, you’re gambling. The token has no active development, no trading volume, and no community momentum. It’s worth less than a penny per billion tokens. The smart move? Cut your losses, learn from the experience, and focus on projects with real use cases - not memes.