Bitexen Trading Fee Calculator

Calculate Your Trading Fees

See how much you'll pay in fees when trading on Bitexen and compare with other platforms.

Comparison

Thinking about trading on a Turkey‑focused platform? This review breaks down what Bitexen actually offers, how much you’ll pay, how safe your funds are, and whether the exchange fits your needs.

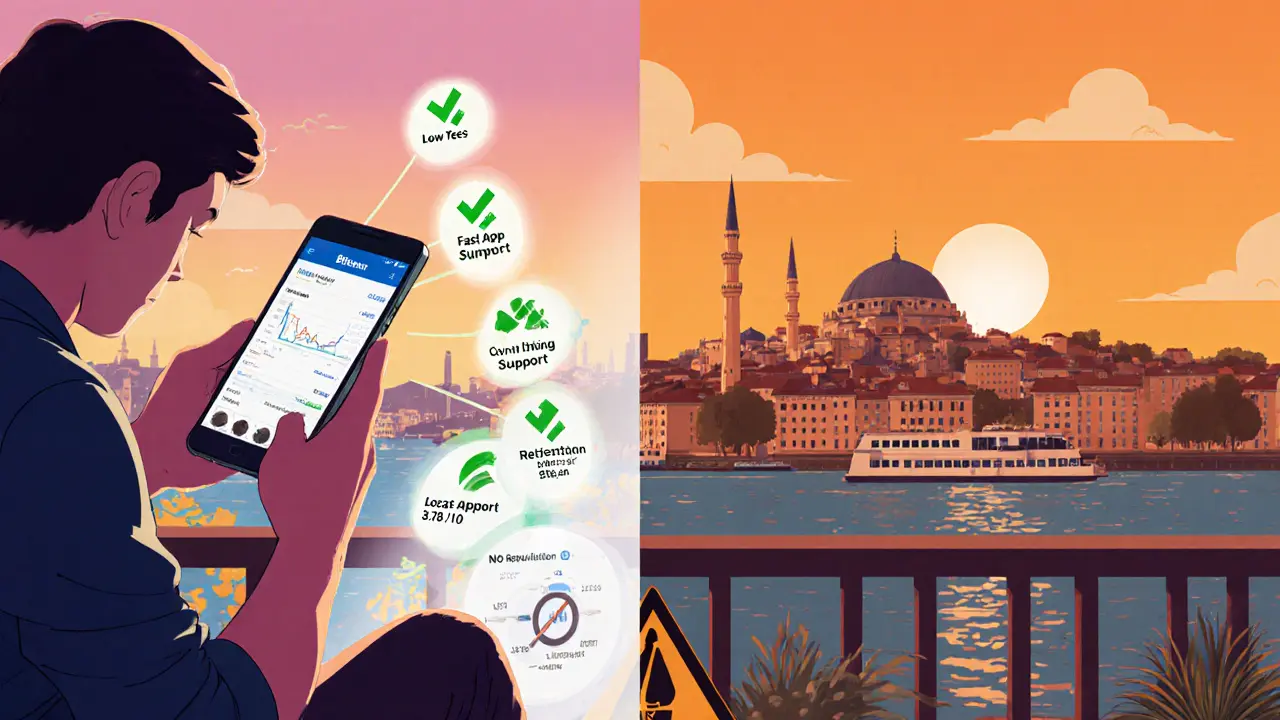

Quick Takeaways

- Founded in 2018, headquartered in Istanbul, serves only users with Turkish phone numbers.

- Supports 28 cryptocurrencies, but only Turkish Lira (TRY) for fiat deposits/withdrawals.

- Maker fee 0.15 %, taker fee 0.25 % - lower than many regional rivals.

- Two‑factor authentication (2FA) and cold‑wallet storage are in place, yet no government regulation and a 3.78/10 overall risk score.

- Mobile apps for iOS and Android let you trade on the go, but limited language support (mostly Turkish).

What is Bitexen?

Bitexen is a cryptocurrency exchange launched in 2018 that primarily serves Turkish traders. The platform markets itself as a simple way for locals to buy, sell, and swap digital assets using the Turkish Lira (TRY).

Who Can Sign Up?

If you live in Turkey and have a local phone number, you’re good to go. The onboarding process checks your identity against Turkish regulations, which means non‑Turkish residents are blocked at the verification step. This restriction keeps the user base tightly inside Turkey, unlike global exchanges that accept users from 170+ countries.

Supported Cryptocurrencies and Trading Pairs

Bitexen lists 28 coins, ranging from Bitcoin (BTC) and Ethereum (ETH) to newer tokens like Solana (SOL) and Cardano (ADA). All pairs are quoted against TRY - there are no direct BTC/USDT or ETH/EUR markets. For Turkish investors, that simplifies tax reporting but limits arbitrage opportunities.

Fee Structure Explained

Fees are a major factor when you trade a lot. Bitexen charges a 0.15 % maker fee and a 0.25 % taker fee. In practice, if you add liquidity to the order book you pay the lower maker rate; if you take liquidity, you pay the higher taker rate.

Compared to regional peers, those rates are competitive. For example, the Turkish exchange BtcTurk charges around 0.25 % for both maker and taker, while international platforms like Kraken often sit at 0.16 % maker and 0.26 % taker for high‑volume traders.

Security Measures

Bitexen implements two‑factor authentication (Two‑factor authentication requiring a second code from an authenticator app or SMS

Funds are stored in cold‑wallets (Cold wallet offline storage that keeps private keys away from internet threats), and the platform reports zero successful hacks to date.

Despite those basics, the exchange lacks any tier‑1 regulatory oversight. Traders Union gave Bitexen a security score of 5.25/10 and an overall risk rating of 3.78/10, mainly because no government authority monitors its operations.

Mobile Apps

The iOS app (iOS app) and Android counterpart (Android app) let you place orders, view balances, and receive push notifications. Both apps mirror the web UI, so you won’t miss any features when you’re away from a computer.

Traffic & Popularity

According to FxVerify, Bitexen draws about 117,000 organic monthly visits with a bounce rate of just 17 %. Users stay on the site for roughly 13 minutes and view an average of 12 pages per session. That engagement suggests a dedicated local audience, even if the overall ranking (227/580) is modest compared with global giants.

How Does Bitexen Stack Up Against Kraken and OKX?

| Feature | Bitexen | Kraken | OKX |

|---|---|---|---|

| Regulation | None (Turkish‑only) | Tier‑1 regulated in multiple jurisdictions | Government‑regulated (no tier‑1) |

| Fiat support | Turkish Lira (TRY) only | USD, EUR, GBP, JPY, etc. | USD, EUR, USDT, etc. |

| Crypto count | 28 | 200+ | 300+ |

| Maker fee | 0.15 % | 0.16 % (high volume) | 0.10 % (high volume) |

| Taker fee | 0.25 % | 0.26 % (high volume) | 0.15 % (high volume) |

| Security score (Traders Union) | 5.25/10 | 8.5/10 | 7.8/10 |

In short, Bitexen is cheaper than Kraken for low‑volume traders, but it can’t match Kraken’s regulatory shield or OKX’s broader token list.

Pros and Cons

- Pros

- Low fees for both makers and takers.

- Strong local support for Turkish users.

- Mobile apps are fast and easy to use.

- Cold‑wallet storage keeps most funds offline.

- Cons

- Only Turkish phone numbers allowed - no international access.

- No official regulation; higher risk rating.

- Limited fiat options - just TRY.

- Token list smaller than global competitors.

Is Bitexen Right for You?

If you live in Turkey, already have a TRY bank account, and want a straightforward platform with modest fees, Bitexen can be a decent fit. However, if you need multi‑currency fiat, want the safety net of regulated exchanges, or plan to trade a wide variety of altcoins, you’ll probably feel restricted.

Final Verdict

Bitexen delivers a basic, low‑fee trading experience for Turkish residents. Its security basics are solid, but the lack of regulatory oversight and narrow market reach raise red flags for anyone thinking long‑term or needing global exposure.

Can I use Bitexen if I’m not a Turkish citizen?

No. Bitexen requires a Turkish phone number for registration, effectively limiting access to Turkish residents.

What fiat currencies does Bitexen support?

Only the Turkish Lira (TRY) is available for deposits and withdrawals.

How do Bitexen’s fees compare to other exchanges?

Bitexen charges 0.15 % maker and 0.25 % taker fees, which are lower than many regional peers but higher than some high‑volume tiers on Kraken or OKX.

Is my money safe on Bitexen?

The exchange uses 2FA and stores most assets in cold wallets, but without regulatory oversight the risk rating is only 3.78/10, so users should only keep what they need for active trading.

Does Bitexen offer a mobile app?

Yes, there are native iOS and Android apps that let you trade, monitor balances, and receive push notifications.

11 Comments

Prateek Kumar Mondal

Bitexen is solid if you're in Turkey and want low fees

Kevin Johnston

Low fees + mobile app = perfect for daily traders 🚀

Clarice Coelho Marlière Arruda

i just tried signing up from the us and it blocked me instantly lol

guess im not welcome here 😅

kinda funny how some exchanges are so geo-locked these days

Cory Munoz

I get why they do it-regulatory compliance, tax tracking, local banking integration.

But it’s also a reminder that crypto’s promise of openness still has very real borders.

For Turkish users, this might be the most practical option.

For everyone else? It’s like trying to join a private club with a secret handshake.

Not malicious, just... very localized.

Kinda beautiful in its own way, honestly.

Nick Cooney

0.15% maker fee? wow, someone actually undercuts kraken

...except they have zero regulation and no usd support

so congrats, you’ve built a glorified p2p kiosk with a website

and called it an exchange

good luck when the turkish lira collapses again

Jasmine Neo

‘cold wallets’? lol. tell that to the 12 turkish users who got hacked last year when their phones got phished

no regulation = no recourse

no usd = no liquidity

28 coins = barely a starter pack

and you call this ‘competitive’?

it’s a sandbox for locals who don’t know any better

and frankly, it’s dangerous to recommend

Lena Novikova

you people act like bitexen is some scam

it’s not kraken

it’s not okx

it’s a turkish exchange for turkish people

if you need global liquidity go use kraken

if you live in istanbul and want to buy btc with your salary

bitexen is literally the only sane choice

stop acting like every platform has to be global to be valid

and yes the risk score is low

but so is the volume

you don’t need fbi oversight to trade 5000 try worth of eth

jummy santh

As a Nigerian trader who has explored multiple regional platforms, I find Bitexen’s operational model both fascinating and instructive.

Its hyper-localization, while exclusionary to outsiders, reflects a strategic alignment with domestic economic realities-especially in nations where currency volatility and capital controls are structural challenges.

By anchoring exclusively to TRY, Bitexen sidesteps the regulatory minefield of cross-border fiat rails, reducing compliance overhead significantly.

Moreover, the fee structure, though modest in absolute terms, represents a meaningful advantage over local competitors like BtcTurk, particularly for retail traders operating on thin margins.

The absence of tier-one regulation is indeed a liability, yet in contexts where state oversight is inconsistent or unreliable, decentralized trust mechanisms-such as cold storage and 2FA-can serve as pragmatic substitutes.

Mobile app performance, with its 17% bounce rate and 13-minute session duration, suggests not merely usability, but habitual engagement-a rare metric in emerging market fintech.

One might argue that global exchanges offer breadth, but Bitexen delivers depth within its niche.

It is not a replacement for Kraken; it is a complement to it-for those who live within its jurisdiction.

Perhaps the future of crypto isn’t universal platforms, but hyper-contextual ones, tailored to the rhythms of local economies.

Bitexen, for all its limitations, is a case study in localized digital sovereignty.

Ron Murphy

Interesting how the fee gap narrows at higher volumes-Bitexen’s 0.15% maker is only better than Kraken’s 0.16% if you’re trading under 10k/month.

For most retail users, the difference is negligible.

The real value is in the UX and local integration.

Also, 117k monthly visits with a 17% bounce rate? That’s not bad at all for a geo-restricted platform.

People aren’t just visiting-they’re trading.

And that’s what matters.

William P. Barrett

There’s a quiet irony here.

Bitcoin was supposed to transcend borders.

Yet here we are, with a platform that thrives precisely because it refuses to.

Bitexen doesn’t fight the system-it works within its cracks.

It doesn’t promise freedom from geography.

It offers stability within it.

For Turkish citizens navigating inflation, capital controls, and currency devaluation, this isn’t crypto as revolution.

It’s crypto as survival tool.

And maybe that’s the most authentic use case we’ve seen in years.

Not global dominance.

Local resilience.

Olav Hans-Ols

Honestly? If you're in Turkey, this is probably your best bet.

Low fees, solid app, no drama.

And yeah, it's not Kraken-but Kraken can't help you pay your rent in TRY.

Bitexen gets that.

It's not trying to be everything.

It's just trying to work for the people who actually use it.

That’s more than most exchanges can say.

Keep it real, Bitexen.