Crypto Exchange Legitimacy Checker

This tool helps you verify if a crypto exchange is legitimate or potentially fraudulent. Based on industry standards from the article, answer the questions below to get a risk assessment.

Key Safety Indicators

Check all indicators that apply to the exchange:

- Regulatory licenses verified with SEC, FCA, or ASIC

- Third-party audit reports available (proof of reserves)

- At least 90% of funds stored in cold wallets

- 2FA authentication with app-based or hardware keys

- Transparent fee structure with no hidden charges

- Active customer support with timely responses

- Domain registered more than 6 months ago

- Verifiable physical business address

If you're considering using Barkis Blockchain Exchange to trade crypto, you should know something important: Barkis Blockchain Exchange doesn't appear to exist as a verified, operational platform. No official website, no regulatory filings, no user reviews on trusted sites like CoinMarketCap, CoinGecko, or Reddit. No press coverage. No customer support contacts. Not even a social media presence that checks out. That’s not just suspicious-it’s a red flag flashing brighter than a phishing link.

There are thousands of crypto exchanges out there. Some are legitimate, some are poorly run, and some are outright scams. If you’ve come across Barkis Blockchain Exchange through an ad, a YouTube video, or a DM from someone promising ‘guaranteed returns,’ you’re being targeted. This isn’t a review of a platform-it’s a warning.

Why You Can’t Find Any Info About Barkis Blockchain Exchange

Legitimate crypto exchanges don’t vanish from the internet. They’re listed on industry directories. They publish audit reports. They have KYC/AML procedures you can verify. They’re mentioned in news outlets like CoinDesk or Cointelegraph when they launch new features or get licensed.

Barkis Blockchain Exchange has none of that. No LinkedIn page. No Twitter account with real followers. No domain registration history that goes back more than a few months. No team members listed. No whitepaper. No API documentation. No customer service email that works. That’s not a startup struggling to grow-that’s a shell.

Scammers create fake exchanges all the time. They copy the logos of real platforms, use fancy animations, and promise low fees or instant withdrawals. Then they disappear with your funds. In 2024 alone, over $1.2 billion was lost to fake crypto platforms, according to Chainalysis. Barkis fits the pattern perfectly.

What a Real Crypto Exchange Should Look Like

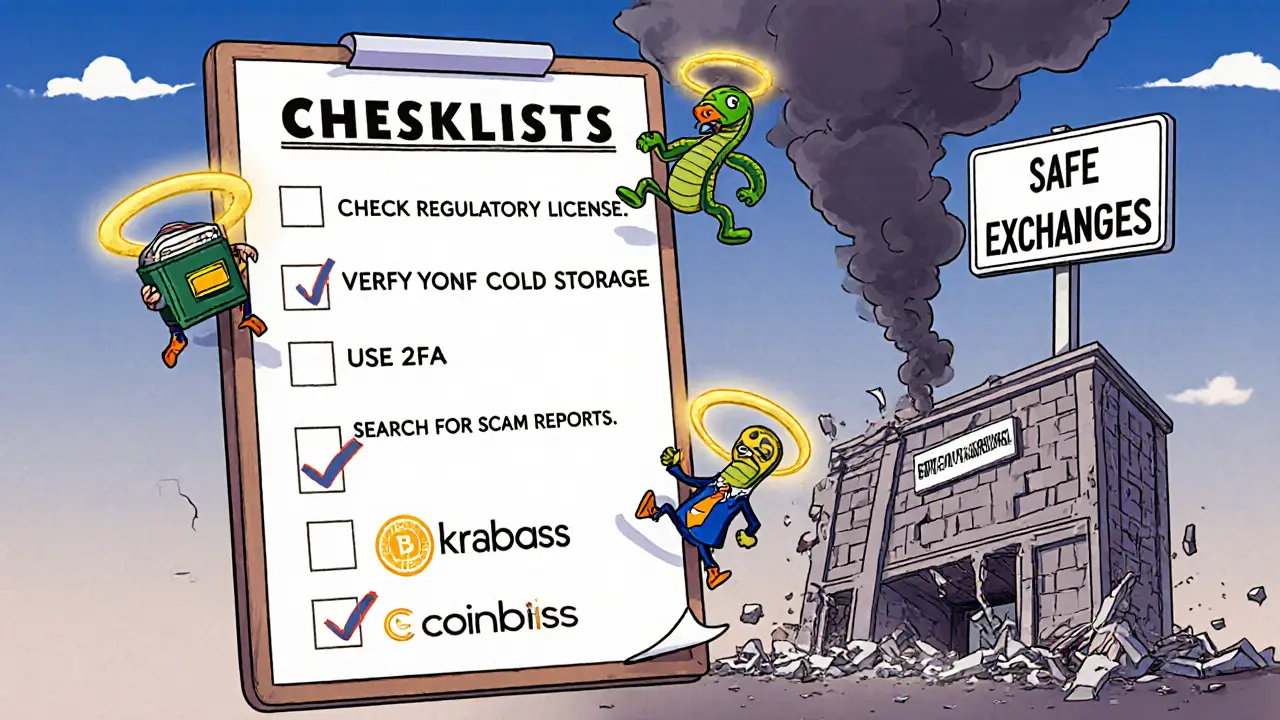

If you’re looking for a safe place to trade crypto, here’s what you should demand:

- Regulatory licensing-Check if they’re registered with authorities like the SEC, FCA, or ASIC. If they’re not, they’re operating illegally.

- Third-party audits-Reputable exchanges publish proof of reserves from firms like Bitfury or Armanino. These show they actually hold the crypto they claim to.

- Cold storage-At least 90% of user funds should be stored offline. If they don’t say how much is cold-stored, walk away.

- Two-factor authentication (2FA)-Not SMS-based 2FA. You need app-based (Authy, Google Authenticator) or hardware key (YubiKey) authentication.

- Transparent fee structure-No hidden charges. Withdrawal fees should be clearly listed. No surprise deductions.

- Active customer support-Try contacting them. If replies take days or never come, that’s a bad sign.

Platforms like Kraken, Coinbase, or Binance (where legally available) meet these standards. They’ve been around for years. They’ve survived hacks, regulatory crackdowns, and market crashes. They’re not perfect-but they’re accountable.

The Real Danger: Losing Your Crypto Forever

Once you send crypto to a fake exchange, it’s gone. There’s no chargeback. No customer service rep who can undo it. Blockchain transactions are irreversible. If Barkis Blockchain Exchange asks you to deposit Bitcoin, Ethereum, or any token, you’re handing over money to someone who will vanish.

Think about the Mt. Gox collapse in 2014. Over 850,000 BTC disappeared. Even after a decade, most victims haven’t recovered a cent. That was a real exchange with real users. Now imagine the same thing, but with a platform that never existed in the first place.

Scammers don’t need to hack your account. They just need you to trust them. They’ll show fake profit graphs. They’ll send you fake transaction confirmations. They’ll even let you withdraw a small amount at first to build false confidence. Then they lock your account-or disappear.

How to Spot a Fake Crypto Exchange

Here’s a quick checklist to protect yourself:

- Search the exchange name + “scam” or “review” on Google. If the first page is full of warnings, don’t go near it.

- Check if the domain was registered recently. Use whois.domaintools.com. If it’s less than 6 months old, treat it as high risk.

- Look for a physical address. Fake exchanges list vague locations like “Cyprus” or “British Virgin Islands” without a street address.

- Verify their social media. Real exchanges have thousands of followers with real engagement. Fake ones have bots, low comments, and recycled images.

- Try to contact support with a simple question. If you get no reply, or a robotic answer, it’s a scam.

- Never deposit crypto unless you’ve independently confirmed their regulatory status and audit reports.

There’s no shortcut to safety. If something sounds too good to be true-low fees, high yields, no KYC-it is.

What to Do If You Already Deposited

If you’ve already sent crypto to Barkis Blockchain Exchange:

- Stop all further deposits immediately.

- Do not respond to any messages claiming to be from their “support team” asking for more funds to “unlock” your account. That’s a second scam.

- Report the platform to your local financial regulator (like NZ’s FMA if you’re in New Zealand).

- File a report with IC3 (Internet Crime Complaint Center) or Action Fraud if you’re in the US or UK.

- Warn others on forums like Reddit’s r/CryptoCurrency or BitcoinTalk.

Recovery is unlikely, but reporting helps authorities track patterns and shut down these operations before they hurt more people.

Safe Alternatives to Barkis Blockchain Exchange

If you want to trade crypto safely, stick with platforms that have a proven track record:

- Coinbase-Best for beginners. Strong regulation, insured custody, simple interface.

- Kraken-Strong security, low fees, supports 200+ cryptocurrencies.

- Binance-Highest liquidity, advanced tools. Only use if available in your country.

- Bybit-Popular for derivatives. Good for active traders.

- Bitstamp-One of the oldest exchanges. Based in Europe, fully licensed.

All of these have been audited, regulated, and tested over time. None of them disappeared overnight.

Final Warning

Barkis Blockchain Exchange is not a crypto exchange. It’s a trap. No matter how polished the website looks, no matter how many testimonials it has, if you can’t verify its existence through independent sources, it’s not real. Your crypto isn’t just at risk-it’s already gone if you’ve sent anything there.

Don’t gamble with your money. Don’t trust anonymous platforms. Don’t fall for the illusion of speed or profit. The crypto world is full of real opportunities-but they’re not hiding behind fake names and empty promises.

Do your homework. Verify everything. When in doubt, walk away.

10 Comments

rachel terry

I mean sure it's a scam but have you considered that maybe the real scam is the entire crypto ecosystem? Like we're all just lab rats in a giant Wall Street experiment where the only thing that matters is who gets to print the next whitepaper. I'm not saying Barkis is legit, I'm saying the whole game is rigged from the start.

Susan Bari

Barkis? More like Barkis-NOPE. If you're depositing crypto into something that doesn't even have a LinkedIn page you're not investing you're just throwing money into a black hole and hoping it sings back

Sean Hawkins

The checklist in the post is spot on. Regulatory licensing and proof of reserves are non-negotiable. I've reviewed dozens of exchange architectures and if there's no on-chain audit or cold storage transparency, it's not just risky-it's indefensible. Always verify the domain registration date too-anything under 12 months is a red flag. Also, SMS 2FA is a joke. Use WebAuthn or YubiKey if you care about security.

Marlie Ledesma

I just hope whoever got scammed by this is okay. I know how easy it is to get caught up in the hype, especially when you're new. Please reach out if you need help figuring out what to do next. You're not alone.

Daisy Family

barkis? more like barkis-who? 🤡 if your exchange doesn't have a twitter with 500k bots following it then its probably not even a dream

Paul Kotze

Interesting breakdown. I've seen similar scams in South Africa-fake platforms using translated versions of real exchange UIs. The real danger is how convincing they look. I always tell newcomers: if you can't find a regulatory license with a simple Google search, it's not worth the gas to click 'Deposit'.

Jason Roland

I get why people fall for this. I used to think if a site looked professional, it was legit. Then I lost $3k to a fake DeFi platform that had a 4.8-star rating on Trustpilot (all fake, obviously). The emotional manipulation is real-they let you withdraw $50 first to build trust. Don't be that guy. If it feels too smooth, it's a trap.

Niki Burandt

I'm just saying... if Barkis had a Discord with 10k members and a meme channel, would you still call it a scam? 🤔 Also, why do we always assume the worst? Maybe it's just a super quiet startup? ...nah, it's definitely a scam. But still. 😅

Chris Pratt

This reminds me of when I was in Japan and someone tried to sell me a 'crypto wallet' that looked like a vending machine. The guy had a suit, a smile, and a QR code. I walked away. Always walk away. Crypto doesn't need flashy ads. Real projects speak for themselves through code and transparency.

Karen Donahue

Honestly I think the real problem here isn't Barkis-it's the fact that people still think they can get rich quick by clicking a button on some website they found on a Reddit thread that someone posted at 3am after drinking too much Red Bull. Like, you wouldn't invest your life savings in a guy selling 'guaranteed lottery tickets' from a bus stop, so why do you think crypto is any different? You're not a trader, you're a sucker with a wallet. And now you're going to spend the next six months blaming the blockchain instead of your own poor judgment. And don't even get me started on how everyone thinks 'decentralization' means they can ignore basic financial literacy. It's not the system that's broken-it's the people.