The ADGM crypto framework is one of the most advanced and tightly regulated digital asset systems in the Middle East. Unlike other regions that treat cryptocurrency as a novelty or a risk to be contained, Abu Dhabi Global Market (ADGM) built its rules from the ground up to handle serious financial innovation - not just trading apps and meme coins, but institutional-grade digital securities, custody services, and tokenized assets. If you're a business looking to operate in this space, or even an investor trying to understand where the real action is, ADGM’s rules are not just important - they’re defining the future of crypto in the region.

What Exactly Is ADGM’s Crypto Framework?

ADGM is a financial free zone in Abu Dhabi, operating under English common law. It’s not part of the UAE’s federal system - it’s its own legal and regulatory island. That means it can move faster, be more precise, and design rules specifically for digital assets without being slowed down by broader national policies. The Financial Services Regulatory Authority (FSRA) runs the show. And unlike other regulators that just slap on old banking rules to crypto, ADGM created entirely new rulebooks for digital assets.

Here’s how it breaks down:

- Any digital token that acts like a security - think shares, bonds, or investment contracts - is regulated as a security. That means issuers must follow strict disclosure rules, and trading platforms need FSRA approval.

- Derivatives on crypto (like futures or options) are treated as traditional derivatives. You need a license to trade or clear them.

- Crypto custody, trading, advisory, and fund management are all separate regulated activities. You can’t just start a wallet service or a crypto hedge fund without getting licensed.

This isn’t a vague guideline. It’s a detailed, enforceable legal structure. And it’s designed for institutions - banks, asset managers, hedge funds - not retail traders.

The Big Changes in 2025: Privacy Tokens and Algorithmic Stablecoins Are Banned

In June 2025, ADGM made a bold move. It banned two types of digital assets outright: privacy tokens and algorithmic stablecoins.

Privacy tokens? Those are coins like Monero or Zcash that hide transaction details. ADGM says they’re too risky. No transparency means no accountability. That’s a red flag for any financial regulator serious about anti-money laundering (AML) and know-your-customer (KYC) rules.

Algorithmic stablecoins? These are coins that claim to stay worth $1 by using complex code and market incentives - not actual cash reserves. Think TerraUSD before it collapsed. ADGM saw the danger. Without real backing, they’re unstable by design. So they’re banned too.

This wasn’t a surprise. The FSRA had been warning about these for months. The June 2025 update was the final step. It also changed rules around how firms handle client funds, manage risks, and report transactions. If you’re operating in ADGM, you’re now under tighter scrutiny than ever.

How Licensing Works: It’s Not Easy, But It’s Clear

Getting licensed by the FSRA isn’t a form you fill out in an hour. It’s a months-long process. You need:

- A detailed business plan showing exactly what you’ll do - no vague statements like "we do crypto stuff."

- Proof you have enough capital to cover losses. For custody services, that’s often over $5 million in liquid assets.

- A full risk management system, including cybersecurity, operational continuity, and fraud controls.

- Senior staff with real experience - not just crypto enthusiasts, but people who’ve worked in regulated financial firms.

Before you even submit an application, the FSRA expects you to have at least two meetings with their team. They’ll ask hard questions: Who are your clients? How do you store private keys? What happens if the market crashes? If your answers are weak, they’ll tell you to go back and fix it.

And yes, there are fees. Application fees start at $10,000. Annual fees can run $50,000 or more, depending on your activity. This isn’t for startups. This is for firms with real resources.

Cybersecurity Isn’t Optional - It’s Mandatory

On July 29, 2025, the FSRA dropped its new Cyber Risk Management Framework. All regulated firms had six months to comply - meaning October 29, 2025, was the deadline.

Here’s what you need to have:

- Multi-layered encryption for all digital asset storage - cold wallets must be air-gapped and geographically distributed.

- Continuous monitoring of all network traffic related to crypto transactions.

- Third-party audits of your security systems at least once a year.

- A documented incident response plan that includes how you’ll notify clients and regulators if you’re hacked.

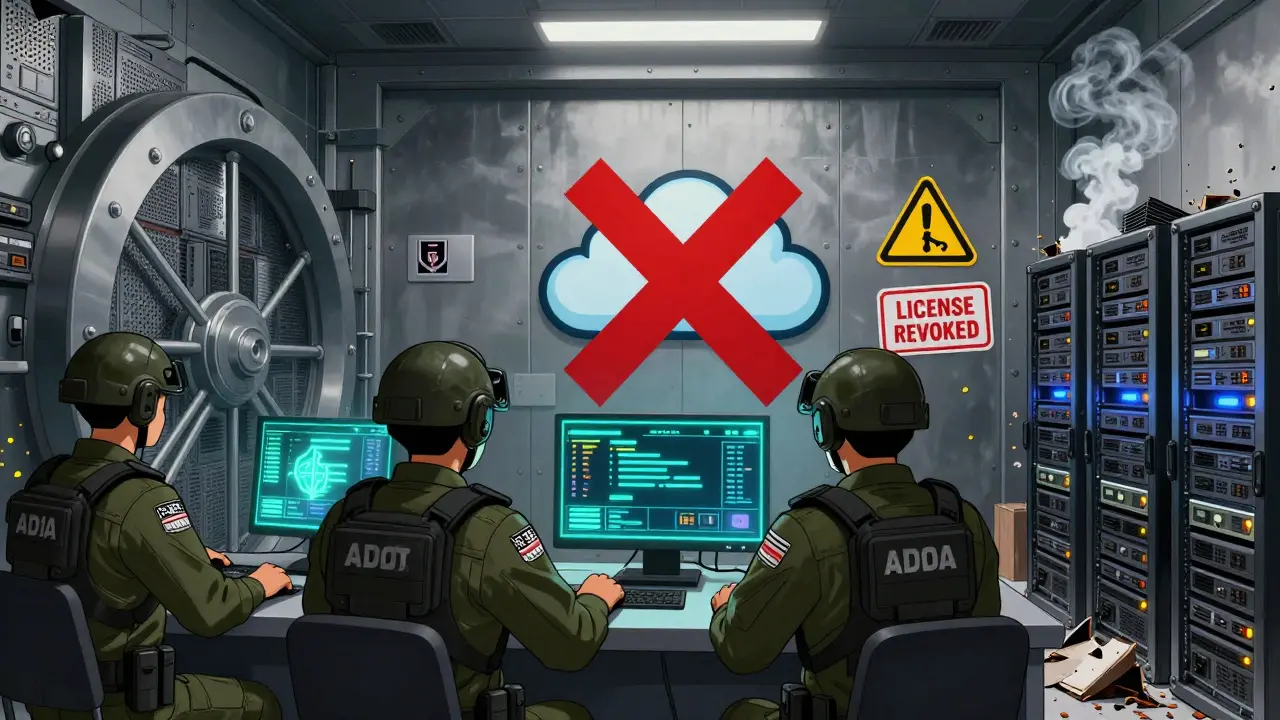

One firm lost $12 million in crypto last year because they stored keys on a cloud server with weak access controls. The FSRA shut them down. They didn’t even get a second chance. That’s how serious this is.

ADGM vs. Dubai’s VARA: Two Very Different Paths

It’s easy to confuse ADGM with Dubai’s Virtual Assets Regulatory Authority (VARA). But they’re not the same.

VARA is built for retail. It lets individuals trade crypto, launch NFTs, and use crypto for payments. It’s more like a licensing hub for crypto startups and exchanges.

ADGM is built for institutions. It doesn’t care if you’re selling a Bored Ape NFT. It cares if you’re issuing tokenized bonds to pension funds or managing a $2 billion crypto hedge fund. Its rules are stricter, its standards higher, and its focus entirely on financial integrity.

That’s why you’ll see BlackRock, Goldman Sachs, and major European asset managers setting up crypto desks in ADGM - not Dubai. They want a jurisdiction that speaks their language: regulation, transparency, and control.

What’s Next? The Future of ADGM’s Crypto Rules

ADGM isn’t done. In late 2025, they launched a consultation on fiat-referenced tokens - basically, stablecoins backed by real cash or government bonds. They’re not banning them. They’re building rules for them.

They’re also looking at crypto payment services. Right now, only licensed banks can process crypto payments. But ADGM might soon allow regulated non-bank firms to offer payment gateways for businesses - as long as they meet the same standards as banks.

And they’re working on rules for tokenized real estate and commodities. Imagine buying a share of a building in Abu Dhabi using a blockchain token. That’s not science fiction anymore - it’s coming.

One thing is clear: ADGM is not trying to be the biggest crypto hub. It’s trying to be the most trusted. And in a world where crypto scams and collapses make headlines every week, that’s worth more than volume.

Who Should Use ADGM? And Who Should Avoid It?

ADGM is perfect if you:

- Manage institutional money - hedge funds, family offices, pension funds.

- Issue digital securities or tokenized assets.

- Need custody services with bank-grade security.

- Want to operate under English common law with clear, predictable rules.

ADGM is NOT for you if you:

- Are a retail trader or crypto influencer.

- Run a simple exchange for meme coins.

- Want to launch an algorithmic stablecoin or privacy coin.

- Don’t have $1 million+ in capital or a team of compliance experts.

The bar is high. But if you meet it, you get access to a global financial network with zero tolerance for chaos.

Is ADGM’s crypto framework legal under UAE federal law?

Yes. ADGM operates under its own legal framework as a financial free zone, but it complies with the UAE’s overarching federal policy on virtual assets, including Cabinet Decision No. 111 of 2021. The Securities and Commodities Authority (SCA) retains federal oversight, but ADGM has been granted authority to regulate digital asset activities within its jurisdiction independently. This means firms licensed by ADGM are legally compliant both locally and federally.

Can I trade privacy coins like Monero on ADGM-regulated platforms?

No. As of June 2025, the FSRA explicitly banned privacy tokens - including Monero, Zcash, and similar coins - from being traded, issued, or held by any regulated entity in ADGM. This ban applies to all licensed firms, including exchanges, custodians, and fund managers. Any platform offering these tokens is in violation of ADGM regulations and risks losing its license.

Do I need to be based in Abu Dhabi to get an ADGM crypto license?

No. You don’t need to be physically located in Abu Dhabi. Many licensed firms operate remotely from London, Singapore, or New York. But you must have a legal entity registered in ADGM, maintain a physical presence (like a registered office), and appoint a local compliance officer. The FSRA requires clear governance and oversight, even if your team works from another country.

How long does it take to get licensed by ADGM’s FSRA?

The process typically takes 6 to 12 months. The timeline depends on how complete your application is and how quickly you respond to FSRA feedback. Firms with strong compliance teams and clear business models have been approved in as little as 5 months. Those with incomplete documentation or unclear risk controls often take over a year. Pre-application meetings with the FSRA can reduce delays significantly.

Are algorithmic stablecoins completely banned in ADGM?

Yes. Algorithmic stablecoins - those that rely on smart contracts and market incentives to maintain value without real-world collateral - are prohibited under ADGM’s June 2025 updates. This includes any token that claims to be pegged to a fiat currency but lacks full, transparent, and regularly audited reserves. The FSRA considers them inherently unstable and a systemic risk to financial integrity.