State Crypto Laws: What Each U.S. State Allows and Blocks

When it comes to state crypto laws, the rules governing cryptocurrency use, trading, and mining vary widely across individual U.S. states. Also known as cryptocurrency regulation at the state level, these laws determine whether you can legally mine Bitcoin in Texas, use a crypto exchange in New York, or get taxed on your Ethereum gains in California. There’s no single federal rulebook—so where you live matters more than you think.

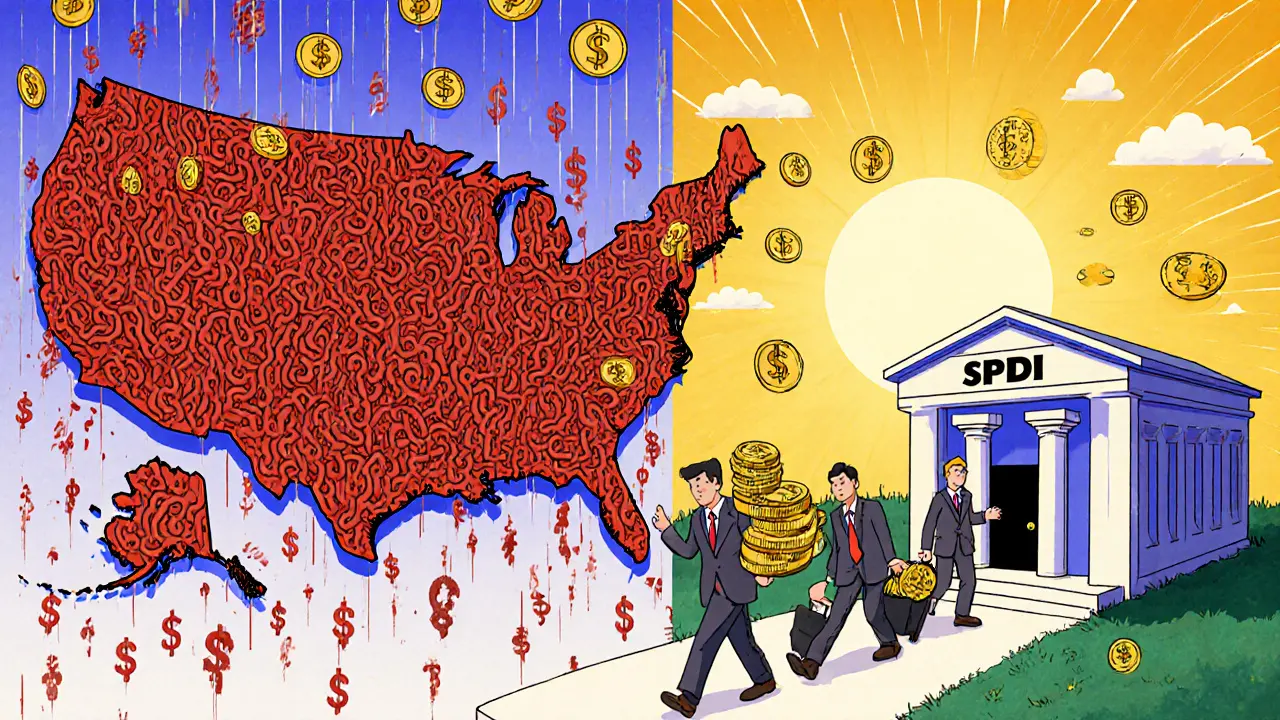

Some states, like Wyoming, a leader in crypto-friendly legislation that recognizes digital assets as property and allows special crypto banks, actively court blockchain businesses with tax breaks and clear rules. Others, like New York, home to the strict BitLicense, which forces exchanges to jump through costly compliance hoops just to operate, make it hard for even big platforms to serve residents. Then there are states like Florida, where lawmakers passed bills letting residents pay taxes in Bitcoin and encouraging crypto adoption. These differences aren’t just paperwork—they affect whether you can use a local exchange, get a crypto debit card, or even get fined for mining without a permit.

State crypto laws also shape what you can do with your wallet. In California, crypto transactions are taxable as property, and exchanges must report large transfers to the state. In Texas, mining thrives because of cheap power and no state income tax, making it a hotspot for Bitcoin farms. Meanwhile, states like Hawaii, have banned certain crypto lending products outright, citing investor risk. These aren’t abstract policies—they directly impact your ability to trade, earn interest, or even hold crypto without legal trouble.

If you’re trading on a platform like Bybit or using a DEX like LFJ v0, your location might block you entirely. Some exchanges geofence users based on state laws, not just federal ones. You might think you’re just trading crypto, but behind the scenes, your IP address triggers compliance rules set by state regulators. That’s why you see some airdrops available in Ohio but not in New Jersey, or why certain tokens are banned in New York but listed everywhere else.

What you’ll find below are real reviews and deep dives into platforms, tokens, and policies that reflect these state-level differences. From how Iran dodges sanctions using Bitcoin to how Zug, Switzerland, became a crypto hub, you’ll see how local rules shape global behavior. Whether you’re trying to claim a TacoCat Token airdrop or avoid a scam like RicHamster, knowing your state’s stance on crypto isn’t optional—it’s your first line of defense.