BitLicense – What New York’s crypto license really means

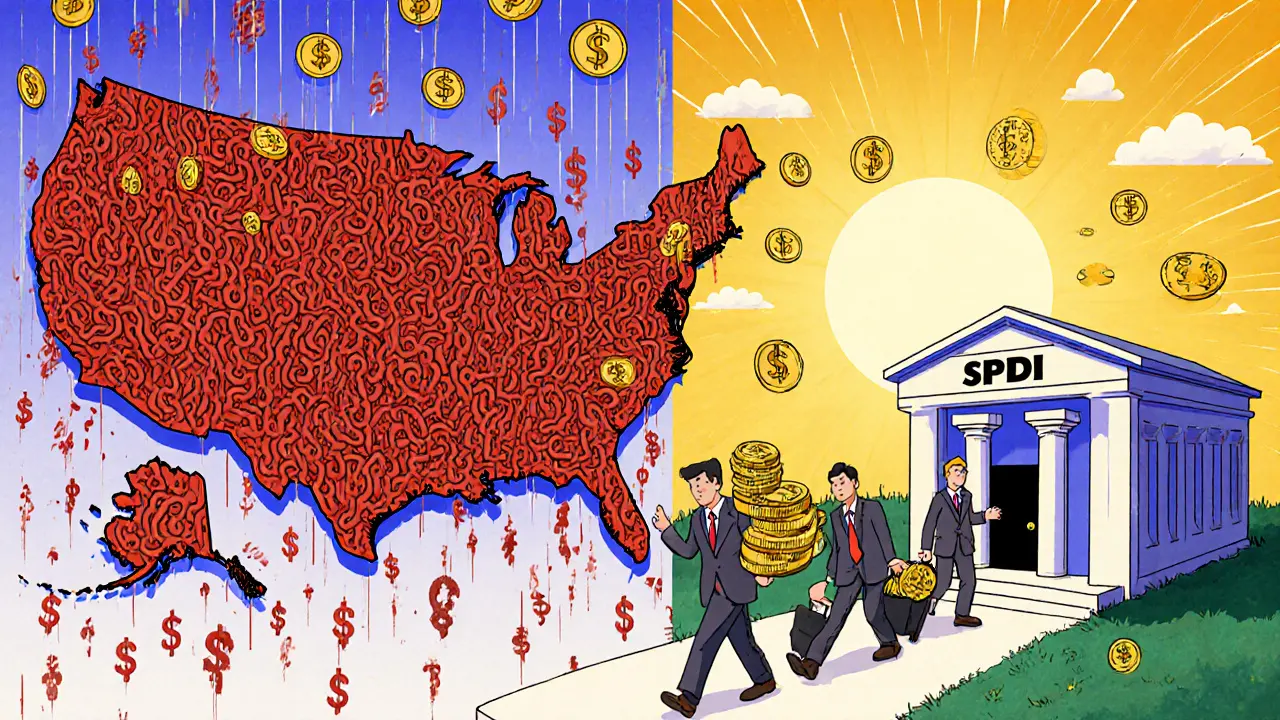

When dealing with BitLicense, a licensing regime created by the New York Department of Financial Services (NYDFS) for crypto‑related businesses operating in the state. Also known as the New York crypto license, it sets strict rules on capital, reporting, consumer protection and anti‑money‑laundering (AML) practices.

The issuing authority, New York Department of Financial Services, the state regulator that oversees banks, insurance firms and now crypto firms, requires every BitLicense holder to maintain robust AML/KYC programs, submit regular financial statements, and keep a dedicated compliance officer on staff. This means a crypto exchange, wallet provider, or token issuer must prove they can identify users, monitor suspicious transactions, and report them to the Financial Crimes Enforcement Network (FinCEN). In short, BitLicense requires solid AML/KYC controls and ongoing supervision.

BitLicense doesn’t exist in a vacuum. It sits alongside international frameworks like the EU’s Markets in Crypto‑Assets Regulation (MiCA, the European Union’s first comprehensive crypto‑asset rulebook). While MiCA focuses on harmonizing rules across EU member states, BitLicense remains a state‑level, highly detailed scheme. The two regimes influence each other: compliance teams often adopt MiCA‑style risk assessments to streamline their BitLicense filings, and the stringent New York standards sometimes serve as a benchmark for other jurisdictions.

Because BitLicense is about control, many platforms add technical layers to meet its geographic restrictions. Bybit’s geofencing and VPN detection system, for example, blocks users from regions where the license does not apply. This multi‑layered approach—IP checks, device fingerprinting, and VPN blocking—helps firms stay on the right side of NYDFS rules while protecting non‑NY users from accidental non‑compliance. In practice, a BitLicense‑holding exchange will combine legal policies with these technical safeguards to ensure only eligible traders can access NY‑specific services.

Tax reporting is another piece of the puzzle. The OECD’s Crypto‑Asset Reporting Framework (CARF) pushes for automatic exchange of crypto tax information across borders, and BitLicense holders must align their internal reporting with both NYDFS and CARF requirements. Failure to sync these obligations can trigger penalties from both state and international tax authorities. The overlap shows how BitLicense encompasses a broader compliance ecosystem that includes AML, KYC, geofencing, and tax transparency.

For anyone building or operating a crypto business in New York, understanding BitLicense means grasping a web of related entities: the regulator (NYDFS), the compliance processes (AML/KYC), the technical enforcement tools (geofencing, VPN detection), and the global standards (MiCA, CARF). This page stitches those concepts together, showing how they interact and why each piece matters.

What you’ll find next

Below you’ll discover articles that break down specific aspects of this ecosystem— from detailed MiCA guides and Bybit’s geofencing methods to how Iran sidesteps sanctions with Bitcoin mining, and practical tips on 2FA recovery. Together they give a full picture of the regulatory landscape that BitLicense sits inside, helping you navigate compliance, tech safeguards, and cross‑border challenges with confidence.