Crypto Exchange Legitimacy Checker

Security Checklist Assessment

Evaluate the legitimacy of any crypto exchange using the five key criteria from industry standards.

LFWSwap review starts with a simple question: does this platform even exist? In October 2025 the crypto world is crowded with big players, strict regulations, and transparent fee tables. Yet a quick search returns almost nothing on LFWSwap. This article breaks down the red flags, compares known exchanges, and gives you a practical checklist before you click ‘Buy.’

Key Takeaways

- LFWSwap lacks any verifiable registration, audit reports, or mentions from reputable sources.

- Established exchanges like Kraken, Coinbase, Uniswap and Coinstash openly publish security, fee, and compliance details.

- Use a five‑point security checklist (registration, cold‑storage ratio, KYC/AML, audit trail, customer support) for any new platform.

- If an exchange can’t prove its legitimacy, treat it as a high‑risk investment.

- Always start with a small test trade and keep assets in a hardware wallet you control.

What makes a crypto exchange trustworthy?

Before we look at LFWSwap, let’s set the baseline. A reputable exchange typically meets these criteria:

- Regulatory registration: Listed on a national financial authority (AUSTRAC in Australia, FinCEN in the US, FCA in the UK).

- Security architecture: Majority of funds in cold wallets, two‑factor authentication, encryption standards (TLS 1.3, ISO 27001).

- Transparent fee structure: Maker/taker rates, withdrawal fees, and any hidden spreads are publicly posted.

- Compliance processes: KYC (Know Your Customer) and AML (Anti‑Money‑Laundering) procedures that match the jurisdiction.

- Audit and insurance: Regular third‑party security audits, sometimes insurance coverage for custodial assets.

When an exchange skips one or more of these items, the risk score spikes.

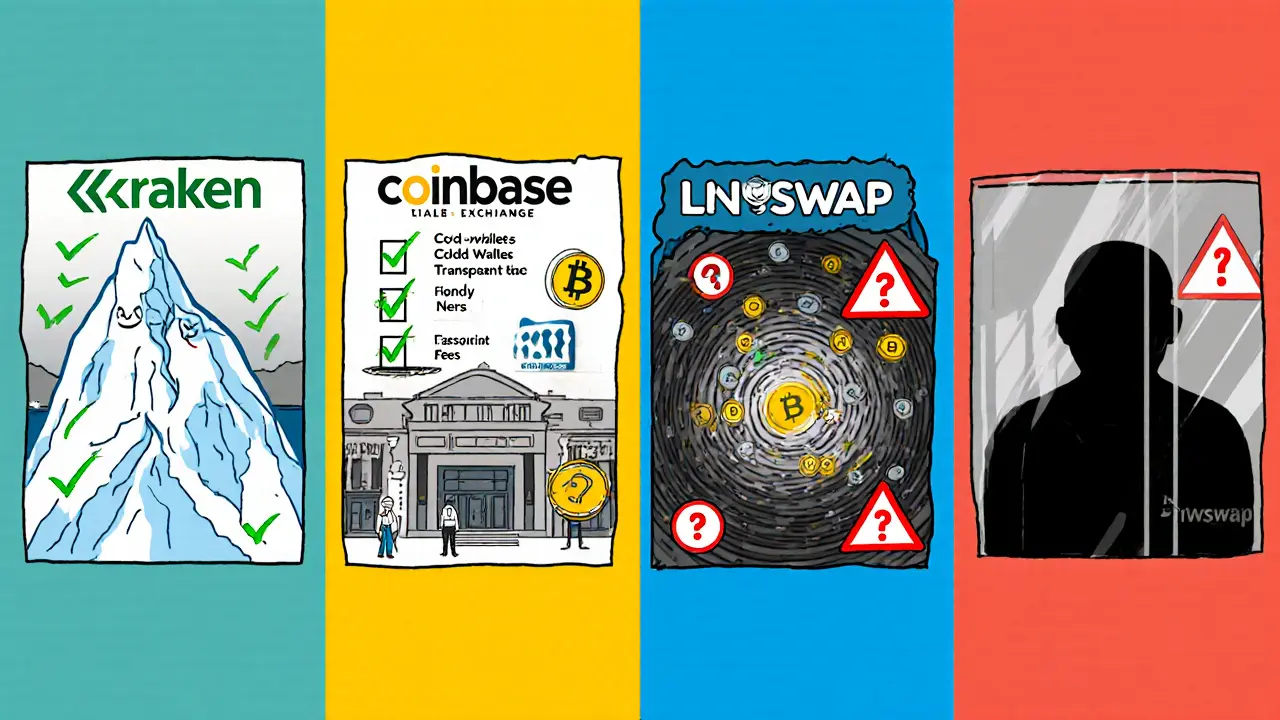

Benchmark: Established Exchanges in 2025

Below are four platforms that consistently meet the above standards. Each definition is wrapped in Thing microdata for easy extraction.

Kraken is a US‑based crypto exchange founded in 2011 that offers deep liquidity, advanced order types, and a tiered fee schedule (maker 0.00‑0.25 %, taker 0.01‑0.40 %). It holds AUSTRAC registration for Australian users and stores over 98 % of assets in cold storage.

Coinbase is a regulated exchange headquartered in the United States, known for a beginner‑friendly UI, insured custodial services, and mandatory KYC for all users. Fees range from 0.5 % for small trades to 0 % for high‑volume institutional accounts.

Uniswap is a decentralized exchange (DEX) on Ethereum and multiple sidechains. It operates without KYC, lets users trade directly from their wallets, and charges only variable gas fees (typically 10‑20 gwei after the Dencun upgrade).

Coinstash is an AUSTRAC‑registered Australian exchange launched in 2017. It offers over 1,000 crypto assets, fee tiers from 0.85 % down to 0.13 %, and stores more than 98 % of deposits in cold wallets.

LFWSwap: The Information Gap

LFWSwap is a crypto‑trading platform that appears in only a handful of low‑authority web mentions and a questionable YouTube video titled “LWEX Exchange REVIEW 2025! Top Profitable Crypto Trading Platform or Risky SCAM?”

The search landscape shows zero results from reputable sources such as Money.com, Finder.com, Koinly.io, or official regulatory registers. No AML/KYC policy, no audit report, no fee schedule, and no clear corporate entity are publicly available. The closest match, LWEX Exchange, suffers from the same transparency problem and is frequently flagged as “potential scam” in community forums.

Key red flags identified:

- Absence from any regulator’s whitelist (AUSTRAC, FCA, FinCEN, etc.).

- No published security architecture-no cold‑wallet ratio, no 2FA details.

- Fee structure is never disclosed; the only claim is “free deposits,” which often hides network fees.

- Lack of verifiable corporate information-no founder names, no registered office.

- Community sentiment is sparse and leans toward caution, with most traders advising to avoid unlisted platforms.

Without these fundamentals, any trade on LFWSwap carries a high probability of loss, either through hidden fees, withdrawal blocks, or outright fraud.

Side‑by‑Side Comparison

| Feature | LFWSwap | Kraken | Coinbase | Uniswap (DEX) | Coinstash |

|---|---|---|---|---|---|

| Regulatory registration | None found | AUSTRAC, FCA, FinCEN | FinCEN, SEC (US) | None (decentralized) | AUSTRAC |

| Cold‑wallet storage | Unclear | ≈98 % | ≈95 % | N/A (user‑held) | ≈98 % |

| KYC/AML | Not disclosed | Mandatory | Mandatory | Not required | Mandatory |

| Fee transparency | Absent | Maker 0.00‑0.25 %, Taker 0.01‑0.40 % | 0.5 % - 0 % (volume tiered) | Variable gas (10‑20 gwei) | 0.85 % - 0.13 % |

| Supported assets | Not listed | ≈466 tokens | ≈300 tokens | Thousands across 11+ chains | ≈1,000 tokens |

| Customer support | Unclear | 24/7 live chat | Email + phone (US) | Community forums only | Chat + email |

The table makes it obvious: established platforms score high on every metric, while LFWSwap offers no data to assess risk.

How to Protect Yourself When Facing an Unknown Exchange

If you still want to test a brand‑new platform, follow these steps:

- Check the domain’s WHOIS record: a newly registered domain (< 6 months) is a warning sign.

- Search the company name in the regulator’s database (AUSTRAC, FCA, ASIC, etc.).

- Look for a third‑party security audit (e.g., CertiK, Quantstamp). Absence equals higher risk.

- Start with a tiny amount (≤ 0.001 BTC) and withdraw immediately to a hardware wallet.

- Monitor community forums (Reddit r/cryptocurrency, Bitcointalk) for real‑user experiences.

Remember: the safest place for long‑term holdings is a non‑custodial wallet you control.

Frequently Asked Questions

Is LFWSwap a legitimate crypto exchange?

Based on publicly available data as of October 2025, LFWSwap shows no regulatory registration, audit reports, or transparent fee schedule. These omissions are strong indicators that the platform is not verified as legitimate.

How can I verify if a crypto exchange is registered?

Visit the regulator’s official website (e.g., AUSTRAC, FCA, FinCEN) and search for the exchange’s legal name or license number. Legitimate exchanges always list this information on their “About” page.

What are the typical fees on reputable exchanges?

Maker fees range from 0 % (high‑volume) to 0.25 %; taker fees from 0.01 % to 0.40 %. Withdrawal fees depend on the blockchain (e.g., $1‑$5 for Bitcoin) and are clearly listed on the exchange’s fee page.

Can I trade on a decentralized exchange without KYC?

Yes. Platforms like Uniswap let you connect a wallet directly, bypassing KYC. However, you lose the safety net of regulated consumer protections.

What should I do if I suspect an exchange is a scam?

Stop any further deposits, withdraw any available balance to a personal cold wallet, and report the platform to your local financial regulator. Also share your experience on community forums to warn others.

14 Comments

Ali Korkor

Man, I saw this LFWSwap thing pop up on a Telegram group and thought it was too good to be true. Turns out it's basically a ghost site. Don't touch it. Stick with Kraken or Coinbase if you're not trying to lose your life savings.

Serena Dean

Love this breakdown! Seriously, if an exchange doesn't list its registration or cold wallet ratio, that's like buying a car with no VIN or service history. Start small, stay safe, and always keep your keys in a hardware wallet. You got this!

James Young

This post is way too gentle. LFWSwap isn't just risky-it's a full-blown exit scam waiting to happen. Anyone who deposits even a cent is either naive or already scammed. If you're not checking AUSTRAC or FinCEN before trading, you're part of the problem. Stop being polite and start calling these things what they are: fraud.

Andrew Morgan

Man I just spent 45 minutes digging through WHOIS records and forum threads after reading this. Turns out LFWSwap's domain was registered 3 months ago with a privacy shield and the same server as 7 other sketchy crypto sites. And no one's talking about it? That's wild. I'm not even gonna say I told you so but... yeah.

madhu belavadi

I lost $2k on something like this last year. I thought I was smart. I wasn't. Don't make my mistake. Just walk away. No amount of profit is worth your peace of mind.

Roxanne Maxwell

Thank you for writing this. I showed this to my mom who just started crypto and she was about to try LFWSwap because it said 'no fees' on the homepage. Now she's using Coinbase. You saved her from a nightmare.

Dick Lane

I don't know why people keep falling for this stuff. You check the domain age, you check the regulator list, you check if anyone's written about it outside of a YouTube ad. If all three are empty you walk away. It's not that hard. I wish more people would just stop clicking

Norman Woo

you think this is just a scam? nah bro. this is part of the fed's plan to push everyone into central bank digital currencies. they let these fake exchanges pop up so people get scared and beg for the gov to 'protect' them. then bam-CBDC. they want your crypto so they can track every satoshi. dont trust anyone. even this post might be a distraction

Chloe Jobson

Zero regulatory footprint + no audit = non-compliant by definition. Even Uniswap, while decentralized, has on-chain transparency and community governance. LFWSwap offers neither. This isn't a gray area-it's a black hole.

Elliott Algarin

It's funny how we treat crypto like it's the wild west when really it's just capitalism with fewer rules. The real question isn't whether LFWSwap is a scam-it's why we keep building systems where the only safety is personal vigilance. Maybe the real scam is believing we can outsmart greed.

Michael Folorunsho

US and EU users are lucky. In the rest of the world, people still fall for this junk because they don't know how to check FCA or FinCEN. It's embarrassing. If you're trading on a platform you can't verify, you're not a trader-you're a liability to the whole industry.

Jonathan Tanguay

Look i've been in this space since 2017 and i've seen 1000s of these fake exchanges and let me tell you the pattern never changes first they use a name that sounds legit like LFWSwap or LWEX then they copy the UI of kraken but with worse fonts then they post fake testimonials on reddit and telegram then they disappear after 3 months with everyone's eth and btc and the saddest part is the same people keep falling for it every single time i swear if you're reading this and you're thinking about depositing you're probably the 47th person to do it today

Bert Martin

Good call on the five-point checklist. I made a habit of checking each one before even loading a wallet. It takes 10 minutes but saves you months of stress. I've walked away from 3 'promising' platforms because they failed on one point. Worth it every time.

Ayanda Ndoni

bro why are you even writing this? just post the link to the scam and let people figure it out themselves. i dont care if someone loses money. if you cant tell a scam from a real exchange you dont deserve to have crypto