When you hear about Iran's Bitcoin mining is a state‑run effort that turns cheap electricity into digital cash, letting the regime slip around crippling sanctions. The approach started after the U.S. pulled out of the JCPOA in 2018 and has grown into a multi‑billion‑dollar engine that fuels everything from oil sales to missile programs.

Why Bitcoin Became Iran’s Go‑to Sanctions‑Evasion Tool

Sanctions block traditional dollar‑based banking, but Bitcoin moves on a borderless network. By mining the world’s most liquid cryptocurrency, Iran creates a native reserve that can be swapped for other assets without touching the SWIFT system. Analysts at Elliptic estimate that about 4.5% of global hash power runs inside Iran, generating “hundreds of millions” of dollars each year.

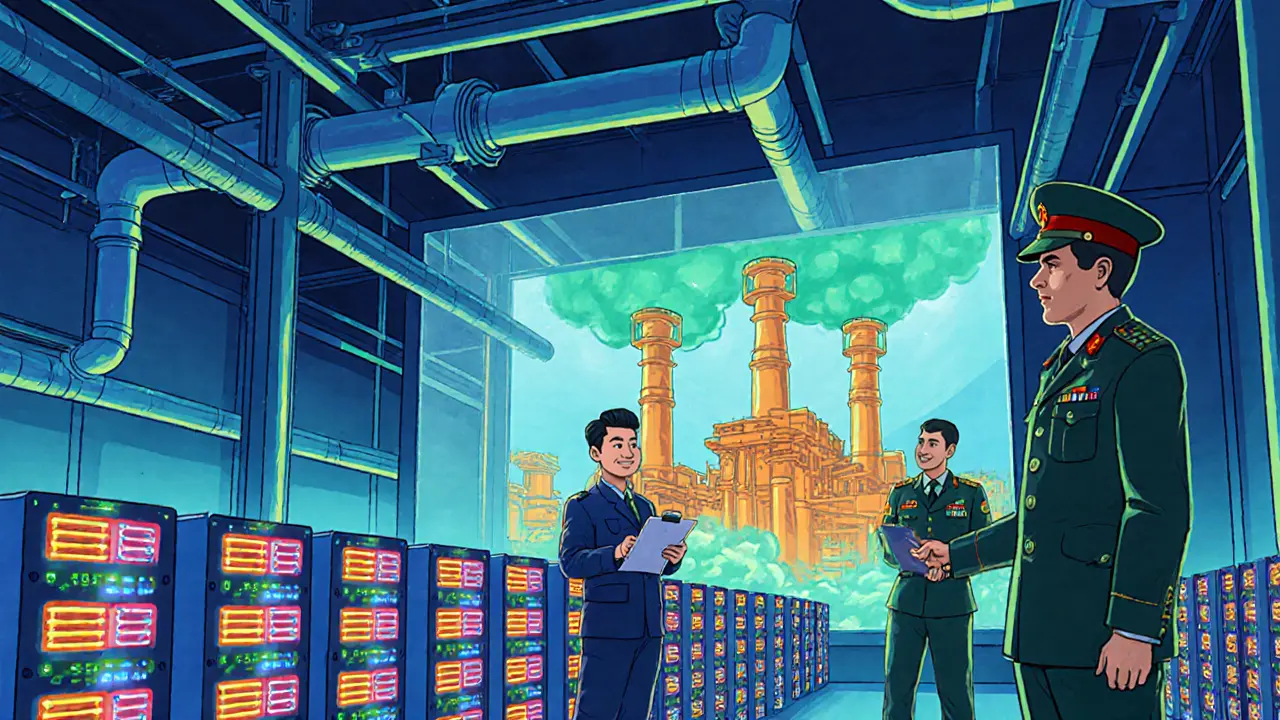

Technical Backbone: From Power Plants to ASIC Farms

The mining complex is a classic case of energy‑cost arbitrage. State‑subsidised electricity-often sourced from natural‑gas‑fired power stations-drops the cost per kilowatt‑hour to near‑zero. The crown jewel is the 175‑megawatt Rafsanjan mining farm in Kerman province, a joint venture between IRGC‑linked firms and Chinese investors. Chinese ASIC miners dominate the hardware pool because sanctions prevent Iran from buying the latest chips on the open market.

- Location: Special Economic Zone, Rafsanjan, Kerman

- Power: 175 MW, fed directly from a dedicated natural‑gas plant

- Output: ~3.2 EH/s, roughly 1.5% of the global Bitcoin network

Smaller, dispersed farms pepper the country, providing redundancy and making enforcement harder. Advanced proxy services mask the origin of mined blocks, while custom wallet‑management software routes Bitcoin through a web of exchanges-both domestic and foreign.

Economic Impact: From Oil to Digital Cash

By 2024 Iran had moved $4.18 billion in crypto abroad, a 70% jump from the previous year. The revenue plugs a gap left by dwindling oil exports. Roughly 10 million barrels of oil‑equivalent energy power the mining sector each year-about 4% of Iran’s 2020 oil export volume.

Licensing exploded: over 10 000 farms were authorized in 2022, and about 90 crypto exchanges now operate under the Central Bank’s framework. The state‑run crypto ecosystem works like a parallel banking system, letting firms pay for imports, fund the IRGC’s missile program, or support proxy groups without a paper trail.

How Iran’s Model Stacks Up Against Other Sanctioned Nations

| Country | Primary Crypto Tool | Scale of Operation | State Involvement | Key Weakness |

|---|---|---|---|---|

| Iran | Bitcoin mining (hash‑rate 4.5%) | ~10,000 licensed farms | High - IRGC & ministries direct policy | Hardware access, grid strain |

| Venezuela | State‑backed Petro (digital token) | Limited adoption, no real hash power | Medium - government‑issued token | Lack of international acceptance |

| North Korea | Crypto theft & ransomware | Estimated $1‑2 bn yearly exfiltration | High - Ministry of ICT coordinates | Reliance on illicit hacks |

| Russia | Mixed: mining & crypto payments | ~11% global hash rate | Medium - policy support, less direct control | Sanctions risk, Western exchange bans |

The table shows why Iran’s approach is unique: it pairs massive, centrally coordinated mining capacity with a clear economic motive-sanctions evasion-rather than pure profit or political messaging.

Risks, Countermeasures, and International Response

Financial watchdogs like the U.S. Treasury and the EU have issued advisories warning banks about inadvertent exposure to Iranian‑mined Bitcoin. Chainalysis and TRM Labs trace most of the flow through shell companies in UAE free zones, “teapot” refineries, and TRON‑based stablecoins. Sanctions‑compliant firms face a dilemma: block all Iranian‑origin Bitcoin and risk market exclusion, or develop sophisticated tagging tools that could violate Bitcoin’s fungibility principle.

Energy analysts also warn that mining aggravates Iran’s chronic power‑grid shortfalls, leading to seasonal blackouts. The regime’s practice of waiving electricity bills for mining farms fuels public resentment, as ordinary citizens often endure load‑shedding while the state pocketes digital cash.

Future Trajectory: What’s Next for Iran’s Crypto Engine?

Government roadmaps aim to lift mining capacity by another 50% in the next two years, adding new farms in Bushehr and Khuzestan provinces. Simultaneously, Iran plans a domestic crypto‑exchange platform to cut reliance on Binance‑type services, which are increasingly under scrutiny.

However, two trends could erode the advantage:

- Energy efficiency shift: New mining algorithms (e.g., Proof‑of‑Space‑Time) require less electricity, potentially neutralising Iran’s cheap‑energy edge.

- Regulatory convergence: Multilateral efforts at the Financial Action Task Force (FATF) aim to tighten crypto‑sanctions enforcement, making it harder for Iranian wallets to move through mainstream exchanges.

If sanctions ease through a renewed nuclear deal, the incentive to pour resources into Bitcoin mining could dwindle. Until then, the crypto‑sanctions engine is likely to stay a core pillar of Iran’s financial resilience.

Quick Checklist for Policy Makers and Analysts

- Monitor hash‑rate share - 4.5% signal for sanction‑risk exposure.

- Track electricity subsidies - a key lever the regime can adjust quickly.

- Map wallet clusters - focus on proxy services that hide Iranian origin.

- Engage with energy‑sector experts - understand grid constraints that may cause mining shutdowns.

- Prepare AML/KYC upgrades - ensure banks can flag indirect crypto exposure.

How does Iran profit from Bitcoin mining?

Cheap, state‑subsidised electricity lets miners earn Bitcoin at a fraction of global costs. The coins are then sold on foreign exchanges, converted to dollars, euros, or stablecoins, and used to fund imports, military projects, or hidden cash reserves.

Is Iran’s mining operation legal under international law?

Domestic law permits mining, but because the proceeds fund sanction‑evading activities, many jurisdictions treat related transactions as violations of secondary sanctions.

What role does the IRGC play in the mining sector?

The IRGC controls key licensing, provides political protection, and channels mining revenue into its own budget and proxy networks. Its involvement makes the sector highly centralized.

Can sanctions be enforced against Bitcoin miners?

Direct enforcement is tough because Bitcoin transactions are pseudonymous. Regulators focus on exchange compliance, wallet‑tagging, and cutting off the electricity subsidies that make mining profitable.

What are the biggest risks for Iran’s mining future?

Hardware shortages from sanctions, increasing power‑grid strain, and tighter crypto‑AML coordination worldwide could choke revenue streams. A major diplomatic breakthrough could also remove the “need” for the scheme.

16 Comments

Ali Korkor

Man, this is wild. Iran’s basically turning their power grid into a Bitcoin ATM. Who knew electricity could be worth more than oil?

Niki Burandt

So… they’re mining Bitcoin to fund missiles? 😅 That’s some next-level irony. Like, ‘Hey, let’s burn our own grid to buy nukes.’

Karen Donahue

This is exactly why crypto is a disaster. It’s not about freedom, it’s about enabling dictators to bypass sanctions while regular people get blackouts. The whole thing is morally bankrupt. People act like this is some kind of tech revolution, but it’s just criminal money laundering with more servers.

And don’t even get me started on how they’re stealing power from schools and hospitals. This isn’t innovation-it’s theft dressed up in blockchain buzzwords.

And then you’ve got these so-called ‘analysts’ acting like it’s cool that Iran’s got 4.5% of the hash rate. Like, congrats, you’re helping a regime that hangs people for protesting. What’s next? Mining Bitcoin to pay for chemical weapons?

It’s not a game. It’s not a tech story. It’s a humanitarian crisis disguised as a financial loophole. And we’re all just sitting here clicking ‘upvote’ like it’s some kind of YouTube video.

Why don’t we just admit that crypto’s a tool for the worst people on earth? It’s not decentralized freedom-it’s decentralized lawlessness.

And now the U.S. is telling banks to watch out for Iranian Bitcoin? Bro, you’re 5 years late. It’s already everywhere. You think Binance doesn’t know where it’s coming from? They just don’t care.

They’re not even trying to stop it. They just want plausible deniability. Same as always.

Meanwhile, families in Tehran are freezing in the dark because the government decided to run 175 megawatts of ASICs instead of heating their homes. That’s not capitalism. That’s fascism with GPUs.

And you wanna talk about ‘energy arbitrage’? That’s just a fancy word for stealing from the poor to fund war machines.

Don’t call it innovation. Call it what it is: state-sponsored crime.

And if you think this is going to end well? You’re not paying attention.

madhu belavadi

Bro, I’m from India and we’re just trying to get Wi-Fi in our villages. And Iran’s running a whole Bitcoin empire on subsidized power? I’m not mad, I’m just impressed… and also kind of jealous.

Dick Lane

It’s insane how much energy this takes. I live in Texas and we had blackouts last summer from heat and demand. Imagine if half our grid was running ASICs instead of AC units. People would riot.

And the fact that they’re using Chinese hardware because they can’t get the latest chips? That’s the real story here-sanctions don’t stop tech, they just reroute it.

Chris Pratt

Interesting how this mirrors what Russia’s doing too-using crypto to bypass financial isolation. It’s like every sanctioned nation is building its own parallel economy. Kinda fascinating, kinda terrifying.

Also, the fact that they’re using TRON stablecoins to launder Bitcoin? That’s a sneaky move. No one’s really watching TRON like they watch Bitcoin.

Serena Dean

Just wanted to add-this isn’t just about sanctions. It’s about energy sovereignty. Iran realized oil is volatile and politically risky, so they turned their biggest asset-cheap gas-powered electricity-into digital gold. Smart move, even if it’s morally shady.

And honestly? If the U.S. didn’t pull out of the JCPOA, this probably wouldn’t have exploded. Sanctions created the problem, then acted surprised when Iran found a workaround.

Andrew Morgan

Imagine being a kid in Tehran and your lights go out because the government is running 175 megawatts of Bitcoin rigs instead of keeping your house warm

That’s not innovation that’s a betrayal

And the fact that people still act like crypto is neutral? Bro

It’s not neutral

It’s a weapon now

And we’re all just watching

Jonathan Tanguay

Everyone’s acting like this is some new thing but it’s not. Iran’s been doing this since 2018 and the U.S. just kept talking about ‘maximum pressure’ while ignoring the fact that Bitcoin doesn’t care about borders. You can’t sanction a decentralized network with a bunch of press releases. The entire system is outdated. If you want to stop this, you need to ban ASICs globally or shut down all cheap energy in sanctioned countries. Which you won’t do because you’re not serious. You just want to look tough while your banks still take Iranian crypto through UAE shell companies. Pathetic.

Bert Martin

Good breakdown. One thing I’d add-this whole system is fragile. If China cuts off ASIC exports or the grid collapses during peak demand, Iran’s entire crypto economy could crash overnight. They’re one drought or transformer failure away from chaos.

Also, if Bitcoin’s price drops hard, mining becomes unprofitable even with free power. So it’s a gamble.

Ayanda Ndoni

Why do we even care? They’re just using tech to survive. We sanction them, they adapt. That’s capitalism. If you don’t like it, don’t be so harsh on the poor people trying to feed their families.

Also, I heard the U.S. mines Bitcoin too. Just not as openly. Hypocrites.

James Young

You think this is bad? Wait till North Korea starts mining with stolen cloud servers and laundering through Dogecoin. That’s the real nightmare. Iran’s just the warm-up act.

And don’t give me that ‘they’re just using free energy’ crap. The energy isn’t free-it’s stolen from the Iranian people. This isn’t innovation, it’s exploitation.

And the fact that you’re all acting like this is some kind of tech triumph? It’s not. It’s a warning.

Roxanne Maxwell

My cousin lives in Tehran. She says the blackouts are worse every winter. Kids can’t study. Hospitals use generators. And the government is mining Bitcoin like it’s a national sport.

I don’t know what to feel anymore.

Norman Woo

Wait… what if this is all a psyop? What if the U.S. is secretly funding these mining farms to destabilize Iran’s grid and make them look like a rogue state? I mean, think about it-how convenient that the hash rate is exactly 4.5%… just enough to look dangerous but not enough to trigger a full crackdown. They want us to panic so they can justify more sanctions. I’m not buying it.

Chloe Jobson

Key insight: Iran’s model is the first state-run, energy-based crypto sovereign wealth fund. Not just evasion-it’s asset-building. Think of it as OPEC 2.0, but with SHA-256.

Also, the IRGC’s control makes it uniquely centralized. Unlike Russia’s decentralized mining, Iran’s is a coordinated state asset. That’s why it’s so effective-and so vulnerable.

Jason Roland

It’s wild how tech always finds a way. Sanctions are like trying to stop water with a net. Iran didn’t break the system-they just built a new one inside it. Kinda respect that. Not the regime, but the ingenuity.